Why Was Consumer Credit Surprising?

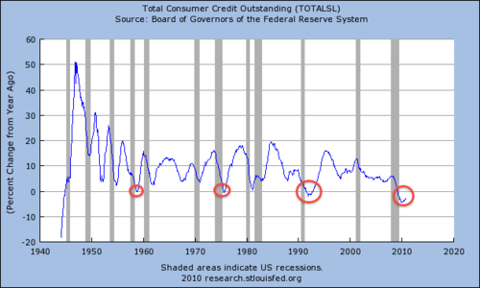

A principal difference between this and past cycles is the relentless consumer deleveraging. In the past, the malinvestment has been limited to governments and business - the consumer was always a good bet. Excluding this cycle, only three times have the year-over-year numbers dipped into negative territory since the series began in 1943.

In the 67 years the data has been collected, this cycle experienced the worst recorded year-over-year decline in consumer credit -- cutting almost 5% away.

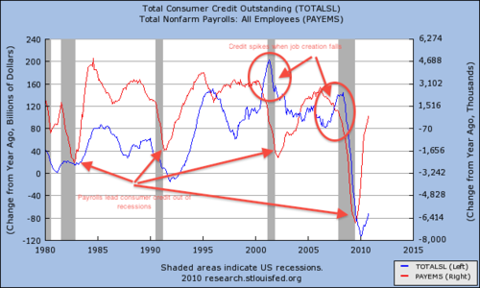

The relationship between the consumer and credit is curious, and not entirely linear. The most obvious driver is payroll. For most of the economic cycle, consumer credit and payrolls travel in the same direction. However, there is some very interesting divergent behaviour around the beginning and end of cycles.

At the end of a business cycle, when payroll growth begins to decline, consumer credit spikes. Ostensibly, this is a result of consumers who have lost some of their income, and temporarily maintain their lifestyle on credit - something like the roadrunner who doesn't realise he's run out of ground.

At the beginning of a new business cycle, after the trough of economic activity, payrolls have lead consumer credit by approximately 1-2 quarters.

The behavioral explanation is that consumers are overly confident towards the end of business cycles, and far more cautious at the beginning of new ones.

This principle has been demonstrated in our current cycle. We are not yet seeing the fundamental shift in psychology that has suppressed economic growth in Japan with debt deflation, but the cut definitely has run more deeply now than ever before.

The order in which we've come to expect data to recover in the birth of a new economic cycle has still been followed. Again: the surprise has been how far economic activity had fallen, rather than how it's recovered. Based on payroll data -- more than a million new payrolls have been added this year so far -- I think we can expect further upside "surprises" in consumer credit in the coming months...but you'll no longer be so surprised.

Disclosure: None.