Stocks Reacting Positively To Earnings - Friday, August 10

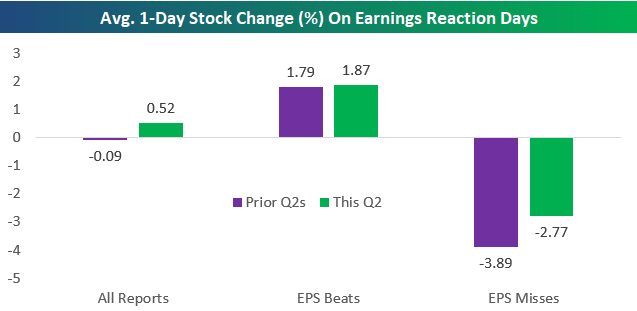

The second quarter earnings reporting period has actually been the most bearish for stock price reactions throughout history. It’s the only quarter of the year where stocks have historically averaged a decline (-0.09%) on their earnings reaction days going back to 2001. As shown below, though, this Q2 is shaping up very positively. The average stock that has reported this season has gained 0.52% on its earnings reaction day. (For a stock that reports after the close, its earnings reaction day is the next trading day. For a stock that reports before the open, its earnings reaction day is that trading day.)

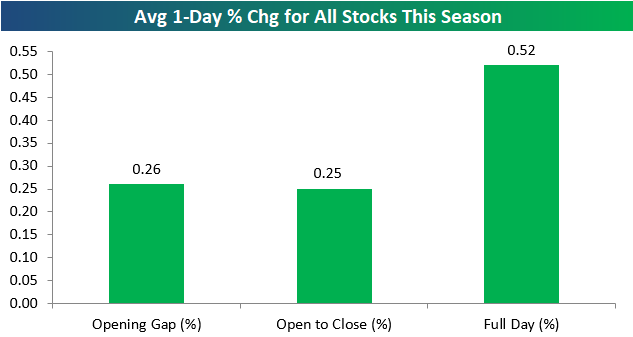

Notably, investors have bid up stocks in after-hours and pre-market trading after they’ve reported, and they’ve bid them up more during regular trading hours. Also shown in the chart below, the average stock that has reported this season has opened higher at the start of the trading day by +0.26%, and then it has averaged a further gain of 0.25% from the open of trading to the close. (The combination of the opening gap of 0.26% and the open to close move of 0.25% results in a full day change of +0.52%).

During prior Q2 reporting periods, the average stock that has reported has fallen 0.09% on its earnings reaction day. In addition, the average stock that has beaten EPS estimates has gained 1.79% on its Q2 earnings reaction day, while the average stock that has missed EPS estimates has fallen 3.89% on its Q2 earnings reaction day.

This season, earnings beats are performing slightly better than they normally do, while earnings misses are falling less. As shown in the chart below, the average EPS beat this season has risen 1.87% on its earnings reaction day, while the average EPS miss has only fallen 2.77%. Compared to prior Q2s, smaller declines for EPS misses this season is the big story.