With The Short Seller Squeeze In Energy These High Yields Are Getting Attention

Energy infrastructure stock prices are under attack. Institutional investors are bailing, individual investors are running scared, and I believe the short-selling crowd has jumped on the sectors to push share prices down to unbelievably low levels. These are all dividend-paying stocks, which means yields have risen to eye-popping levels. I think the sector is set up for a short-squeeze rally that could turn into longer-term share price appreciation.

Energy infrastructure, also sometimes called energy midstream, includes the companies that gather, process, transport, and store energy commodities and products. Once upon a time, before 2016, most companies in the sector were organized as master limited partnerships (MLPs). There has been a lot of financial restructuring over the last five years, as the energy complex has gone through a deep and extended bear market.

Financial results from midstream companies have been solidly improving for at least the last year. However, share prices have not followed along with better industry news. Most companies have put out third-quarter earnings results, and the energy infrastructure earnings came in as expected for almost every company. Yet for the week following earnings, share prices crashed. Here is a quote from the MLPGuy.com weekly commentary:

“This week, the MLP Index was down more than 1% each day for three straight days this week, which was the first time since January that has happened. It has only happened 18 other times in the last 10 years.”

I have a theory about why share prices fell so quickly after earnings. Most MLPs and companies that used to be MLPs announce dividends a few weeks before earnings season. Most of those dividends went ex-dividend during the last two days of October and within the first few days in November. For a short seller, if a stock they are short goes ex-dividend, the shorting trader must pay the dividend. I think the short-selling crowd waited until after the ex-dividend dates to pile into the sector with their short trades. The result is share prices dropping due to the regular ex-dividend effect and short-sellers further pushing down share prices.

I think this overselling in the midstream sector has set the group up for a traditional short squeeze. That happens when share prices to rise, the short-sellers get nervous and add to the buying with their orders to buy back shares they have shorted. When a short squeeze happens, the price increases can be dramatic. MLPGuy provides further “proof” with the continuation of the above statement:

“…15 of those 18 times (or 83%) the AMZ was positive 30 days later. In those 15 times when AMZ was positive, the average return was 8.6%. Overall average return across all 18 times has been 6.6%. Based on that very small sample size, chances are MLPs trade better at some point in the next 30 days.”

For some ideas in the sector, here are three midstream companies that have experienced steep share price drops, have high current yields and have well-supported dividends.

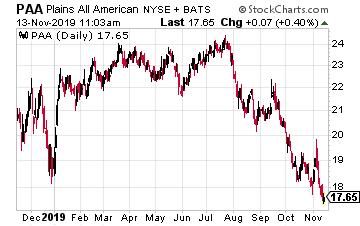

(Click on image to enlarge)

In September Plains All American Pipelines, LP (PAA) was trading for just over $25. Now a few months later, the share are trading for less than $18. That’s a 28% price drop for a company that has a solid growth path, is reducing debt, and has 1.8 times cash flow coverage of the dividend (1.3 times is really good in this sector).

It is likely that Plains will restart dividend growth next year.

Right now, you get a quality midstream company that yields 8%. This stock could easily pop into the low $20’s.

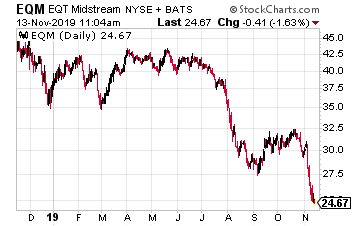

(Click on image to enlarge)

EQT Midstream Partners LP (EQM) provides natural gas gathering and interstate takeaway pipelines in the Appalachia Basin.

The company has faced environmental legal challenges to its 300 mile, $4 billion Mountain Valley Pipeline. The forecast completion date has been pushed back at least two years, now targeted for the end of 2020. When finished, the pipeline will give EQM an immediate 30% boost in EBITDA.

The EQM share value is down 50% compared to a year ago.

Management insists the dividend will be paid, so you will earn 17% while waiting for this one to recover.

This is a riskier play with greater upside potential.

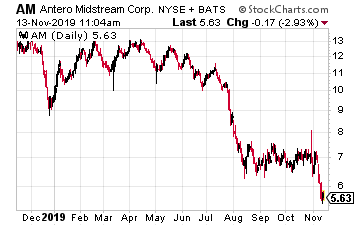

(Click on image to enlarge)

The Antero Midstream Corp. (AM) is down 45% since mid-summer. Like EQT, AM also gathers and transports Appalachia natural gas.

The company’s results are viewed as closely tied to upstream producer Antero Resources. That’s fine since AR is forecasting 8% to 10% production growth for 2020.

Antero Midstream is fighting back against the market with an aggressive share buyback program.

Buying in shares that yield 20% is hugely cash flow accretive to investors that continue to hold the shares. After last week’s 20% sell-off, AM yields 21.8%.

I think the Q4 earnings will produce a very different result.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more