Ignore The Hype: Splunk Remains Overvalued

In early 2012, Splunk Inc. (SPLK: $69/share) burst onto the scene with one of the biggest IPOs of the year. As the first in a new line of "big data" companies to go public, Splunk was seen as a trailblazer in an exciting industry. Since then, the stock price has ridden the hype and is up more than 320%. This price increase should raise serious concerns for astute investors. A combination of profitless growth, an unattractive pricing model, and overvaluation places Splunk in the Danger Zone this week.

Just Another Revenue Growing Tech Company

Much like Twitter, a recent Danger Zone feature, Splunk is similar to many other tech companies that boast impressive revenue growth but fail to turn any of it into profits.

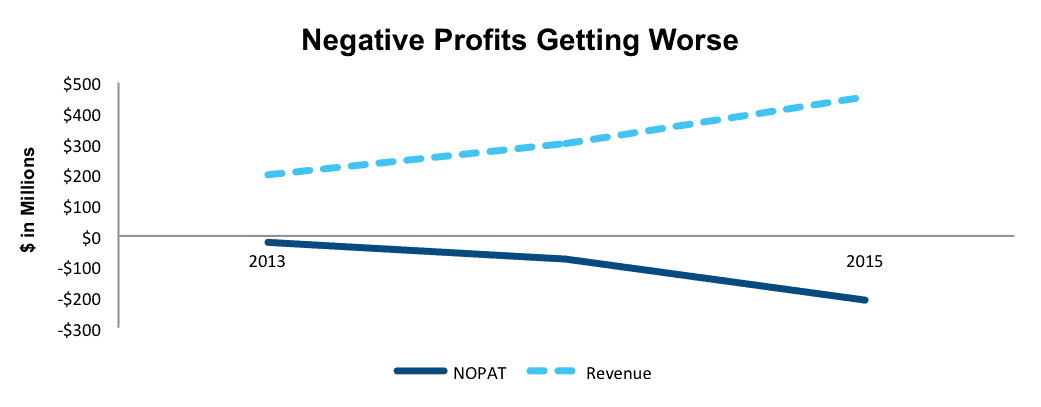

Since 2013, Splunk has grown revenue by 51% compounded annually. In contrast, net operating profit after-tax (NOPAT), has fallen by -220% compounded annually from -$21 million in 2013 to -$211 million in 2015.

Figure 1: Profits on the Downtrend

Sources: New Constructs, LLC and company filings

Similar to Demandware, another recent Danger Zone stock, Splunk’s widening losses come from costs rising much faster than revenues. In 2015, cost of revenues and research and development expenses grew by 91% and 99% respectively year over year (YoY). Sales and marketing expenses also grew by 60%. These cost increases dwarf the 49% revenue growth Splunk achieved in 2015.

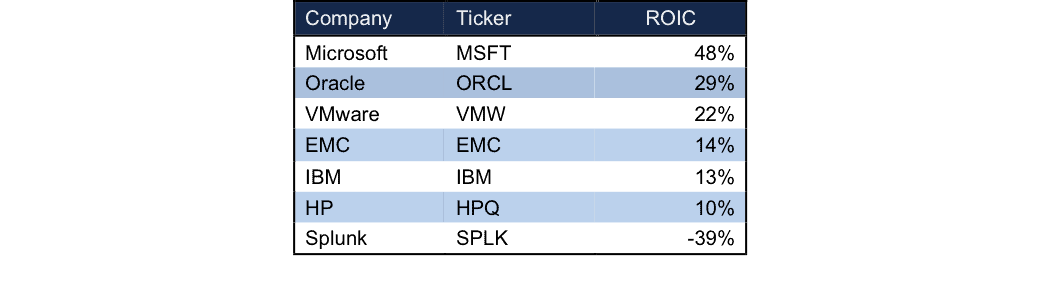

With negative profits, it’s no surprise that Splunk has never earned a positive return on invested capital (ROIC). Splunk’s ROIC has declined from -36% in 2013 to -39% in 2015. Pre-tax operating margins (NOPBT) have also gotten progressively worse as they have fallen from -10% in 2013 to -47% in 2015.

Some would argue that Splunk could achieve profitability by reducing sales & marketing and product development expenses. Even if these two expenses were cut in half, Splunk would be left with NOPAT of roughly $25 million. This value is miniscule considering the company’s market cap is over $8.6 billion. The largest market cap for a company that earns $25 million NOPAT is XPO Logistics (XPO), which has a market cap of only $3.5 billion.

