Would You Pick $1,000 Today Or $1,250 In Five Years?

One of these is better deal. Here’s how to know.

If I offered you a choice between $1,000 right now or $1,000 five years from now, anyone would take the $1k today. But if I offered you $1,000 today and $1,250 in five years, there’s a little more hesitation. Which is actually a better deal? Less money now or more later?

You may be tempted to choose the $1,250 because it’s the higher value. Or you may be tempted to take the $1,000 because, damn, you really want it today. However, there’s actually a formula that’ll factually tell you the better choice.

The Time Value of Money Formula

Having a dollar today is worth more than the guarantee of a dollar in the future. But, worth how much more exactly and at what point does a higher future dollar amount, outweigh whatever I’m being offered now?

You probably experience these decisions every day, but it’s usually not related to money. What are some relatable examples to help demonstrate?

Here’s an overly simple example using pizza. You ordered pizza 🍕

You want to eat the whole pizza tonight, but if you do, you won’t have any for for tomorrow. Is it better to enjoy the whole pizza tonight or do the responsible-sounding-thing & save half for tomorrow?

Thanks to the Time Value of Money, it’s better to eat the whole thing tonight. Why??

First, fresh pizza today is worth more (in the currency of taste dollars) than leftover pizza tomorrow. A fresh pizza cost you $1o in US currency. A fresh pizza is equal to $20 in taste currency. Half of a leftover pizza is equal to $5 in taste currency. It’s only half the size, so it cuts the $20 taste value in half, also it’s leftover which cuts the now only $5 taste value in half again.

Full fresh pizza tonight= $20 in taste dollars

Half fresh pizza tonight($10), half left over pizza tomorrow($5)= $15 in taste dollars.

$20 is obviously a better bang for the $10 pizza investment.

But my pizza taste dollars were just arbitrary numbers pulled out thin air.

To actually show you the formula to use when making money decisions, I’ll go back to the original question: is $1,000 today worth more or less than $1,250? Figuring this out is relatively simple, is there an added benefit to the $1000 today that makes it worth more than the $1,250 in five years? Like the added taste dollars of the fresh pizza, vs. the leftover pizza?

Yes, there is an added value. $1000’s “added value” comes from the fact that you could invest it. Instead of potential added taste dollars to consider, you consider the potential added investment dollars.

How much could you make from investing $1000, over the next five years? How will you know if it’ll be more than the guaranteed $1,250 you’ll get in five years? There is a way….

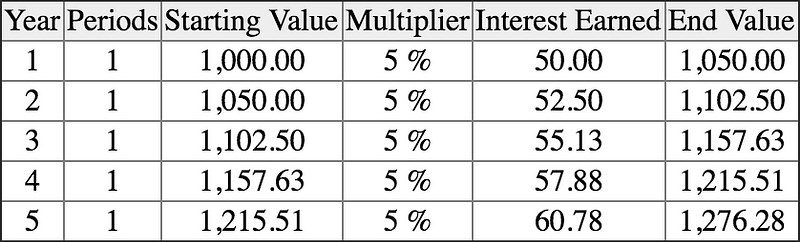

Obviously, you can’t know perfectly what gains you’ll make over the next five years with investing, but if you put the $1,000 in a safe 5% guaranteed investment, you can estimate with a high degree of accuracy that you’ll average a 5% annual return.

5% of $1k is $50. After 1 year, you’ll have $1,050

5% of 1,050 is $52.50. After 2 years, you’ll have $1,102.50. And so on…

We just figured out the the future value of $1,000. Five years in the future, my $1,000 will be worth $1,276.28. Since I’m choosing between $1,276.28 (disguised as $1000 today) or $1,250 five years in the future, I’m going to go with the $1,276.28, disguised as $1000 today.

$1,000 today > $1,250 in five years

To label this accurately according to economic norms, here are the terms you’d use if running this calculation through an online calculator:

- Present Value = $1000

- Future Value = the value of $1000 in five years

- Number of Years (or Periods) = 5 years we’ll be investing the $1000

- Interest Rate = 5%, or the rate you assume you could make by simply investing this money

If $1000 future value is > than $1,250, you take the $1000 today.

Bottom line: You can use the time value of money to figure out common but annoying problems like —

- whether it’s worth paying for equipment upfront or via a payment plan

- whether it’s worth putting some extra money towards student loan payments or towards an investment

- any situation that involves comparing amounts of money, to each be paid & received at different times.

Using the formula will improve your ability to make the best decisions possible. For me, it has largely increased my decision making skill. It’s given me a template and organized guidelines for what would otherwise be chaos. It’s surprising how often decisions are made against what this formula advises.

In many situations, good and bad decisions are based on much more than money alone. But when you’re dealing with money, there is always a more profitable decisions and a less profitable decision. The Time Value of Money can help you decode which is which. Once you at least have that laid out, from there you can more clearly factor in the “life” stuff… the unmeasurable emotions and values that weigh in as well.

Make sure you always get the most bang for you pizza investment 🍕

Disclaimer: The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which course of ...

more

Great thought! This goes to show how important basic financial knowledge is for everyone. Thank you for your post!