The War Over Trade Policy In The White House

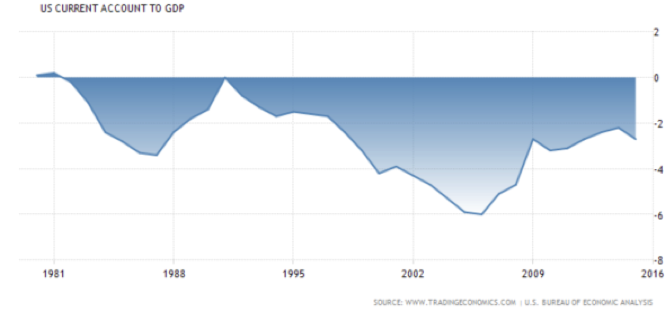

The Financial Times reported that “a civil war has broken out within the White House over trade”[1]. The war has the economic nationalists squaring off against the pro-trade factions from Wall Street. Readers are well-versed in the pro-trade approach since this philosophy has dominated policy making worldwide starting in the 1960s with the Kennedy round of tariff reductions. But today we are hearing more from the Trump officials about the need to eliminate trade deficits, to introduce border taxes and punish currency manipulators. The U.S. trade deficits as a per cent of GDP has hovered around the 3 per cent mark for several decades (see chart). Do these deficits really matter? The economic nationalists think so.

Trump advisor, Peter Navarro, advocates a revival of mercantilism that was conducted in the 15thand 16th centuries in Europe. Mercantilism aims at building and retaining as much economic activity as possible within a country’s borders. Mercantilism calls for high tariffs (i.e. border taxes) on imports of finished products and for subsidies on exports. In the 15th and 16th, trade imbalances were settled by gold shipments from the deficit nation to the surplus nation. The loss of gold lead to deflation and hardship. Today, the settlement takes the form of U.S. dollars absorbed by the surplus nation; these dollars are then reinvested in the United States.

Navarro has been quoted as saying that he wants to break up U.S. multinational supply chains so that more production is carried out in the United States creating jobs and wealth at home. Moreover, he rejects the value of recycling U.S. dollars back into the United States in the form of portfolio or business capital investment. He is just concerned with breaking up the supply chains that characterize international trade today amongst multinationals.

But this is the 21st century and economists look at economic nationalism in a quite different light. Ben Bernanke and Stephen Roach have argued that the U.S. trade deficit manages the ``global savings glut``. As Roach rightly argues the United States simply does not save enough to finance its own economic growth. He states that economic nationalism:

“fails a key reality check: America’s large trade deficit – a visible manifestation of its low saving – calls into question the very notion of economic strength. A significant domestic saving deficit, such as that which afflicts the US, accounts for America’s insatiable appetite for surplus saving from abroad, which in turn spawns its chronic current-account deficit and a massive trade deficit.”[2]

The U.S. savings rate is less than 5 per cent and that is woefully inadequate to finance economic growth at home. The shortfall in U.S. domestic savings is being picked up by foreign countries as they amass trade surpluses. Viewed from a different angle, the trade deficits are a result of persistent federal government deficits (negative savings) and insufficient U.S. domestic savings.

The modern day mercantilists focus exclusively on one side of the balance of payments ledger, namely, the trade flows. But the other side of the ledger --- the flow of funds back into the United States ----is equally important. Hitting one side of the ledger will have consequences for the other side. No one country benefits from economic nationalism in the final analysis.

[1] Financial Times, March 11,2017

[2] https://www.project-syndicate.org/commentary/trump-trade-war-with-china-by-stephen-s--roach-2016-12

Trump and his boys are dangerous. Only a big boost of Helicopter money would allow US citizens to accumulate the dollars to make his plan work. And really, the helicopter money would make the current system work better without all the grief and danger that the Trump radicals want.