Forex Setup Week – A Time Of Reckoning For The Australian Dollar

This week’s forex setup is simply about the Australian dollar, especially against the U.S. dollar FXA.

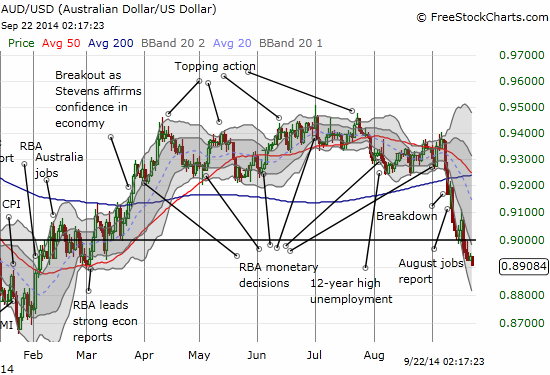

At the time of writing, the Australian dollar is testing the next round number on its stair-stepping down: 0.89. The last time AUD/USD hit this level, the Reserve Bank of Australia RBA talked up the Australian economy ahead of some strong economic reports. Those reports helped sustain the Australian dollar during its last rally: March and into April.

The Australian dollar looks ready for its next leg down

Source: FreeStockCharts.com

While AUD/USD may bounce meekly from 0.89, the most important aspect of this chart to note is the Bollinger Band (BB). The lower Bollinger Band is opening up far and wide with the 20-day moving average (DMA) declining sharply…all setting up what seems to be an imminent time of reckoning for the Australian dollar…much lower.

As has been my pattern learned from the days of the stubborn Australian dollar, I closed out my last short AUD/USD position to lock in profits at this important technical level. I am hoping to refade the pair on a bounce, and I am ready to reload on a fresh breakdown that comes instead.

Be careful out there!

Disclosure: No position

Comments

No Thumbs up yet!

No Thumbs up yet!