Increasing Competition from All Angles

Many competitors have jumped on the chance to claim their own share of the big data pie, including tech giants Microsoft, IBM, Oracle, and HP. Compared to Splunk, these companies provide a much larger set of solutions that cater to a variety of big data needs across a corporation. For example, Microsoft’s cloud computing platform, Azure, provides not only data analytics, but also networking, virtualization, cloud storage, and web/mobile app development all rolled into one suite. In a survey conducted by Computing magazine, 56% of respondents preferred large generalist vendors while only 14% of respondents preferred small specialist vendors.

Due to their greater infrastructure and scale, these tech giants possess two key advantages versus Splunk. First, they have more resources to develop new products. Second, they have profitable businesses that can offset initial losses from expanding into a new business. Splunk’s losses are not sustainable.

Figure 2: Splunk Pales in Comparison to Competitors

Sources: New Constructs, LLC and company filings

Splunk also faces competition from other specialized software vendors. Sumo Logic is a vendor that directly competes with Splunk in log management and analytics software. The private company, which offers an affordable and highly accessible cloud-based platform, is rapidly threatening Splunk’s market share. Sumo Logic recently reported customer base growth of over 300% and increased bookings by 400% year-over-year.

The open-source log analytics platforms offered for free could pose the biggest challenge to Splunk’s ability to ever achieve profits. Elastisearch BV’s “ELK Stack” is one of the most powerful open source platforms currently available. When it comes to functionality, ELK can process and analyze various types of data just as efficiently as Splunk. With over six million downloads, the open source provider needs to monetize a mere fraction of its users to top Splunk’s 9000 customers.

Furthermore, Splunk already has 79 companies in the Fortune 100 as customers. Even with such an impressive customer base, the company sees accelerating losses. This situation places Splunk between a rock and a hard place. Splunk can either continue to spend heavily on growth, further deteriorating profits, or it can cut down expenses, which would leave the company making measly profits from existing customers.

Threats to Splunk’s Already High Prices

We’re not here to dispute Splunk’s product quality. When it comes to data processing and analytics, IT professionals rave about Splunk’s power and efficiency. They are not big fans of Splunk’s pricing model, however.

Instead of charging a flat price, Splunk bases prices on daily indexing capacity. While the company reduces the price per gigabyte for larger licenses, the bottom line is that the more data customers require, the more they will have to pay.

Not only does this model turn off many would-be customers that expect to process large amounts of data, it also adds a factor of unpredictability to clients’ expenses. Given a choice, most businesses will take predictability over unpredictability. For example, when compared to VMware’s Log Insight, which charges based on how many locations from which data is gathered, rather than by data volume, Splunk seems less attractive. Splunk should be in the business of supporting growth in big data, not penalizing it.

Bull Case Overlooks Business Model Weaknesses

Much of the bull case for Splunk focuses on huge expected growth of the big data sector in the upcoming years. There is no arguing that big data is expanding at a rapid pace, but investors often get caught up in the hype and overlook company fundamentals as well as potential industry changes. As the big data industry grows, analytics will become an increasingly commoditized product. A commodity service leads to price wars, and Splunk has neither pricing power nor positive profit margins. Look for Splunk’s profits to keep declining as management has warned that the company may not be profitable in the future and even expects operating expenses to increase over the next several years.

Stupid Money (Buyout) Risk

The strength of Splunk’s technology and software potentially makes the business a strategically sound target. However, with a market cap of $9 billion, only a few potential suitors exist. Back in early 2013, when Splunk’s market cap was just over $3 billion, there was much chatter about apotential buyout by IBM or Oracle. Given that this possibility fizzled out when Splunk was less expensive, we think it is unlikely that a large company will move to acquire Splunk now that there is more competition, many suitors have developed their own products, and SPLK is three times as expensive. Moreover, even if an IBM or Oracle were interested in acquiring the business, it is only financially reasonable at a much lower price per share as we explain below.

Impact of Footnotes Adjustments and Forensic Accounting

In order to derive the true recurring cash flows, an accurate invested capital, and a real shareholder value, we have made several adjustments to Splunk’s 2015 10-K. The adjustments are:

Income Statement: we removed $7 million in non-operating expenses hidden in operating items. One key adjustment made was the removal of $1 million in non-operating income, consisting mainly of interest income. After removing this non-operating income hidden on the income statement, net adjustments totaled $6 million. Despite removing expenses, Splunk’s NOPAT remained negative.

