Dollar Staging A Coup

After a performance that was putting it on pace for its worst year in a long time, the dollar has seen quite a bounce recently as prospects for a December rate hike increase and the US economy picks up steam. After a YTD decline of over 10% through early September, the Bloomberg US Dollar Index has rallied nearly 4% in less than a month! What’s really notable about the bounce is that the Dollar Index has not only broken back above its 50-DMA (a level it didn’t trade above all summer), but it has also broken the downtrend range that it has been stuck in all year long. That’s an encouraging sign, even if the Dollar Index is still down over 7% on the year.

(Click on image to enlarge)

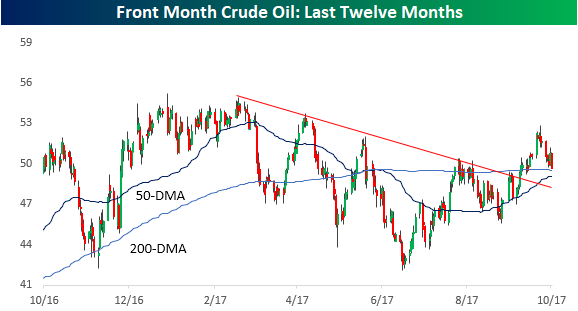

The recent rally in the dollar has also helped to put the breaks on the recent rally in crude oil, which is good for the consumer. After nearly kissing $53 in late September, crude has been under a bit of pressure in the last two weeks and dropped back below 50 bucks earlier today. Anything that keeps some pressure on oil prices, we’ll take.

(Click on image to enlarge)