Danger Zone: Marketo

Photo Credit: Frank Farm (Flickr)

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and Marketwatch.com

Some of our most successful Danger Zone warnings have been on overvalued cloud software companies, i.e. Demandware (DWRE) and Splunk (SPLK). This week we’ve identified another highflying cloud company that exhibits many of the problematic traits we saw in DWRE and SPLK. Revenue growth can only support a stock for so long and this week’s Danger Zone stock, Marketo (MKTO: $29/share) has plenty of room to fall.

Look Past Impressive Revenue Growth

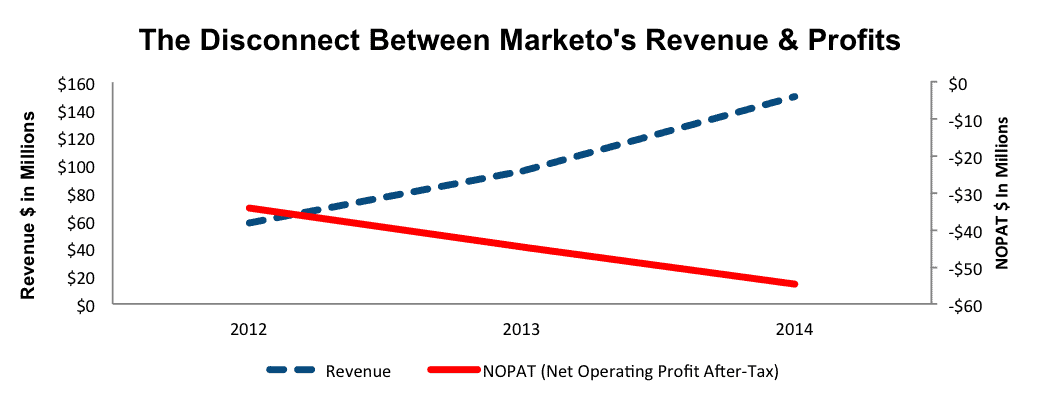

Like many cloud companies, Marketo has used excellent revenue growth to woo investors into buying its “growth story.” The problem with this revenue growth is that is has not resulted in profit growth. Since 2012, Marketo’s after-tax profit (NOPAT) has fallen from -$34 million to -$65 million on a trailing twelve-month (TTM) basis.

Figure 1: Don’t Be Fooled By Revenue Growth

Sources: New Constructs, LLC and company filings

The reason for the divergence between revenues and profits has been the cost of acquiring new customers. Since 2012, revenue has grown by 60% compounded annually but sales & marketing costs have grown by 62% compounded annually. General & administrative costs have grown by 50% compounded annually as well.

In an effort to keep investors’ hopes high for the future, Marketo’s growth at all costs strategy has come at the expense of the bottom line. NOPAT margins remain an alarming -36% on a TTM basis. Not exactly a value creating business model.

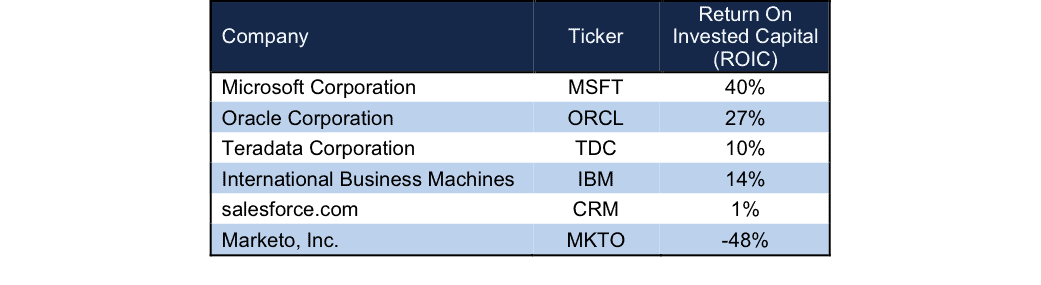

With negative profits and an increasing invested capital base, it should come as no surprise that Marketo earns a bottom quintile return on invested capital (ROIC) of -48%.

Marketo Faces Deep Pocketed Competition

By operating in the online marketing market, Marketo faces competition from multiple firms, many of which are much larger and possess a significantly larger resource pool from which to expand business operations. Making the landscape tougher for Marketo, its largest competitors have many other profitable business lines, which allow them to subsidize losses in other segments. Not surprisingly, Figure 2 highlights how much higher the ROIC is for Marketo’s competitors. Even Salesforce, a company we’ve previously been critical of is able to generate a positive return while Marketo’s ROIC remains well below zero.

Figure 2: Marketo Faces Steep Competition

Sources: New Constructs, LLC and company filings

Investors may argue that these large competitors don’t focus on marketing solutions. However, each of the above companies has either organically created or acquired a direct competitor to Marketo. Microsoft (MSFT) recently partnered with Adobe (ADBE) to create an integrated marketing and sales service, Oracle (ORCL) has acquired Eloqua and Responsys, Teradata (TDC) operates Aprimo, IBM acquired Silverpop, and Salesforce (CRM) has acquired ExactTarget who had previously acquired Pardot.

Making matters worse, each of these larger competitors can package their automated marketing solutions into a larger suite of tools, providing a one-stop shop for clients. A diversified set of offerings also allows Marekto’s competitors to be more selective about which clients to pursue, which means they leave the unprofitable ones to Marketo, just as they do with Demandware (DWRE) in the e-commerce segment.

