Why There Is No Noticeable Benefit From The Fed’s Policies

Image source: Wikipedia

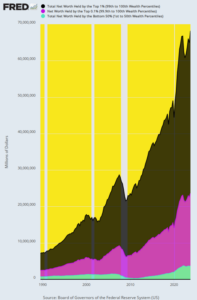

Here is the only noticeable “benefit” from the Fed’s pro-inflation policies since Greenspan’s arrival at the Eccles Building. To wit, these policies have pleasured the tippy top of the economic ladder with massive wealth gains owing to the relentless inflation of financial assets. During the 34 years since 1989, therefore, net worth has increased as follows:

Aggregate Net Worth Gain, Q4 1989 to Q3 2023

- Top 0.1% or 131,000 households (purple area): +$18.2 trillion or 11.4X.

- Top 1.0% or 1.34 million households (black area): +$40.0 trillion or 9.5X.

- Bottom 50% or 65.7 million households (blue area): +$3.7 trillion or 5.1X.

For want of doubt, the corresponding net worth gains on a per-household basis are as follows:

Net Worth Gain Per Household, Q4 1989 to Q3 2023

- Top 0.1%: +$139 million each.

- Top 1.0%: + $30 million each.

- Bottom 50%: +$55,000 each.

- Ratio of Top 0.1% Versus Bottom 50%: 2,500X

Aggregate Net Worth By Economic Class, 1989 Q4 to 2023 Q3

Needless to say, the only cohort to experience net wealth gains roughly in line with nominal GDP growth during this 34-year period was the bottom 65.7 million households. Their 5.1X gain was only a tad larger than the 4.9X gain in nominal GDP during the period, which rose from $5.7 trillion to $27.6 trillion.

The veritable eruption of net worth at the tippy-top of the economic ladder at more than double the gain in GDP, therefore, should not be confused with superior virtue, greater investment prowess or any other meritorious factor.

To the contrary, it was an unearned windfall owing to massive, artificial asset price inflation. In rough terms, those Fed-fostered windfalls amount to about half the gain reported above or about $20 trillion for the top 1% and $9 trillion, or about $70 million per household, for the top 0.1%.

It is any wonder then that the Wall Street financial concierges who cater to the nation’s small population of significant financial asset-holders are currently beating the tom-toms for another round of Fed rate cuts?

Their clients not only want another giant windfall, but that they are entitled to it. Yet that’s the sum and substance of the case for rate cuts in the context of the Fed’s massive recent and longer-term saturation of financial markets with cheap credit. There is flat-out no main street-based case for rate cuts whatsoever.

What that rate cut brigade baldly ignores is that the run rate of inflation at any moment in time is essentially meaningless. What matters is the cumulative change over a reasonable period of time, as well as the broader macroeconomic context in which the inflation variable is embedded.

In that framework, what is relevant at the moment is that the general price level as measured by the CPI has increased by 28% since January 2017. That is to say, the spend/borrow/print policies of the UniParty, as practiced by both Trump and Biden, have destroyed nearly one-third of the buying power attributable to a dollar of savings or wages extant at the time the Donald was sworn in.

It might well be asked, therefore, has not enough inflation punishment already been meted out to main street households for some time to come? Is there not some logical and common sense economic notion that suggests the massive overshoot of inflation especially in 2021 and 2022 merits a remedial period of little, no, or even negative inflation?

The current Wall Street blather, of course, is just the opposite. By the lights of the gamblers and speculators who operate there, the Fed should start crushing interest rates again the minute it can find some tortured version of the inflation yardstick that is temporarily posting in the wider neighborhood of 2.00%. But that’s just plain bogus, and especially so when it comes to the Fed’s risible efforts to arbitrarily shorten the inflation yardstick.

For instance, Powell has recently peddled the “supercore” inflation measure, which excludes food, energy, commodities, manufactured goods and shelter from the CPI!

That’s right. These items account for 62% of the weight in the CPI and upwards of 85% of the weight in a typical lower middle-income family budget, yet it is being trotted out because for a time it appeared to be getting back to the 2.00% neighborhood faster than the full index.

But that kind of fiddling isn’t even clever, to say nothing of being remotely honest. It’s just an excuse for capitulating to the incessant demands of Wall Street and the 1% for still another dose of central bank liquidity and the boost that it provides to financial asset prices.

It goes without saying, however, that the Fed’s massive money-pumping of recent decades has brought multitudinous harms to the main street economy and the wage-earning classes. And that harm lies in the fact that inflation is everywhere and always cumulative, not monthly, quarterly or even annual. It is a permanently rising price level, not a short-term rate of change.

Therefore, when massive cumulative harm has been done by an inflationary tidal wave over time, the Fed’s Keynesian paint-by-the-numbers policy machinations based on the so-called “incoming data” are truly perverse.

The chart below provides a stunning case in point. Since Nixon did the dirty deed in August 1971, the unit labor cost index in the US has risen by 350%, as unions and workers chased the Fed’s endless tide of inflating living costs. But self-evidently, the rest of the world was not necessarily following suit, thereby leaving America’s competitive position unhampered.

To the contrary, the Fed’s monetary inflation became universal, as foreign central banks printed in lockstep with the Fed. But that meant massive amounts of cheap debt became available in low wage, low-cost developing economies, thereby putting modern tools and production technology in the hands of workers who had been subsistence farmers or industrial workers earning wages at only a fraction of US levels as of the early 1970s.

Needless to say, 50 years later and 350% more expensive in dollar terms, US industrial workers did not have a fighting chance of remaining competitive. The Fed essentially caused the world market to be flooded with cheap labor enabled by cheap but state of the art capital and technology.

Change In Unit Labor Costs, Q2 1971 to Q4 2023

Needless to say, at least since the turn of the century, the chickens have been coming home to roost. Almost all of the “growth” in the US economy has been in the lower-wage service sector—including the vast wholesale, warehousing, and retail delivery facilities that distribute foreign-made goods.

More By This Author:

The $1.3 Trillion Elephant In The RoomWhy the Great Labor Arbitrage is Coming to an End…

Why Debt Serfdom is not Prosperity

Disclosure: None.