Why Trump Is Taking The Dollar Down And How To Profit From It

It is no surprise. Donald Trump has an ego. . .

Understanding this is crucial. It gives contrarian investors big hints what to expect.

Look for yourself. It's right there on the White House website.

To get the economy back on track, President Trump has outlined a bold plan to create 25 million new American jobs in the next decade and return to 4 percent annual economic growth.

The economy since 2009 has grown at an average of 2.05 percent. And GDP for 2016 was only 1.6 percent.

This was 38% lower than 2015's GDP - which was 2.6 percent. The downtrend is likely to continue into 2017. . .

Why?

For starters, the post-2008 recovery is in its 9th year.To put this in perspective, the average expansion/recovery since the 1980s has been 80 months. That is only 6.7 years.

So by recent historical standards, the post-2008 recovery has gone on too long.

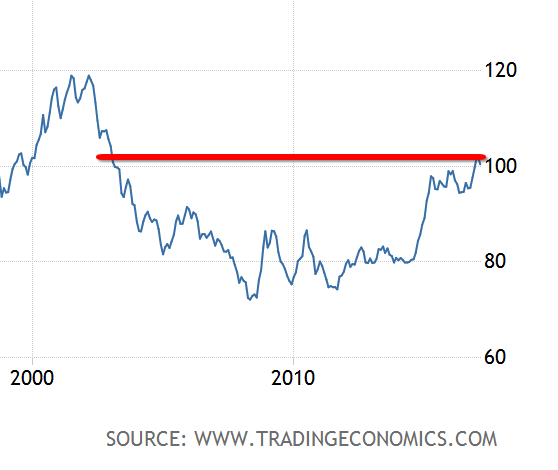

Secondly, and most importantly, the Federal Reserve is tightening. . . This has sent the U.S. dollar to multi-year highs.

The dollar has not been at these levels since 2003. That was 14 years ago. And the stronger the dollar is, the cheaper other currencies are. It is a zero-sum gain. For example, if the dollar is strong, the euro must be weak.

This is exactly at its most fundamental core what Trump is worked up about: a strong dollar makes Americans buy more foreign goods. This subsidizes foreign businesses at the expense of American ones.

Even top Trump trade advisors have already called out such "unfair" currency weakening of our trading partners. Not just China and Japan - but Germany with the euro.

Trump had built a campaign of bold promises, especially for businesses. But to achieve his targeted 4% GDP, he will need more than tax cuts, de-regulation and import tariffs. Corporate tax cuts will invite investment back from tax havens abroad. De-regulations will promote production onshore. And import tariffs will subsidize domestic producers of goods.

Even the trillion dollar "Trump Stimulus" this late in the recovery, especially with a tightening Fed, won't do it. Because there is one fatal flaw. . .

Trump will need a weaker dollar to promote exports and reduce imports.

He has already commented on this in a WSJ interview that the dollar is too strong.

“Our companies can’t compete with them now because our currency is too strong. And it’s killing us,” said President Donald Trump.

And without a weaker dollar, 4% GDP is simply wishful thinking.

But as I wrote earlier - Trump has an ego. . . So don't expect him to not use everything in his arsenal to get the growth he has promised.

Furthering this thesis is that Trump is surrounded by old Ronald Reagan guys. And using a Reagan playbook. Most striking is his appointment of Robert Lighthizer as U.S. Trade Representative.

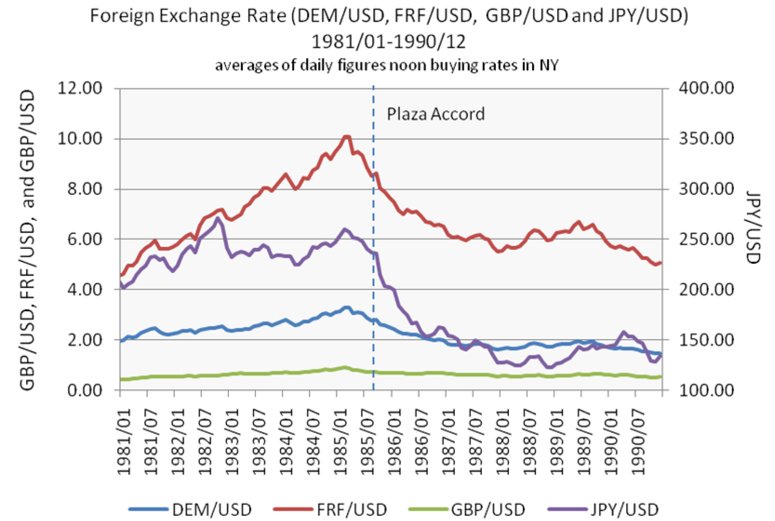

This man was part of the infamous Plaza Accord deal of 1985. Some context of the Accord:

After Paul Volcker curbed inflation by hiking rates double digits in early 1980s, the dollar's value soared. This severely dampened U.S. exports, and cheap imports swelled the U.S. deficit. The Plaza Accord was a currency agreement between the U.S., Japan, Germany and other trading partners. The deal was to systematically weaken the dollar against their currencies - specifically Japan. Over the next few years the dollar fell over 40% against the Japanese yen. And U.S. trade improved over 50%.

During his tenure, Reagan struck the 1985 Plaza Accord currency deal with Japan, Germany and other major trading partners that brought down the dollar's value and encouraged more foreign companies to set up U.S. manufacturing plants," wrote Reuters.

With Trump surrounded by such men, and his ego to keep his word, a weaker dollar looks almost inevitable. . .

My favorite ways to play this is by buying 12-month CALLS on a euro and yen trust. Even PUTS on a dollar ETF.

And my favorite currency - gold.

CALLS on gold trusts and select miners look attractive. Especially hand-picked junior miners that offer option-like returns without the fixed timeframe.

Paying pennies every 12 months to buy these options offers asymmetric (low fixed risk / high unlimited reward) opportunities. I will patiently wait and accumulate such positions.

It is worth mentioning that George Soros made a vast fortune by positioning for a weakening dollar from the 1985 Plaza Accord.

In his September 28 entry Soros describes the Plaza accord coup as “the killing of a lifetime . . . the profits of the last week more than made up for the accumulated losses on currency trading in the last four years . . .” George Soros — Global Speculator (The Money Masters) by ValueWalk.

It took a while to play out - but all good things do.

more