T2108 Update – A Calm Bullish Divergence Amid A Raging Storm For The S&P 500

T2108 Status: 27.3%

T2107 Status: 25.4%

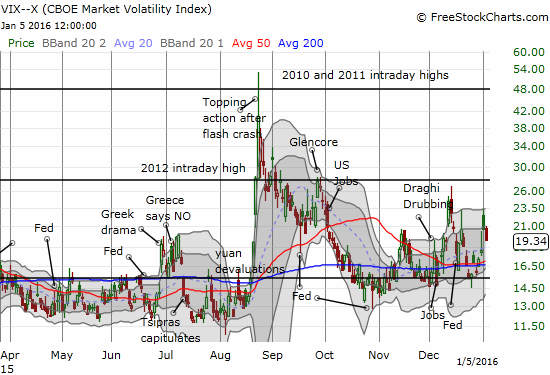

VIX Status: 19.3 (dropped from elevated conditions)

General (Short-term) Trading Call: bullish with a “very short leash”

Active T2108 periods: Day #14 over 20%, Day #2 under 30% (underperiod), Day #18 under 40%, Day #22 below 50%, Day #37 under 60%, Day #378 under 70%

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

IBB (iShares Nasdaq Biotechnology).

Commentary

Not liking what I see with big fades on stocks, surging Japanese yen. Despite near oversold conditions, moving on $UVXY for spec $AUDJPY

— Dr. Duru (@DrDuru) January 5, 2016

Bullish divergence: %stocks>40DMA is now above yesterday's high. Could drag $SPY upward kicking and screaming to extend relief rally.

— Dr. Duru (@DrDuru) January 5, 2016

It was a choppy kind of day with a very mixed message. After an encouraging open, sellers quickly descended upon the market and generated alarming fades in some of the key stocks that I watch. The fade on Apple (AAPL) was a key tell for me at the time. It ended the day down 2.5% and almost completely wiped out the previous day’s nice bounce of oversold lows.

This 5-minute chart spans two days to show the fade in the middle that sparked the major reversal.

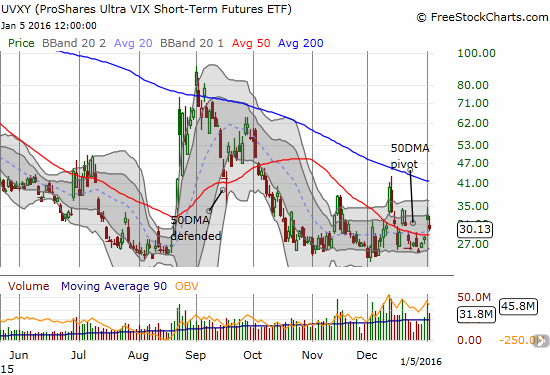

Given my wariness, I gave into the danger signs and actually purchased call options on ProShares Ultra VIX Short-Term Futures (UVXY). I also sold my shares in SVXY from the previous day’s trade on oversold conditions. As it turned out, my purchase of UVXY was close to the intraday high which poked into positive territory ever so briefly on the day.

ProShares Ultra VIX Short-Term Futures (UVXY) is pivoting around its 50DMA in what now looks like a coalescing base.

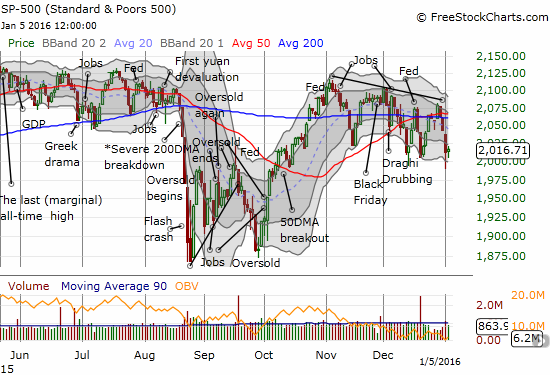

The end result of the day was a bullish divergence: T2108, the percentage of stocks trading above their respective 40-day moving averages (DMAs), closed with a solid 13% gain for the day while the S&P 500 (SPY) gained a VERY marginal 0.2%. It was one of those rare days in this market of deteriorating technicals where the typical leaders fared relatively poorly. Stocks like AAPL were a large drag on the indices. The NASDAQ fell 0.3%.

Buyers and sellers battle to a stalemate on the S&P 500.

After seeing UVXY top out, I became emboldened once again to follow the T2108 oversold trading script. I got back into call options on AAPL and added to Netflix (NFLX) – which like AAPL faded hard from the open. I was of course surprised to see these titans close so poorly given the strength in T2108.

