A World Gone Negative

Japanese Negativity:

Apparently, the world of investors and economists were surprised of Japans (worlds third largest economy) recent decision to cut interest rates negative, except me.

It was not an "if" they would ever go negative, but a "when", and it appears the time has come that many large economies embrace it (as previously written).

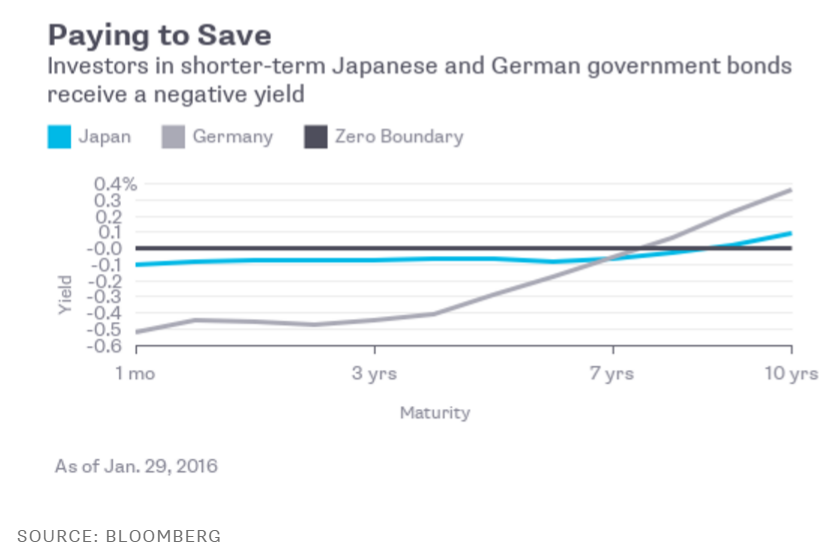

And as of the end of January 2015, there is a record $5.5 trillion of government bonds with negative yields. What was once a hypothetical,improbable, and dire situation is now reality for 1/4 of the index of government bonds. This means that investors for the first 7 years are literally not getting nothing, they're paying:

Side note: what is absolutely necessary to explain is that simply a week before Japan adopted negative rates, Haruiko Kuroda had publicly RULED OUT the adoption of negative rates. In simpler terms, the man in charge of the third largest economies central bank shamelessly contradicted himself.

Bank of Japan Governor Haruhiko Kuroda said he is not thinking of adopting a negative interest rate policy now, signalling that any further monetary easing will likely take the form of an expansion of its current massive asset-buying programme.

Investors should ask themselves: what if Yellen does something similar? How would that affect portfolios? Wall Street is following every syllable that mutters as holy scripture, what if she suddenly changes course completely opposite of her stance now?

"The economy is recovering and growing at a steady pace, we can proceed lifting rates," this sentence could suddenly become "The economy is floundering and we are reversing course and in fact going negative."

Not likely? Well Japanese bond and equity investors and their countries savers/retirees/pensions learned the hard way. As I had discussed in previous articles: its not that these global central banks are run by unintelligent lying people, but that they cannot see what the future holds.

And what makes sense today could quickly not make sense tomorrow, and vice versa.

Kuroda even added that the BOJ (Bank of Japan) has ample room to further go negative. What will be enough? -.01%? -2%? -4%? What is the number that will "hit his ambitious inflation target."

Negative rates were something that no one ever thought is possible. Why would investors pay their banks to store money? Not only does the average Joe is not get any interest at all while the banks speculate with their deposits, but now they have to pay to keep it stored.

Individuals are better off putting the money under their mattress - sure, the money will inflate away but at least they wont have to pay the banks.

Its interesting that the usual consequence of owning gold is that it yields nothing - it generates no utility or pays no dividends. Thus, even investing in bonds for 1% is better than 0. But now 25% of global government bonds are negative, and 0 is > negative, thus gold is actually becoming a high yielding asset. Ironically the very consequence the pundits used to push investors from gold into stocks and bonds is now turning on them.

