Where Is Tesla Going To Get The Lithium And Graphite For The “Gigafactory”?

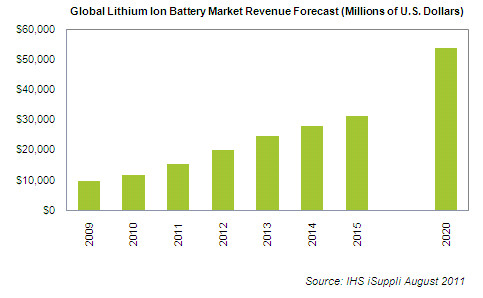

Lithium Ion batteries aren’t just for cars and mobile computing. For months, I highlighted the growing use of lithium-ion batteries for energy storage solutions. Tesla Motors (TSLA), known for making top notch electric cars, is making a major move into building battery systems aimed at residences, commercial buildings and for power companies.

These batteries could provide the answer for intermittent energy sources like sun or wind which is dependent on the weather. Solar or wind is great but what happens when the sun goes down or the wind isn’t blowing. Tesla believes they can provide the solution through rechargeable lithium ion batteries that can be placed in homes or businesses storing energy and providing stability for intermittent renewable sources. Tesla has spent millions of dollars in battery research for their electric cars, now management believes that they can use that technology outside of the automobile sector.

Last night, Tesla announced the Powerwall, derived from the batteries used in the Model S car, that can be bought for $3,500. The batteries are connected from one’s residence to Tesla through the web in case power goes out.

Tesla is showing the world that their ambitious battery technology research could be disruptive across many sectors including the auto and energy space. Tesla Motors could be soon known as Tesla Solutions, not only disrupting the car industry but completely changing homes, businesses and utilities.

Many investors ask me, have they missed the boat when it comes to the battery sector? I believe the market is still in its infancy and should ramp up quickly once the $5 billion battery plant aka “GigaFactory” is built near Reno, Nevada. Below is a recent photo of the beginning of the construction in the middle of the Nevada desert.

Credit James Glover/Reuters

Tesla believes that this large factory could bring down the cost of the lithium ion battery packs to make it more affordable for the average consumer. It's hard to compete with Tesla and that is why it is such a high-price stock. So where does the real opportunity lie? The real question is where will the raw material needed for these Tesla batteries come from. Does Tesla have any off-take arrangements yet?

I have not heard of any deals between the giant Tesla company and the small junior lithium and graphite miners trading at miniscule valuations. I expect that to change in the near term as junior lithium and graphite companies receive capital for development from deep pocketed end users such as Tesla and Samsung.

Thus there could be major investment interest for the junior lithium and graphite miners as battery makers look to secure supply of the raw materials needed to make a battery work. Demand could double over the next decade for these batteries. What junior lithium and graphite miners should you consider?

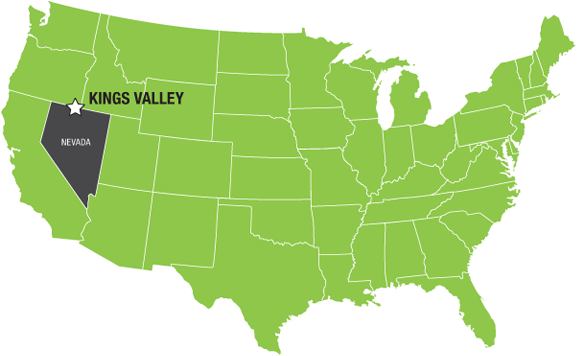

In the lithium sector, my only holding over the past couple of years has been Western Lithium. For years I have told you that Western Lithium (WLC.TO or WLCDF) could be the major source of lithium for the electric batteries used in cars and smart grids. Western Lithium owns the Kings Valley Lithium Deposit in northern Nevada, which is one of the largest assets in the world of this critical resource.

In the lithium sector, my only holding over the past couple of years has been Western Lithium. For years I have told you that Western Lithium (WLC.TO or WLCDF) could be the major source of lithium for the electric batteries used in cars and smart grids. Western Lithium owns the Kings Valley Lithium Deposit in northern Nevada, which is one of the largest assets in the world of this critical resource.

Western Lithium recently released an important development on the lithium processing. They produced 99.8% high quality lithium carbonate in the first trial run at its demonstration plant. This could cause major interest from potential strategic partners who have already expressed interest to partner with the company to accelerate development of the asset. These end users need a domestic and secure supply.

Western Lithium’s CEO Jay Chmelauskas said, “…The lithium market now appears ready for Western Lithium to accelerate the development of its Nevada lithium deposit as a new major supply source. Nevada is emerging as the world’s largest lithium battery manufacturing center and provides potential synergies for Western Lithium to establish its business locally and to become integrated with the global battery supply chain.”

