Above The 40 – The S&P 500 Shows Off Again

AT40 = 59.3% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 58.3% of stocks are trading above their respective 200DMAs

VIX = 9.9 (volatility index)

Short-term Trading Call: neutral

Commentary

The stock market continued its healing process from its last bout of mild indigestion. Most impressive is the S&P 500 (SPY) which confirmed support at its 50-day moving average (DMA) with a gap up and break out above the previous short-term downtrend. The index gained 0.7% the previous day (Wednesday, June 12) and followed-through with a little more buying interest today.

The S&P 500 made a statement with a gap up that broke through the churning downtrend that defined trading for 3 weeks. Follow-through buying confirmed the move.

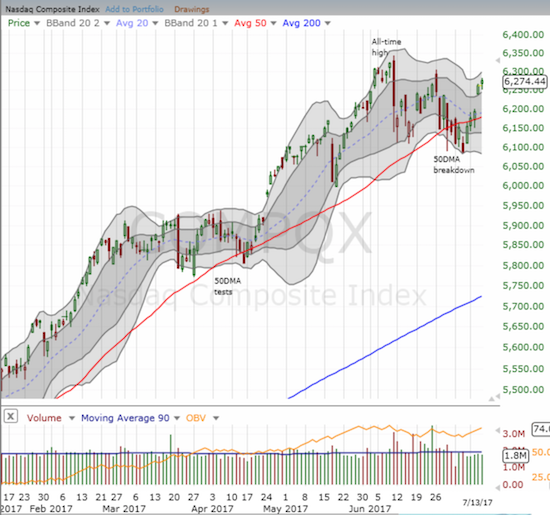

Tech also impressed by gaining without sucking air out of the rest of the market. The Nasdaq increased 1.1% on the previous day and pushed a little higher today. The PowerShares QQQ ETF (QQQ) moved along with the Nasdaq. Both tech-laden indices delivered confirmed 50DMA breakouts.

The Nasdaq confirmed its 50DMA breakout with a gap up and more follow-through buying.

The PowerShares QQQ ETF gapped up for its 50DMA break out and confirmed the move with buying the next day.

AT40 (T2108), the percentage of stocks trading above their respective 40DMAs, confirmed the return of bullish sentiment with its own gap up on Wednesday. Trading looked shakier today, but AT40 managed to eke out a marginal gain to close at 59.3%. The volatility index, the VIX, rounded out the bullish flavor with a plunge back toward 14-year lows (recall that the VIX at extreme lows is typically a BULLISH sign).

The volatility index, the VIX, ended its upward bias with a whimper and now plumbs 14-year lows again.

Putting these moves all together, I am suddenly looking at a short-term trading call that is slipping out of step with the market’s latest mood. Still, I am sticking with neutral until buyers prove themselves by firmly planting a new all-time high flag on the S&P 500. And even then, I am not expecting much more upside from there in the short-term as I discussed in the last Above the 40.

This resurge of the bull placed my trading strategy on the usual suspects a little off synch. For the first week in 4, Apple (AAPL) was better played to the upside. AAPL particularly seemed to wake up today with a 1.4% gain the makes it look like the stock is finally ready to join the rest of the usual suspects who have already recovered into bullish technicals. I tried to low ball some call options, but the market refused to deliver.

Apple looks like it is finally ready to get going again. A 1.4% gain rallied the stock closer to its closest point to 50DMA resistance since the June 9th swoon.

Two of the usual suspects, Facebook (FB) and Nvidia (NVDA), notched fresh all-time closing highs over the last two trading days. Netflix (NFLX) and Alphabet (GOOG) finally closed above 50DMA resistance over the past two trading days. Amazon.com (AMZN) spent the week confirming its 50DMA breakout from last Friday.

The next biggest play on my radar is in the financials. Major earnings are coming up Friday morning and beyond, and Financial Select Sector SPDR ETF (XLF) still looks tentative. So I expect some positive news to send XLF soaring. I loaded up on call options on XLF rather than attempt to pick and choose which financial(s) would deliver the blockbuster post-earnings performance. If the financials fail to deliver, I will consider my neutral short-term trading call well-justified!

The Financial Select Sector SPDR ETF looks like a spring-loaded ETF just ahead of major bank earnings.

My trade in Tesla (TSLA) worked out about as well as I could expect. I locked in profits on Wednesday as the stock traded “close enough” to 50DMA resistance. I am now riding on the put spread on the house’s money although I do not expect my net profits to increase from here without, at least, another vicious swoon from TSLA. Sellers tried to make another run today (on high volume too).

Tesla bounced enough from last week’s selling to get within spitting distance of 50DMA resistance. However, are sellers moving to regain control?

Traders hit the reset button on Deere & Company (DE). DE’s latest retail sales report left everyone with a bad feeling and sent the stock plunging into a complete reversal of the last breakout. I was late in buying back into DE and could not get a low ball offer on call options to fall my way. I will be ready again in the next few days. I have to imagine the sellers are not quite finished yet.

Traders hit the reset button on Deere when they wiped out over a week of impressive gains all at once. Is a rebound already underway?

On the other hand, Target (TGT) delivered news that delighted traders and investors and gave them a reason to put “Amazon Panic” aside for the time being. TGT rallied for a 4.8% gain on trading volume that was over 3x the 90-day average. This was another one of those cases where my trading went on automatic and I secured call options as soon as possible. The story on TGT has now quickly changed from complete doom and gloom to at least a glimmer of hope. The stock is now at a new post Amazon panic closing high. Next up is downtrending 50DMA resistance and several gaps down to fill…

Target got some love after delivering surprisingly positive guidance. TGT is still below 50DMA resistance and has several gap downs left to fill.

Lastly, a miss for the week: iShares MSCI Brazil Capped ETF (EWZ). I wrote about my trade in EWZ in the wake of its steep sell-off on news of bribery charges against the Brazilian President. After that, I waited patiently for a new entry point. That point came in mid-June with EWZ trading around $33. Inexplicably, I failed to pull the trigger. Ten percent later, EWZ has broken out above 50 and 200DMA resistance in a move that pretty much confirms for me that the earlier panic in EWZ was overdone.

The iShares MSCI Brazil Capped ETF has broken out from 50 and 200DMA resistance and trades at its highest post-bribery level.

Other trades: took reduced profits in Monro Muffler Brake, Inc. (MNRO) after it rallied today; locked in profits on Nvidia call spread, and locked in profits on iShares Silver Trust (SLV) calls.

Active AT40 (T2108) periods: Day #353 over 20%, Day #167 over 30%, Day #34 over 40%, Day #5 over 50% (overperiod), Day #7 under 60% (underperiod), Day #113 under 70%

Daily AT40 (T2108)

Black line: AT40 (T2108) (% measured on the right)

Red line: Overbought threshold (70%); Blue line: Oversold threshold (20%)

Weekly AT40 (T2108)

*

All charts created using freestockcharts.com unless otherwise stated

The charts above are my LATEST updates independent of the date of this given AT40 post. For my latest AT40 post click here.

Related links:

The T2108 Resource Page

You can follow real-time T2108 commentary on twitter using the #T2108 or #AT40 hashtags. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag.

*Charting notes: FreeStockCharts.com uses midnight U.S. Eastern time as the close for currencies.

Disclosure: long AAPL puts, long NFLX puts, long TSLA puts, long TGT calls, long XLF calls

Follow Dr. Duru’s commentary on financial markets via more