Negative Rates Coming to US Courtesy of Yellen:

Negative rates are coming as i keep speculating. Why? Because the Fed needs individuals to keep from saving and continue spending. That has been the entire goal of central banks all over since 2008 - keep the machine going, no deleveraging can happen.

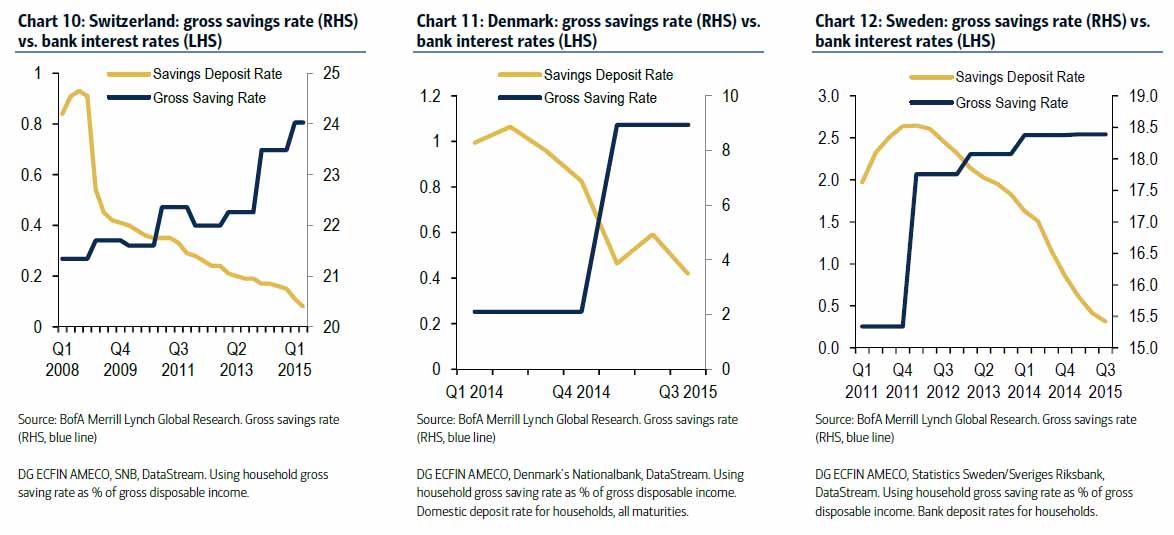

Yet, the paradox is that negative rates have actually increased savings:

(Click on image to enlarge)

Classic economics states that when individuals make less interest on their savings, they have to make up for it with more additional savings. As shown in Europe, for anyone to retire or protect themselves from growing economic uncertainty, they must slow consumption and save more - the complete opposite of what Draghi and the ECB wants.

The law of unintended consequences seems to have been all but forgotten in the era of full faith in the central banks.

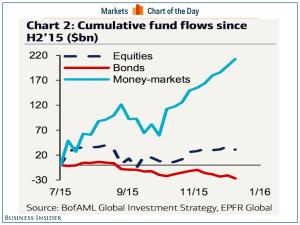

Now for the U.S.? It appears that investors are flooding into cash as money market funds: since summer/2015 money market funds have had over $212 billion and roughly $50 billion in the last 4 months alone:

What the chart doesn't show is: stocks being slaughtered since the New Year and junk bonds imploding, investors are clearly keeping liquid in cold hard cash.

All these inflows also explain the overvalued dollars strength as well.

Money market funds are almost hated as much as gold is by the Fed. This is because all these inflows into money market funds, simply being parked cash, are not being used to stimulate the economy.

The Fed will force its hand and stop this trend into money market funds and continue forcing investors into assets deemed to stimulate the wealth affect.

One can expect the decision to go negative will be sudden. I do not hold any weight in Yellen's optimism of the economy and the currency wars will reignite as a global recession kicks off, forcing economies to export their ways out.

What is a direct beneficiary of negative rates and more QE? Again i reiterate gold and high quality miners.

Disclosure: This is a column I wrote in my recent newsletter issue.