Bull Case Focuses on The Wrong Metrics

The success of Marketo relies upon its ability to add new clients, create additional features in its software and eventually make a profit. Bulls like to point to Marketo’s excellent customer growth as well as their ability to retain customers as reason to believe in the company’s business. In the company’s 3Q15, Marketo had just over 4000 customers. Even if we ignore that direct competitor Hubspot has nearly 16,000 customers, it’s impossible to ignore that growing customers and revenue has only driven profits lower. At the same time, competition has increased, making the future for profits at Marketo bleaker. Additionally, as the automated marketing services business matures, it will become increasingly commoditized, which will lead to pricing wars. With such a negative margin, Marketo can ill afford to enter into a pricing war with their more profitable competition and no amount of customer growth can offset a pricing war. Investors must beware companies with revenue growth that inversely relates to profits. This trend has a very limited life span especially in today’s markets.

Hidden Liabilities and Poor Strategic Fits Make Buyout Unlikely

As noted above, the online marketing service industry has been ripe for acquisition activity, with numerous large tech firms picking and choosing their targets. However, we argue that the most desirable firms have already been purchased. Since each of the companies in Figure 2 either acquired or partnered with a firm other than Marketo, one must question whether Marketo is as attractive as investors want to believe. In addition, Marketo has some hidden liabilities that make the company more expensive than the standard accounting numbers suggest:

- $19 million in off balance sheet operating leases

- $114 million (10% of market cap) in outstanding employee stock options

We think betting on a white knight to buy MKTO anywhere near its current valuation is a bad bet.

Even with An Acquisition Premium, Valuation Is Alarming

At current prices, Marketo shares imply the company will execute a major turnaround in operations and generate significant profits. To justify its current price of $29/share, Marketo must raise its pre-tax margin from -37% to 5% and grow revenue by 21% compounded annually for the next 23 years. In this scenario, Marketo would be generating more revenue than what VMware and Salesforce combined to produce in 2014.

Those expectations are so high that we think the market must be pricing in a buy out from a larger and far richer suitor. To account for this possibility, we analyze the feasibility of the most likely acquisition scenarios.

Assuming that Microsoft could, upon acquisition, immediately elevate Marketo to its industry-leading level of profitability, it is the best-case scenario acquirer. In that scenario, Marketo would still have to grow revenue by 24% compounded annually for the next eight years to justify Microsoft’s purchase at its current price. A more realistic price MSFT might pay for Marketo is $9/share, which is the value of MKTO’s business based on the value of the firm if it achieves Microsoft’s 21% NOPAT margin in year 1 of the acquisition. This scenario is unlikely on two levels: (1) such an immediate and large improvement in Marketo’s profits is a stretch and (2) Microsoft has partnered with Adobe in April of this year.

Another scenario is IBM acquiring Marketo to further integrate with the acquisition of Silverpop. In this scenario, assuming Marketo immediately achieves IBM’s ROIC and pre-tax margin, it would still have to grow revenue by 22% compounded annually for the next 17 years. A more realistic price IBM might pay for Marketo is $7/share, which is the value of the MKTO’s business based on the value of the firm if it achieves IBM’s 16% NOPAT margin in year 1 of the acquisition.

This math makes it tough to argue for MKTO shares to go anywhere but down from current levels.

Investors Will Grow Tired Of Revenue Growth and Sell Shares

Over the past month we have seen the overall market make drastic up and down movements. When the dust settles, we’re seeing that companies without profits (despite impressive revenues) are no longer participating in the upward movements. We think Marketo will follow the path of these similar Danger Zone members.

- Splunk (SPLK) – Danger Zone July 7, 2015

- Performance: SPLK -20%; S&P -5%

- Demandware (DWRE) – Danger Zone June 23, 2015

- Performance: DWRE -26%; S&P -7%

- Groupon (GRPN) – Danger Zone June 9, 2015

- Performance: GRPN -39%; S&P -5%

- Twitter (TWTR) – Danger Zone June 1, 2015

- Performance: TWTR -26%; S&P -6%

Insider Sales/Short Interest Raise Red Flags

Over the past 12 months 600,000 shares have been purchased and 3.5 million shares have been sold for a net effect of 2.9 million insider shares sold. These sales represent 7% of shares outstanding. Additionally, there are 4.9 million shares sold short, or 11% of shares outstanding. It seems clear that not only are insiders cashing in but also investors are beginning to realize the overvaluation of MKTO.

Executive Compensation Is Inconsistent With Shareholder Value Creation

Apart from base salaries, executives receive annual cash bonuses and equity awards. In 2014, bonuses were based upon new business bookings and dollar retention rate. In 2015, bonuses are now based upon the value of new customer subscriptions and customer retention. We prefer to see compensation aligned with ROIC.

Impact of Footnotes Adjustments and Forensic Accounting

We have made several adjustments to Marketo’s 2014 10-K. The adjustments are:

Income Statement: we made $2 million of adjustments with a net effect of removing less than $1 million of non-operating income (<1% of revenue). We removed $1 million related to non-operating expenses and $1 million in non-operating income.

Balance Sheet: we made $32 million of balance sheet adjustments to calculated invested capital with a net increase of $22 million. The largest adjustment was the inclusion of $19 million due to operating leases. This adjustment represented 16% of reported net assets.

Valuation: we made $139 million of value decreasing adjustments. There were no value increasing adjustments. The largest adjustment to shareholder value was the removal of $114 million in outstanding employee stock options. This adjustment represented 10% of Marketo’s market cap.

Dangerous Funds That Hold MKTO

The following fund receives our Dangerous rating and allocates significantly to Marketo.

- Advisers Trust JOHCM U.S. Small Mid Cap Equity Fund (JODMX) – 2.1% allocation and Dangerous rating

Disclosure: New Constructs staff receive no compensation to write about any specific stock, sector, or theme.