Why I Own Salesforce Stock

Salesforce (CRM) announced solid earnings numbers on Tuesday, outperforming expectations and delivering vigorous growth rates across the board. The company has abundant room for sustained growth in the years ahead, and the stock price still offers attractive upside potential from current valuation levels.

Salesforce Is Firing On All Cylinders

Salesforce reported both sales and earnings numbers above market expectations for the third quarter of fiscal year 2020. Total revenue was $4.5 billion, an increase of 33% year-over-year. Adjusted earnings per share came in at $0.75, increasing by 23% year over year and beating the consensus expectation of $0.67 per share

Salesforce also raised its earnings guidance for the current year to the range of $2.89 to $2.90 per share, surpassing the $2.86 per share expected by analysts. Full-year operating cash flow growth was also increased to the range of 22% to 23% versus a prior range of 21% to 22%.

Guidance for the fourth quarter was above expectations at the top line, but below forecasts in terms of earnings. The company is expecting sales in the range of $4.743 billion to $4.753 billion, an annual increase of 32% and better than the $4.74 billion expected by Wall Street. On the other hand, the adjusted earnings guidance of $0.54 to $0.55 per share was below the $0.61 per share expected by the analysts following the stock.

The fact that earnings guidance for next quarter was below expectations is the main weak spot in the report. Nevertheless, revenue guidance is more than healthy, and this is arguably much more important for a high growth business such as Salesforce. As long as the company keeps growing at full speed, the market can easily tolerate the volatility in profit margins.

The Big Picture

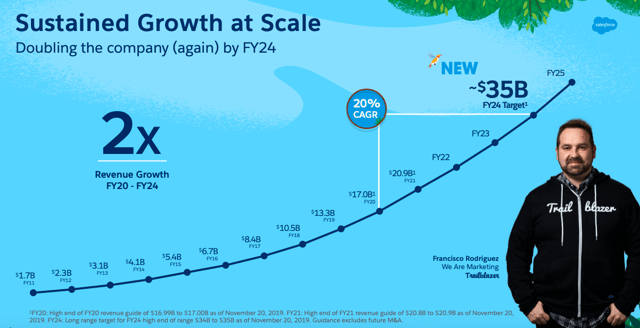

Management is expecting $34 billion to $35 billion in revenue by fiscal year 2024. If the company can deliver on such a target, it would mean doubling revenue versus the fiscal year 2020 and generating a compounded annual growth rate of 20% over 4 years.

Source: Salesforce

This target is clearly ambitious, but not unachievable at all considering the company's current performance and its future growth prospects. Corporate spending tends to be fickle and depending on economic conditions, but digital transformation is a key strategic area for companies all over the world, and Salesforce is the undisputed leader in customer relationship management.

During the Dreamforce conference in November, management shared some impressive statistics:

- According to the company's survey data, Salesforce customers reported a 25% average increase in revenue.

- Customer satisfaction increased by 30%.

- Marketing return on investment also jumped 30%.

- IT costs declined 26%.

- App development is 57% faster.

- Productivity reportedly increased by 70%

Considering these statistics, Salesforce is creating a lot of value for its customers. These customers should arguably be quite reluctant to cut spending in CRM solutions from Salesforce, so maybe the business is far more resilient to tough economic times than what the market is giving it credit for.

The company also has a solid track record of successful acquisitions, management showed how revenue growth rates at Mulesoft have accelerated from 38% before the acquisition to 52% now. Investors have been concerned about the recent acquisition of Tableau for $16 billion, so it's good to know that the company knows how to potentiate its acquisitions and accelerate value creation.

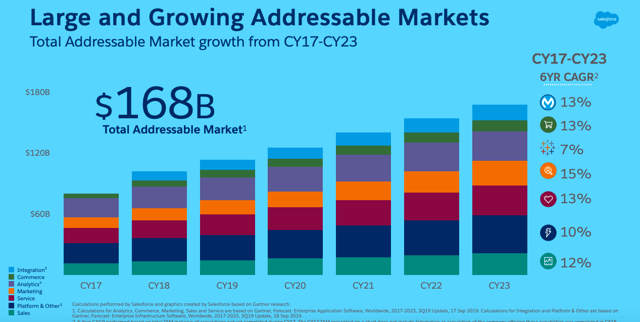

Source: Salesforce

Salesforce is a market leader across the different markets where it operates, and those markets are tightly integrated, this creates attractive cross-selling opportunities, and the company can materially benefit from up-selling superior features to existing customers.

