Don’t Be Fooled By March’s Wimpy Payroll Growth

With nothing more than a quick glance, March's jobs report was a bit alarming. We only added 103,000 new positions, and the unemployment rate actually didn't edge lower to 4.0%, as was expected. That's a far cry from the 326,000 new payrolls added in February, particularly in light of the fact that we're allegedly in the midst of a booming economy.

As has been the case for a while now, there's more to the story.

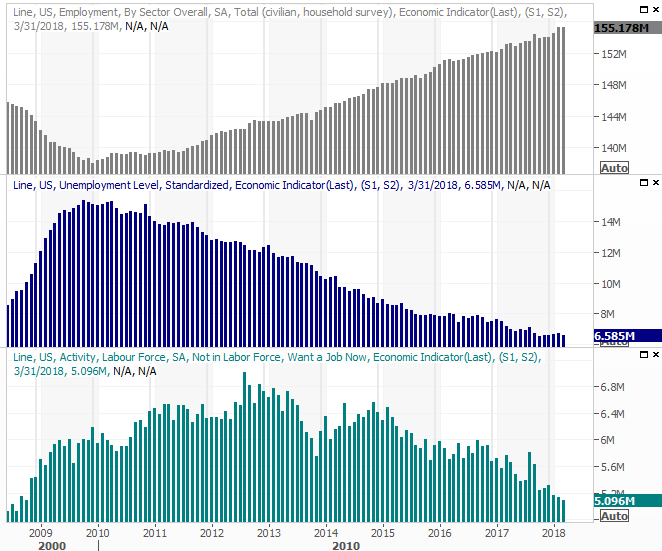

Yes, we only added 103,000 new jobs last month. There's a reason, though. That is, the unusually cold weather put the kibosh on construction work that would normally be underway by now. And, with an unemployment rate of 4.1%, there may simply be not enough available workers to fill open positions (more on that in a moment). Take a look.

Not all is as it seems.

Though a "just barely" change, there are fewer officially unemployed people out there right now, and fewer people who are not in the labor force but looking for a job. The latter is at a multi-year low, and the former is almost at a multi-year low. Both are edging lower too, but there's just not much room left for structural progress on those fronts. That's why we just couldn't add to the total number of people with jobs last month... we're quite close to maximum employment as is. (Per the latest look at the job openings report, "JOLTS," the number of unfilled positions as of January was indeed at a record high.)

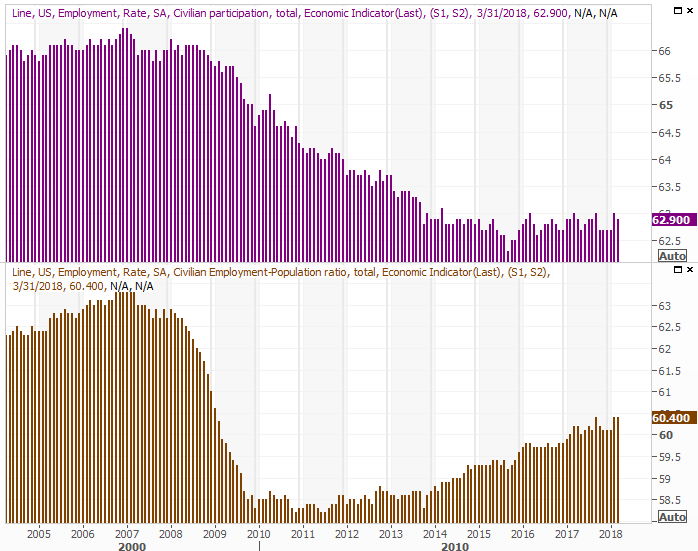

In that same vein, the number of people actively in the labor force (with a job, or just looking for one) continues to inch higher, but still has tremendous room to continue improving. This is true of the employment/population ratio as well as the labor force participation rate. The labor force participation rate isn't exactly humming, but we do see forward progress there.

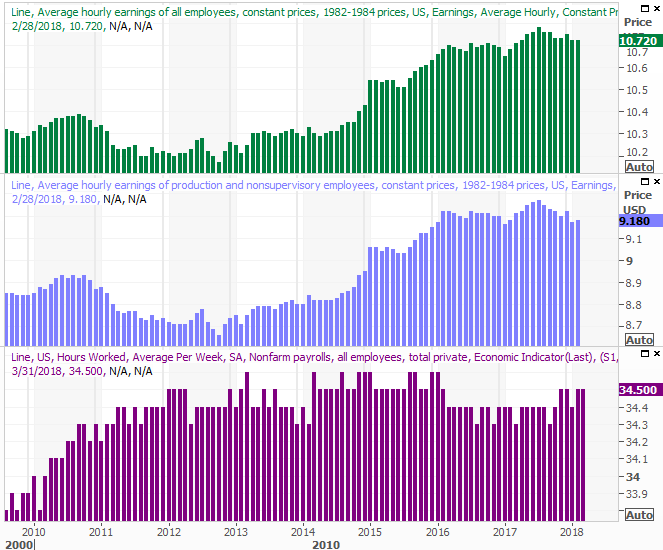

Finally - and as we've said many times of late - the real litmus test for an improving employment picture will mostly be improved wages, as a lack of available employees and demand for labor (created by a strengthening economy) will force employers to pay better to compete for workers. We're seeing progress there too.

The chart below only plots hourly wages through February (the bottom of the graphic is the average workweek), but in March, hourly wages were up 0.3% versus expectations of only 0.2%...and February's increase of 0.1%. The data renews a bigger, even if sometimes wobbly, uptrend seen since late 2014.

Bigger paychecks haven't swollen to the point where we'd expect to see rampant inflation, but if we see a few months of this kind of growth, that may well become a problem.

All in all, the jobs picture continues to point toward the same economic growth most other economic information points to. That doesn't mean the market won't suffer, but any correction is only a short-term matter and won't necessarily quell the bigger-picture bull market. Corrections, after all, have nothing to do with fundamentals. They're more about emotions and headlines, which have clearly been troubling of late.

Just something to remember a few weeks from now, if the selling effort takes hold and really does some damage to the broad market. As long as employment remains firm our mostly-consumer-driven economy will continue to drive profits for corporations.