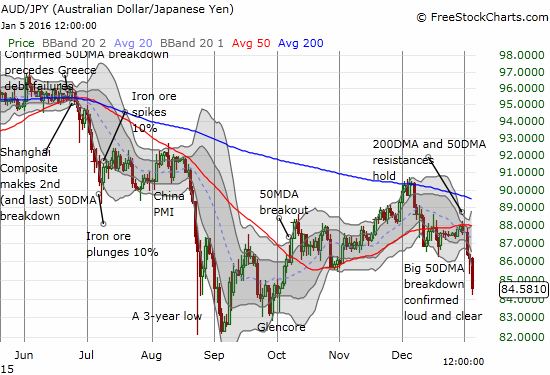

The Japanese yen (FXY) remains the big tell for me even as the U.S. dollar index is also regaining post-Fed momentum (as expected). The Australian dollar (FXA) versus the yen, AUD/JPY, is selling off anew at the time of writing. Just compare the current episode to the sell-off going into the August Angst to understand why I remain so wary even at these near-oversold conditions for T2108. AUD/JPY is a big reason for the very short leash I am maintaining on my T2108-related bullishness. I still like the pair as a key indicator of market sentiment (up is bullish, down is bearaish). This overnight breakdown could lead the way to a fresh dip into official oversold territory for T2108.

The Australian dollar versus the Japanese yen, AUD/JPY, continues to plunge sharply as underlying market sentiment worsens to (short-term) extreme levels.

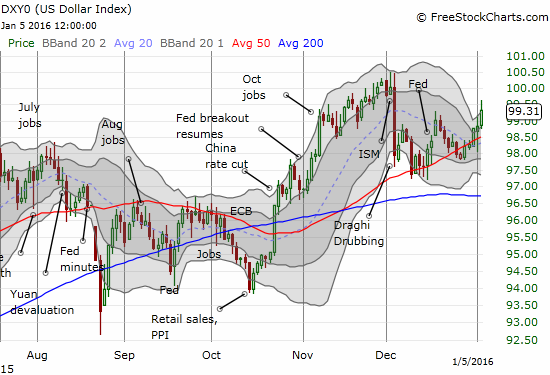

The U.S. dollar index has regained post-Fed momentum. The index now looks ready to make another run at multi-year highs.

The strength of the yen is now looking over-stretched with yen currency pairs like AUD/JPY trading well below the lower-Bollinger Band. A sharp relief rally could occur at any moment. Such a move should drag stock indices upward as well. I stand ready on such a move to sell more bullish positions and then to fade the weakness of the yen by selling short GBP/JPY (Brtish pound versus the yen) all over again. With earnings season about to start, I am also favoring sticking with call options on UVXY until/unless the volatility index closes convincingly below the 15.35 pivot.

The volatility index is chopping wildly above the 15.35 pivot. Despite today’s close at the low, I think the volatility index is prepping for at least one more run-up.

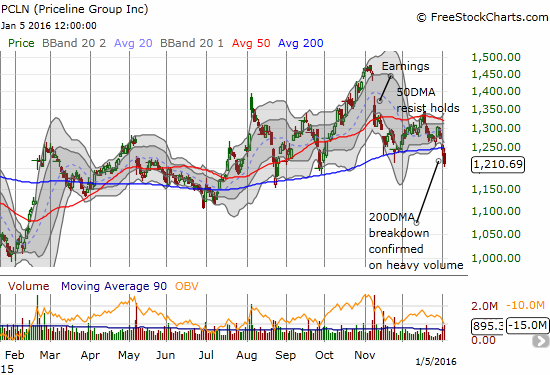

Priceline Group (PCLN) is a stock that I have not monitored in a very long time. Today, it made a potentially important breakdown below its 200DMA. This breakdown looks more ominous than the brief encounters through much of 2015 because it started with a large post-earnings gap down, a successful retest of 200DMA support, and a failed attempt to break 50DMA resistance. This has all the looks of failing momentum.

Priceline Group (PCLN) stumbles again with a 200DMA breakdown that looks like it will last lot longer than previous trips to the 200DMA in 2015.

I will try to end on some kind of positive note with Wal-Mart Stores (WMT). At the end of December, I pointed to WMT as a potential bottom-fishing play. My limit order for long-term call options triggered on the previous day’s dip. Not only did WMT fully recover after that, the stock gained 2.4% today on its way to a fresh 2-month high. Buyers are definitely warming up on aisle WMT with that juicy 3.2% dividend yield.

Wal-Mart Stores (WMT) is slowly but surely beginning a recovery march.

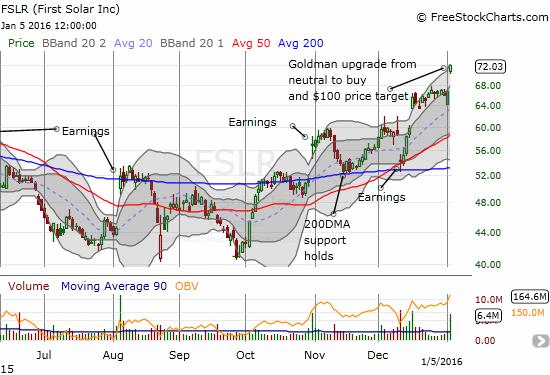

Finally, First Solar (FSLR) continues to prove out my bullish thesis on solar stocks. Goldman Sachs (GS) now agrees with me. GS’s upgrade sent FSLR hurtling upward to a whopping 8.0% close on the day and a near 16-month high. Unfortunately, the recent churn in the stock lulled me to sleep – I did not happen to have a position in play to catch this nice pop. I am definitely back on alert for the next entry point! (I am currently evaluating my select pick of solar stocks separate from whatever else is going on in the general market).

First Solar (FSLR) breaks out again.

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

Be careful out there!

Full disclosure: long UVXY call options, ...

more