Lessons From The Reagan Era On Managing Twin Deficits

Many are harking back to the Reagan era for guidance on how to implement the pro-growth policies advocated by President Trump and Congress. When Ronald Reagan took over the leadership of the United States in 1981, he inherited an economy that had endured nearly a decade of stagnate growth combined with accelerating consumer prices.

Tax cuts lay at the heart of the Reagan revolution. Reagan believed that high taxes threatened individual freedom, suppressed overall economic growth, and encouraged wasteful government spending. Thus tax laws of 1981 are the single most important piece of legislation to emerge from Reagan's first term. That sweeping tax cut slashed federal income tax rates, for taxpayers in every income bracket, by 25% over a three-year period. However, slashing taxes came at high price.

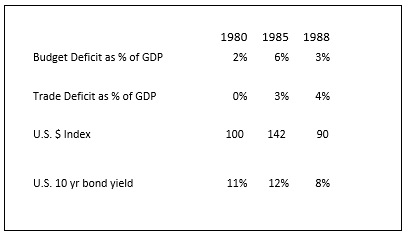

Reagan’s failure was his inability to restrain government spending. Reagan ran for office in 1980 as a harsh critic of "tax and spend" liberalism, vowing as president to shrink the size of the government by slashing federal spending. Once in office, however, Reagan found it impossible to deliver on his promises. Simply, the Reagan administration blew up the federal deficit to 6 per cent of GDP in 1985 from just 2 per cent in 1980. (See accompanying table). It was not until the first term of President Clinton that a balanced budget was restored.

This tripling of the national budget deficit was highly stimulating, ironically, in the sense of the Keynesian model whereby government primes the pump of the economy. But the surge in the deficit had unintended consequences.

First, while still fighting the high inflation created in the 1970s, the Fed continued with its tight-fisted monetary policy. Long term rates remained above 10 per cent for much of the decade and really did not start to make their long decent until the first half of the 1990s. The cost of debt financing was part of the problem of containing the deficit. The United States had to fight internal inflationary pressures and at the same attract foreign savings to fund the deficit.

Second, these high interest rates lead to a surge in the external value of the U.S. dollar. The U.S. dollar index soared by over 40 per cent in the period 1980-85. The U.S. economy was growing and savings from abroad were contributing to the rapid appreciation of the dollar.

Third, The presence of an expensive dollar and a growing economy took a heavy toll on the U.S. trade account. In 1980 the trade account was roughly in balance, but it soared into a deficit measuring 4 per cent of GDP by 1985 and remained so until the end of the decade. There was big push in the United States to introduce protection policies to deal with the trade deficits with Japan. Does this not sound familiar today?

Fourth, A soaring dollar and a rapidly deteriorating trade deficit forced the international community to intervene. The Plaza account of 1985 called for the United States to devalue its currency in response to the rising current account deficit. The central banks of United States, West Germany, Japan, France, and U.K. agreed to intervene in the exchange markets to bring about an orderly devaluation. By the end of the decade, the U.S. dollar declined by 50 per cent

The Trump administration is proposing to cut taxes dramatically and simultaneously to spend up to $1 trillion over the next decade towards to improving infrastructure. Hence, there a deep concern that the federal budget will explode. The Trump tax cuts will likely result in higher budget deficits, not lower deficits. As a reserve currency, the U.S. dollar will likely remain strong, and increase even further due to the tax cuts and rising interest rates in the United States. A higher dollar will likely lead to a widening of the trade deficit as imports becomes even cheaper than today.

As for a new Plaza accord, this seems most unlikely. Since the Trump administration has adopted a very aggressive stance towards it trading partners, in all likelihood, it has eliminated the goodwill necessary to reach any agreement.