Large Cap Biopharma Performance Update 2018

Large Cap Biopharmaceuticals Performance - After Correction

- Technicals: we are holding the December 2017 bottom but 2018 gains on some indices have been wiped out with peak values on Jan. 26.

- The FBT was the top performing ETF in 2018 YTD.

- Many of our picks have outperformed the market.

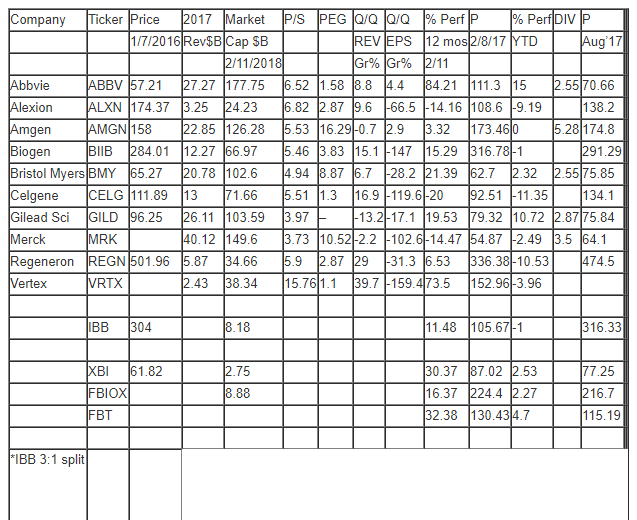

Here are some metrics on large-cap biopharma companies after about a 10% correction from the January top and the XBI all-time high. In our upcoming Part 2, we will dig deeper into recent earnings reports to come up with an evaluation of our Portfolio with possible re-balancing. Stocks that pay decent dividends are ABBV, AMGN, BMY, GILD, and MRK.

Note that the top winners YTD are on the Rayno Biopharmaceutical Focus List.

Also in our Portfolio are bluebird bio (BLUE) and Foundation Medicine (FMI).

From this current performance data we have the following:

Top Winners 2018 YTD

Abbvie (ABBV) up 15%.

Gilead Sciences (GILD) up 10.72%.

Bristol-Myers Squibb (BMY) up 2.55%.

Top Winners 12 Months

Abbvie (ABBV) up 84.21 %.

Vertex Pharmaceuticals (VRTX) up 73.5%.

Bristol Myers Squibb (BMY) up 21.39%.

Celgene (CELG) is one of the worst stocks in the group because of lower guidance but we added it to our Portfolio focus list on 11/20/17 before the correction at $102. Somehow we missed the meteoric rise in Vertex (VRTX) maybe because of the high valuation with a Price/Sales but also we missed the excellent top line growth rate prospects.

Note that the Fidelity Select Biotechnology Portfolio (FBIOX) outperformed the IBB over 12 months by 5 percentage points. But the small cap, equal weighted XBI did outperform all ETFs after the January sell-offs but the new (short-term) performance leader is the First Trust Arca Biotechnology Index (FBT).

The severe market downturn has leveled the playing field for various market sectors but we should move into a more normalized less volatile phase in life science stocks where news and fundamentals matter. But we still have macro risks. We trimmed back positions a bit and expect a rally in biotech this week.

Large Cap Biopharmaceutical Metrics and Performance Update 2/9/18

Disclosure long: ABBV, AMGN, BMY, CELG, FBIOX, GILD.