Winners Keep On Winning: Investing In Outperforming Stocks

Many investors tend to stay away from stocks that are appreciating strongly over time, mostly because of fears of buying too late when the stock is already overvalued. Having some patience when looking for entry prices and being conscious about valuation is very important. However, blindly avoiding stocks with vigorous momentum can mean that you are missing many of the most profitable opportunities in the market.

Momentum and valuation can be remarkably different things, and the best companies in the market can sustain massive outperformance over long periods of time.

Winners Keep On Winning

When a stock is rising strongly, many investors tend to think that it is already too late to buy. In cases when you consider that the valuation is not justified by the business fundamentals, being patient and waiting for a better entry price is in fact the smart thing to do.

On the other hand, avoiding a stock only because its price is rising can be one of the most expensive mistakes that you can make as an investor. The most important thing to consider is that only because the stock has appreciated this does not mean that it is overvalued.

Momentum is about comparing the stock price versus its price in the past (absolute momentum) or versus other stocks in the market (relative momentum). Valuation, on the other hand, is about comparing the price of the stock versus the value of the cash flows that the business is expected to produce in the long term.

Sometimes the stock price is rising because the value of the business is increasing. A clear example could be the internet and software companies that are currently benefiting from accelerating revenue growth during the pandemic. Some companies are particularly successful at building new growth engines over time, which obviously increases the value of the business.

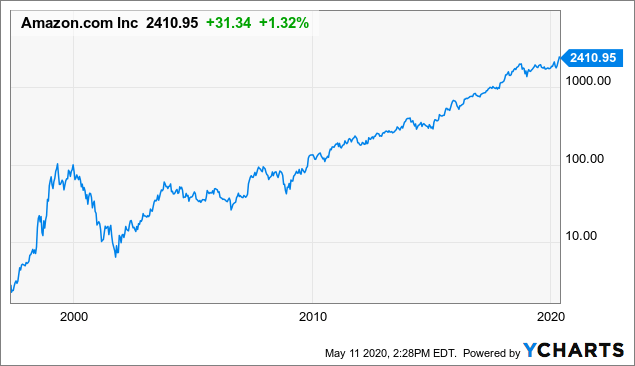

Amazon (AMZN) is a paradigmatic example to consider. In April of 1999 Amazon was considered "by far the market's most overvalued stock, according to a survey of eight leading Wall Street strategists". The stock was trading at $168 per share back then versus over $2,411 per share now. The stock price actually collapsed during the explosion of the dotcom bubble, but this shows how valuation can look very different depending on the timeframe.

More recently, there are many examples of analysts considering Amazon overvalued at much more reasonable valuation levels in the past decade. A Forbes article from 2013 calls Amazon "One Of The Most Overvalued Stocks" in the market at a price level of $358 at the time.

If we could travel back in time to the year 2013, we could see that Amazon was making new all-time highs year after year, the stock price had more than doubled versus price levels during the dotcom bubble, and valuation rations looked expensive. However, the stock was still a major bargain at $358 in 2013.

Data by YCharts

Anchoring to past data can be a very common pitfall. When you see that the stock price is rising steeply, it is only natural to believe that it could be overvalued. In some cases the business fundamentals more than justify the increase in the stock price, but you need to have a forward-looking vision to see that.

Over the past two decades, Amazon has expanded from an online bookstore to the undisputed leader in online retail across multiple categories, while also building new growth engines in cloud computing infrastructure, digital content, and online advertising, among others. The company's growth rate has been much higher than previously expected by the market, which explains why the stock price has appreciated so much over time.

Quantifying The Power of Momentum

Amazon is a very particular case, as the company has created gargantuan amounts of wealth for investors over the long term. But Amazon is not the exception to the rule. On the contrary, all else the same, stocks with powerful momentum tend to deliver superior returns over the long term, and this has been proven extensively in academic research.

The Stocks on Fire algorithm is a stock-picking tool based on two main return drivers: price momentum and fundamental momentum. The price momentum factor measures price performance over different time frames in order to identify consistent price winners. The fundamental momentum component measures the adjustment in sales and earnings expectations in order to find companies that are doing better than expected and also generating rising expectations about future performance.

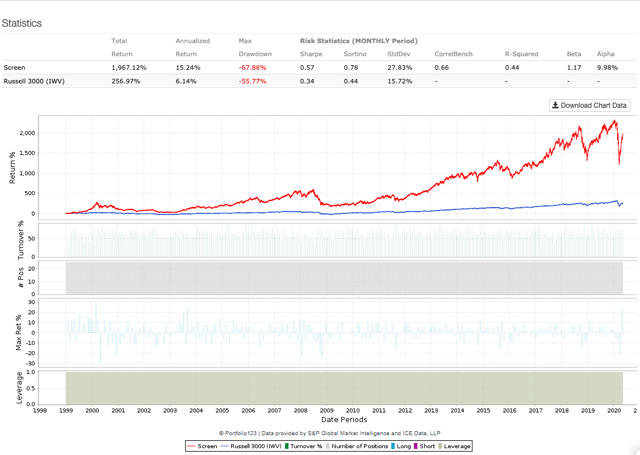

The following backtest picks the 25 stocks with the highest Stocks on Fire algorithm in the Russell 3000 index, and it compares performance versus the iShares Russell 3000 (IWV) ETF. The portfolio is rebalanced every four weeks and the backtest begins in 1999.

