Riding Renewed Market Sentiment, LGI Homes Soars Into A Strong Sales Report

The ink just dried on my last Housing Market Review. In that piece I lamented the on-going lagging performance of home builders and stagnating housing data, and thus concluded that it was time to call an end to the seasonal trade on home builders. Just two days later, home builders surged upward in sympathy with a very strong earnings report from Lennar (LEN) which gained 10.0% on the day.

(Click on image to enlarge)

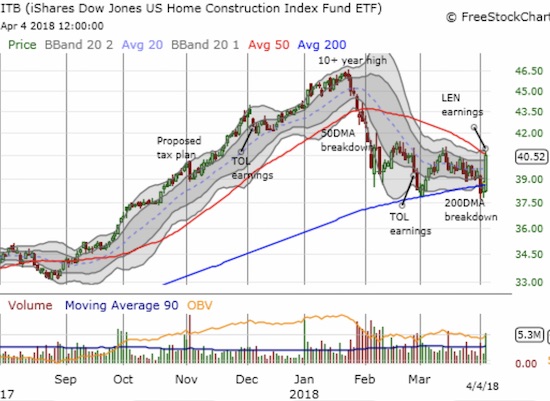

The iShares US Home Construction ETF (ITB) closed below 200DMA support for just one day. Today’s 4.7% run-up took ITB right to 50DMA resistance and another important test.

This surge of optimism provided a turbo boost to LGI Homes (LGIH) which was up next to report results. Likely in anticipation of redeeming results, the market sent LGIH rocketing higher by 8.6%. LGIH erased the losses of the past two days and likely confirmed support at its 50-day moving average (DMA).

(Click on image to enlarge)

LGI Homes (LGIH) rebounded smartly off 50DMA support and closed at a (marginally) new 2+ month high.

Source for charts: FreeStockCharts.com

In the after hours, LGIH reported March and Q1 2018 home closings that were as impressive as ever. The results were stellar:

“…599 homes closed in March 2018, up from 365 home closings in March 2017, representing year-over-year growth of 64.1%. The Company ended the first quarter of 2018 with 1,244 home closings, a 63.5% increase over 761 home closings during the first quarter of 2017.”

Business is still booming for LGIH. These results set the stock up for a strong run into the next earnings report. LGIH is now again a “builder of interest” for buying on the dips. It already recaptured my eye as the “last builder standing” with its resilience and large out-performance.

I earlier targeted KB Home (KBH) as my only new home builder to buy going forward based on its strong earnings report. I executed that plan today as soon as I recognized the robust reaction to LEN’s earnings. KBH’s prospects for holding 200DMA support dramatically improved with its 4.8% gain. Like ITB, it still faces an important test of resistance from its declining 50DMA.

I also put a hold on liquidating my other housing-related holdings. The firming of 200DMA supports came just in time.

Disclosure: long KBH calls, long LEN calls

Follow Dr. Duru’s commentary on financial markets via more