GE: Undervalued By About $53 Billion - Upside Potential Roughly 47%

Summary

- GE's stock has cratered by about 60% over the last 18 months, and the company's market cap has shrunk to just $113 billion.

- But despite the enormous negativity surrounding the company, GE's industrial segments remain quite profitable, and appear to be significantly undervalued right now.

- GE's exit from the DOW could be one of the final selling triggers in the stock.

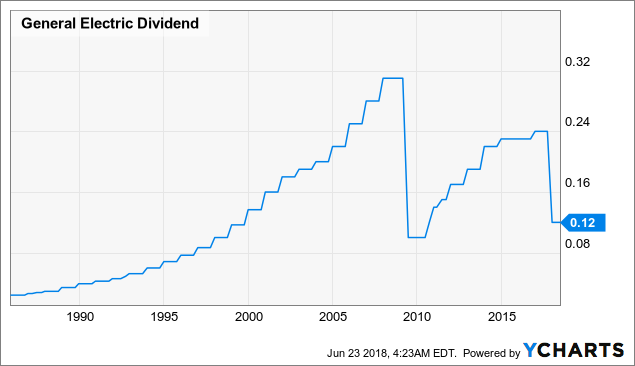

- Fears over a possible additional dividend cut appear overblown, and the cut seems unnecessary and extremely unlikely.

- GE's industrial units earned about $10 billion last year, suggesting GE may be undervalued by about $53 billion right now.

- This idea was discussed in more depth with members of my private investing community, Albright Investment Group .

Source: Moneyandmarkets.com

GE: Undervalued By About $53 Billion

To say that General Electric (GE) investors have had a rough ride over the past year and a half is a huge understatement. Rampant mismanagement, coupled with numerous financial setbacks have caused the once revered industrial giant’s share price to implode. Since late 2016, when the bulk of the declines began, GE’s stock has cascaded lower by a staggering 60%. In conjunction, the company’s market cap and enterprise value have collapsed as well. GE now sports a market cap of just $113 billion and its EV is just $187 billion, the lowest it has been since the mid-90s. To add insult to injury, GE was recently ejected from the DOW, of which it was a member for over 100 years.

GE 18-Month Chart

Source: StockCharts.com

GE Dividend data by YCharts

GE Dividend data by YCharts

So, this is it for GE? Is the once-mighty industrial giant down for the count, never destined to recapture its former glory? Or, is GE a turnaround story just waiting to happen?

Disclaimer: This article expresses solely my opinions, is produced for informational purposes only, and is not a recommendation to buy or sell any securities. Investing comes with risk to loss ...

more