Data from S&P Global via Portfolio123

The strategy is more volatile than the benchmark, but the superior returns comfortably compensate for that volatility. Since 1999 the strategy gained 1967% versus a cumulative gain of 257% for the ETF in the same period.

| Strategy | IWV | |

| Annualized | 15.24% | 6.14% |

| One Month | 23.44% | 5.69% |

| Three Month | -9.64% | -12.25% |

| One Year | 5.68% | 2.09% |

| Three Year | 36.95% | 26.05% |

| Five Year | 69.46% | 47.29% |

| Total | 1967.12% | 256.97% |

| Sharpe Ratio | 0.57 | 0.34 |

| Sortino Ratio | 0.78 | 0.44 |

| Max Drawdown | -67.88% | -55.77% |

| Standard Deviation | 27.83% | 15.72% |

| Correlation | 0.66 | - |

| R-Squared | 0.44 | - |

| Beta | 1.17 | - |

| Alpha (annualized) | 9.98% | - |

Data from S&P Global via Portfolio123

The table below shows the 25 stocks with the highest Stocks on Fire ranking in the Russell 3000 index nowadays. Unsurprisingly, there are many names in the technology and biotech space, which is to be expected in the current market environment. The table also shows market capitalization and returns over different periods.

| Ticker | Name | MktCap (Millions) | Return 4 Weeks% | Return 26 Weeks% | Return 52 Weeks % |

| ATVI | Activision Blizzard Inc | $56,343 | 20.97 | 34.08 | 58.93 |

| ARVN | Arvinas Inc | $2,041 | 15.27 | 108.37 | 138.07 |

| BAND | Bandwidth Inc | $2,540 | 41.77 | 127.1 | 45.14 |

| CALX | Calix Inc | $712 | 68.95 | 67.6 | 83.5 |

| CNC | Centene Corp | $38,153 | -0.81 | 24.09 | 19.67 |

| CCOI | Cogent Communications Holdings Inc | $3,707 | -7.28 | 30.1 | 37.32 |

| DXCM | DexCom Inc | $37,428 | 47.31 | 108.27 | 241.36 |

| DOCU | DocuSign Inc. | $21,127 | 28.61 | 78.2 | 119.72 |

| EVER | EverQuote Inc | $1,332 | 41.08 | 69.23 | 370.84 |

| GLUU | Glu Mobile Inc | $1,515 | 81.74 | 87.39 | 14.53 |

| IMMU | Immunomedics Inc | $6,972 | 66.04 | 90.26 | 113.98 |

| IPHI | Inphi Corp | $5,086 | 27.33 | 57.09 | 118.33 |

| LLNW | Limelight Networks Inc | $611 | -10.75 | 18.17 | 73.05 |

| LMNX | Luminex Corp | $1,483 | 14.8 | 82.46 | 50.63 |

| MTSI | MACOM Technology Solutions Holdings Inc | $2,078 | 28.67 | 35.61 | 104.93 |

| MTEM | Molecular Templates | $775 | 12.82 | 100.12 | 127.75 |

| NVDA | NVIDIA Corporation | $191,250 | 18.84 | 50 | 85.11 |

| QDEL | Quidel Corp | $6,640 | 65.31 | 169.96 | 161.98 |

| RGEN | Repligen Corp | $6,398 | 24.15 | 50.39 | 77.32 |

| SGEN | Seattle Genetics Inc | $27,220 | 31.04 | 51.52 | 133.1 |

| TDOC | Teladoc Health Inc | $13,074 | 20.35 | 120.38 | 189.49 |

| VRTX | Vertex Pharmaceuticals Inc | $70,374 | 10.15 | 38.71 | 60.87 |

| WING | Wingstop Inc | $3,773 | 27.84 | 63.67 | 61.58 |

| ZM | Zoom Video Communications Inc | $43,314 | 24.81 | 132.6 | 95.15 |

| ZYXI | Zynex Inc | $615 | 42.54 | 108.2 | 156.29 |

Practical Considerations

All kinds of factors - value, growth, momentum, etc - can have fluctuating performance over different periods. The historical evidence shows that high momentum stocks tend to outperform over the long term, but there will always be periods of underperformance from time to time. Besides, momentum stocks are particularly volatile, so this can be an additional source of risk to keep in mind when investing in these kinds of names.

The main concern for investors in high momentum stocks is generally valuation. The strategy above can be easily improved by incorporating some valuation metrics into the requirements. However, that is beyond the point. The main idea is showing how winning stocks tend to keep on winning over time, even when you leave valuation out of the equation.

I would never buy a stock solely because the price is rising. You need to make sure that the business fundamentals are strong enough to justify the valuation. Ideally, you want to invest in businesses that can not only meet but also exceed growth expectations over the long term.

However, avoiding a stock only because it has appreciated can be too shortsighted. Think about the most profitable stocks in the past decades, names such as Amazon, for example. These companies probably have many valuable attributes in common, but one thing is for certain: If they have delivered massive returns over the long term this is because the stock price has been moving in the right direction over time.

We all want to buy high-quality stocks at the lowest possible price, but this is unrealistic, and aiming for an ideal entry price can do more harm than good to your returns. If you avoid investing in stocks with strong price performance then you are probably avoiding many of the best companies in the world too. This is an important consideration to keep in mind when making decisions in the market.

Disclosure: I am/we are long DOCU, AMZN. I wrote this article myself, and it expresses my own opinions.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am ...

more