Management calculates that the total addressable market is worth around $168 billion, and Salesforce is in a position of strength to capitalize on such a massive opportunity in the years ahead.

Source: Salesforce

Priced For Growth, But Not Overvalued

Salesforce is not a cheap stock, it never has been, and it probably never will be as long as the business keeps growing rapidly. However, only because valuation ratios are elevated in comparison to the broad market, this does not mean that the stock is overvalued.

In simple terms, the higher the expected growth rate in revenue, the more valuable each dollar of current revenue is for investors, so companies with superior growth potential obviously trade at higher valuation levels.

The table below compares Salesforce versus Adobe (ADBE), Intuit (INTU), Workday (WDAY) and Autodesk (ADSK) in terms of revenue growth and valuation levels. These companies have different markets, and their own weaknesses and strengths, so the comparison is not entirely straightforward.

However, it can be good to compare valuation ratios and growth rates in order to get a broad reference on how Salesforce is priced in comparison to industry standards.

Salesforce is the cheapest company in the group in terms of the enterprise value to sales ratios, but it comes in second place behind Workday in terms of revenue growth and expected revenue growth. When considering valuation and growth together, Salesforce looks like an attractive bet in the sector.

(Click on image to enlarge)

Data from S&P Global via Portfolio123

Looking at projections, the table below shows revenue estimates, the expected growth rate each year and the implied forward price to sales ratio for Salesforce. The stock is not too expensive at all if the company can deliver in accordance with expectations.

(Click on image to enlarge)

Source: Seeking Alpha Essential

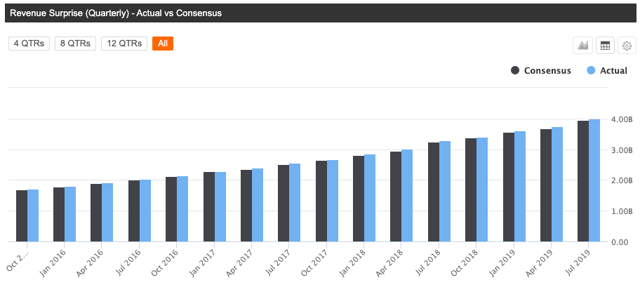

Speaking of which, Salesforce has an outstanding track record of reporting revenue numbers not only in line but also above Wall Street expectations. The company has delivered revenue figures above forecasts in each of the past 16 consecutive quarters.

Source: Seeking Alpha Essential

Valuation is a dynamic as opposed to a static concept. Current prices are reflecting a particular set of expectations about the company's future performance. If revenue outperforms those expectations, then the stock price needs to increase in order for the price to sales ratio to remain constant.

The fact that Salesforce has consistently beaten expectations in the past does not guarantee that it will continue doing so in the future. But there is a clear pattern going on, management tends to make conservative assumptions and outperform expectations over time.

In simple terms, Salesforce is reasonably priced based on the company's growth potential, and it's not unreasonable at all to say that the company could outperform market expectations in the years ahead.

Risk And Reward Going Forward

Growth tends to naturally slow down as a company gains size over time because it's obviously easier to generate rapid growth from a smaller revenue base. Salesforce has proven its ability to sustain vigorous growth in spite of being one of the largest players in the sector, but this is still a relevant risk factor to keep in mind going forward.

Salesforce is focused on long term growth, prioritizing growth investments and acquisitions above current profit margins. This can be a source of uncertainty for investors, and Salesforce is clearly not the best choice for those who like to invest in companies with predictable and consistent profit margins.

In spite of those risks, Salesforce is the top player in a mission-critical software category, and the company stands to benefit from massive growth opportunities in an expanding market through cross-selling and up-selling, international growth, and continued acquisitions.

At current prices, the stock is offering attractive potential if the company delivers in accordance with expectations or, even better if Salesforce continues outperforming expectations like it has done in the past.

Disclosure: I am/we are long CRM, WDAY.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with ...

more