Yellen Boasts About Clean Energy Tax Break Success Despite $1.7T Deficit And $34T In Debt

Image Source: Pixabay

Despite the fact that the country is running record deficits, has just passed $34 trillion in debt, and is, for all intents and purposes, on the precipice of a debt spiral "point of no return", Treasury Secretary Janet Yellen still seems awfully cavalier about spending.

This past week Yellen said that she "welcomed" larger than expected uptake of tax breaks under the Biden administration's Inflation Reduction Act, despite the fact that the country doesn't have any way to pay for it, according to Bloomberg.

Yellen said this week: “What that reflects is the effectiveness, the tremendous response rate, that we’re seeing from the private sector, from cities and states, to these incentives. So you’re clearly having a very major effect on take-up for clean energy investments.”

The 2022 IRA aims to boost clean energy, including electric vehicles, mainly via unlimited tax incentives, ironically producing the opposite result of "inflation reduction".

While the Congressional Budget Office projected a $238 billion deficit reduction over 10 years, the Brookings Institution warns costs could reach $1 trillion due to higher demand, the Bloomberg article noted.

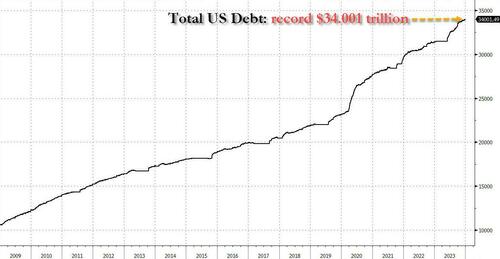

Since this is a topic we have covered more or less daily for our 15-year existence, we don't need to say much suffice to show a chart of total US debt since Zero Hedge launched in Jan 2009, when total US debt was only $10.6 trillion. We sure have come a long way since then.

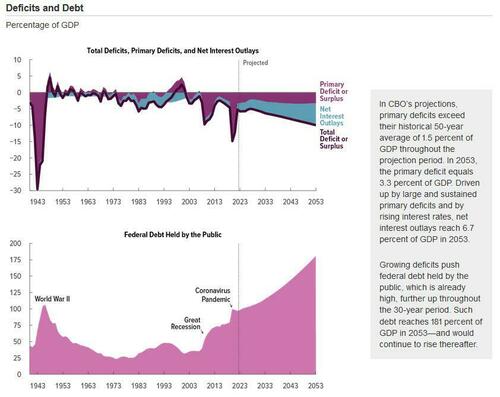

As we noted a couple of days ago, at this point everyone knows how this ends - certainly, the CBO does...

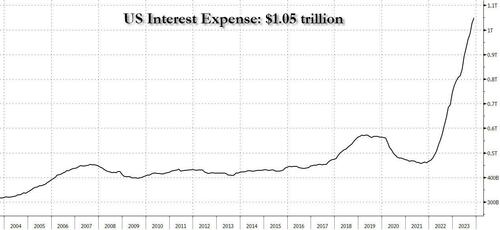

As we wrote about a week ago, at best, one may only prepare for the inevitable hyperinflationary outcome, which would be good news to what is now over $1 trillion in interest expense: after all, someone has to devalue the currency all that interest is payable in.

And since there is no longer a way out, we may as well joke about it so consider this: in the third quarter when US GDP supposedly grew at a 4.9% annualized rate - hardly the stuff of recessions - rising $547 billion in nominal (not real) dollars, the US budget deficit increased by a whopping $622 billion.

More By This Author:

2024 Starts With Deposit Flight From Large Banks, Loan Volumes Shrink; But Trouble Is Brewing For Small BanksAirlines Hit Turbulence After Delta Trims 2024 Earnings Forecast

JPM Reports Mediocre Q4 Earnings But Impresses With Stellar 2024 Forecast (Which Is Based On 6 Fed Cuts)

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more