Balance Sheet: we made $883 million worth of balance sheet adjustments to calculate invested capital. The largest adjustment is the removal of $486 million in assets related to midyear acquisitions. This adjustment equals 54% of reported net assets.

Valuation: we made $412 million worth of adjustments. The largest adjustment to shareholder value is $289 million in outstanding employee stock option liabilities. These liabilities represent 3% of Splunk’s current market cap.

Valuation Ignores Reality – With or Without Being Acquired

Optimism about Splunk’s potential to be acquired has helped drive the share price to new heights. We believe the acquisition hopes are blind to the facts about just how expensive the stock is under multiple acquisition scenarios. First, the basics on how expensive the current valuation is: to justify its current price of $69/share, the company must raise its pretax (NOPBT) margin from -47% to 5% and grow revenue by 30% per year for the next 22 years. While this expectation is extremely optimistic, it doesn’t account for the possibility of a tech giant, namely IBM or Oracle, purchasing Splunk. To evaluate this possibility, we create two different scenarios.

Scenario 1: IBM acquires Splunk. In this scenario, upon acquisition, Splunk’s NOPAT margin and ROIC would immediately rise to IBM’s 16% and 13%, respectively. After these formidable improvements in profitability, Splunk still must grow revenue by 20% compounded annually for 40 years to justify its current price. A more realistic price IBM might pay for Splunk is $4/share, which is the value of the business based on the NOPAT in year 1 of the acquisition.

Scenario 2: Oracle acquires Splunk, and Splunk immediately achieves Oracle’s NOPAT margin and ROIC of 29% and 25% respectively. Even in this more optimistic scenario, Splunk must still grow revenues by 20% compounded annually for 18 years. A more realistic price Oracle might pay for Splunk is $11/share, which is the value of the business based on the NOPAT in year 1 of the acquisition.

No matter which way you look at it, the expectations baked into Splunk’s current stock price are simply too high to warrant investment in the company.

Catalyst for Shares

SPLK experienced heavy selloffs after the past two quarterly announcements, despite beating earnings both times. As a result of its overvaluation, not even significant beats can meet the high expectations for revenue growth embedded in the stock price. Considering this stock action, just a small miss on earnings in the upcoming quarter could send the stock plummeting.

Short Interest

Short interest stands at 10.2 million shares, or over 8% of shares outstanding.

Insider Selling

In the past 12 months, insiders have bought 200 thousand shares and sold 1.9 million shares, for a net of 1.7 million shares sold. This represents 1% of shares outstanding.

Executive Compensation Unrelated to Profits, Focus Mainly on Revenue

As long as leadership gets paid based primarily on revenue and not true profits, we can expect more of the same poor financial performance.

In addition to their base salaries, Splunk’s executives receive a short-term cash bonus and long-term equity awards that are tied to company defined goals. Cash bonuses for sales executives are based mainly on the achievement of target bookings, with some weight given to individual performance metrics such as increase in number of customers and increase in international revenue. Cash bonuses for non-sales executives are based on the achievement of target revenues.

Starting in fiscal year 2016, long-term equity awards for executives will be given as a mix of 50% restricted stock units and 50% performance share units. These awards are determined with equal weight on revenue and operating cash flow percentage relative to revenue growth. Because of the implementation of a revised compensation plan this fiscal year, none of Splunk’s executives, except the newly hired Senior Vice President of Field Operations, received equity awards in 2015.

Dangerous Funds That Hold SPLK

The following ETFs and mutual funds allocate significantly to SPLK and earn our Dangerous or Very Dangerous ratings.

- Ark Web x.0 ETF (ARKW) – 3.6% allocation to SPLK and Dangerous rating

- Berkshire Funds: Berkshire Focus Fund (BFOCX) – 3.5% allocation to SPLK and Very Dangerous rating

- Columbia Funds Series Trust I: Columbia Select Large Cap Growth Fund (ELGCX) – 3.2% allocation to SPLK and Dangerous rating

Click here to download a PDF of this report.

Photo Credit: Ed Hunsinger (Flickr)

Disclosure: David Trainer and Max Lee receive no compensation to write about any specific stock, ...

more