See the full news release on the lithium carbonate produced at their demo plant by clicking here…

The chart on Western Lithium is excellent over the past two years and appears to be forming a classic bullish flag. Another round of accumulation like we saw in 2014 could be on the agenda. The base is almost one year in the making. The stock is just beginning to come off the bottom of the flag and breaking over the 200 day moving average. Look for a golden crossover of the 50 and 200 day moving average to confirm the next move higher. The recent breakout at $.60 could mean the consolidation over the past six months is over.

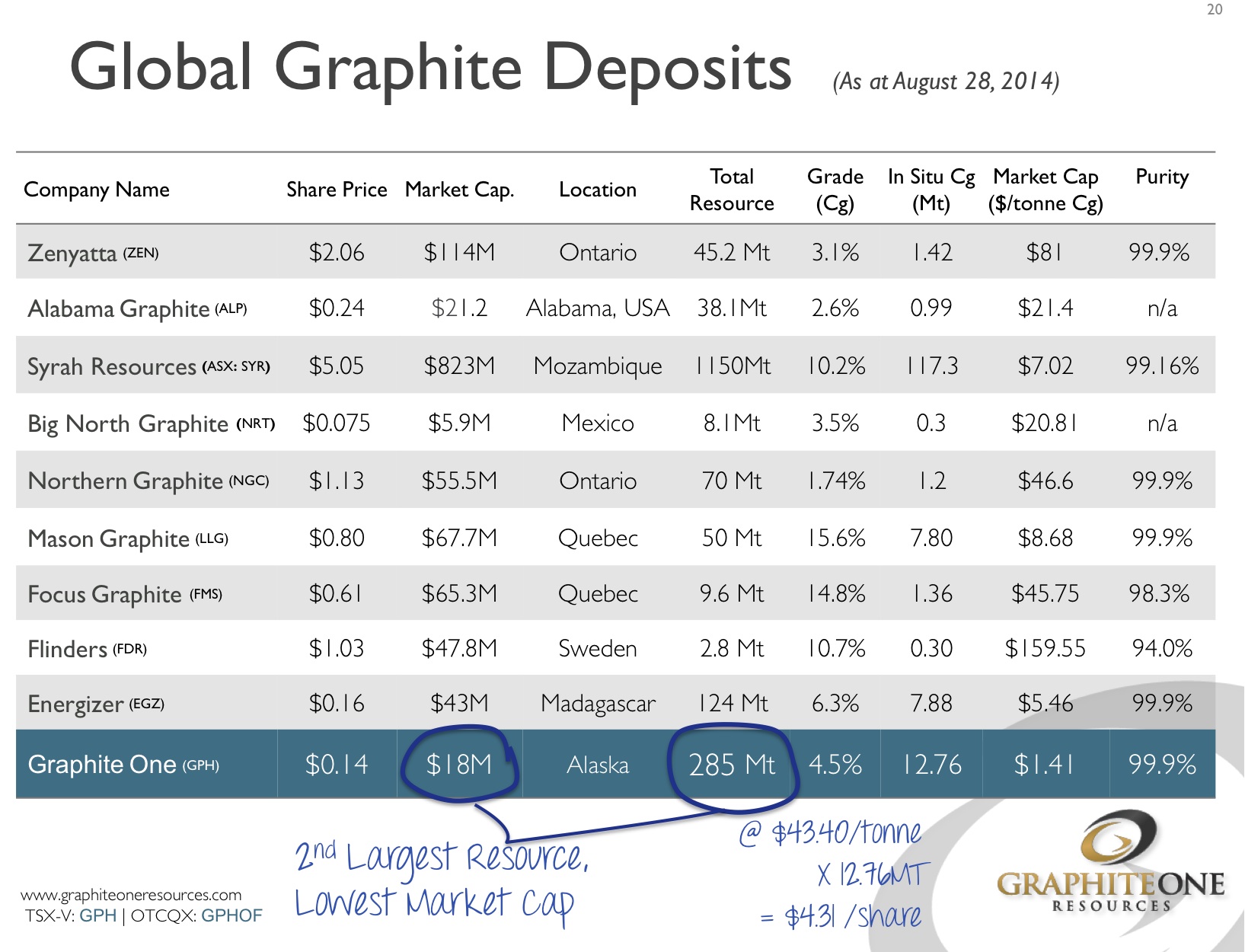

In graphite, I have been accumulating Graphite One (GPH.V or GPHOF).

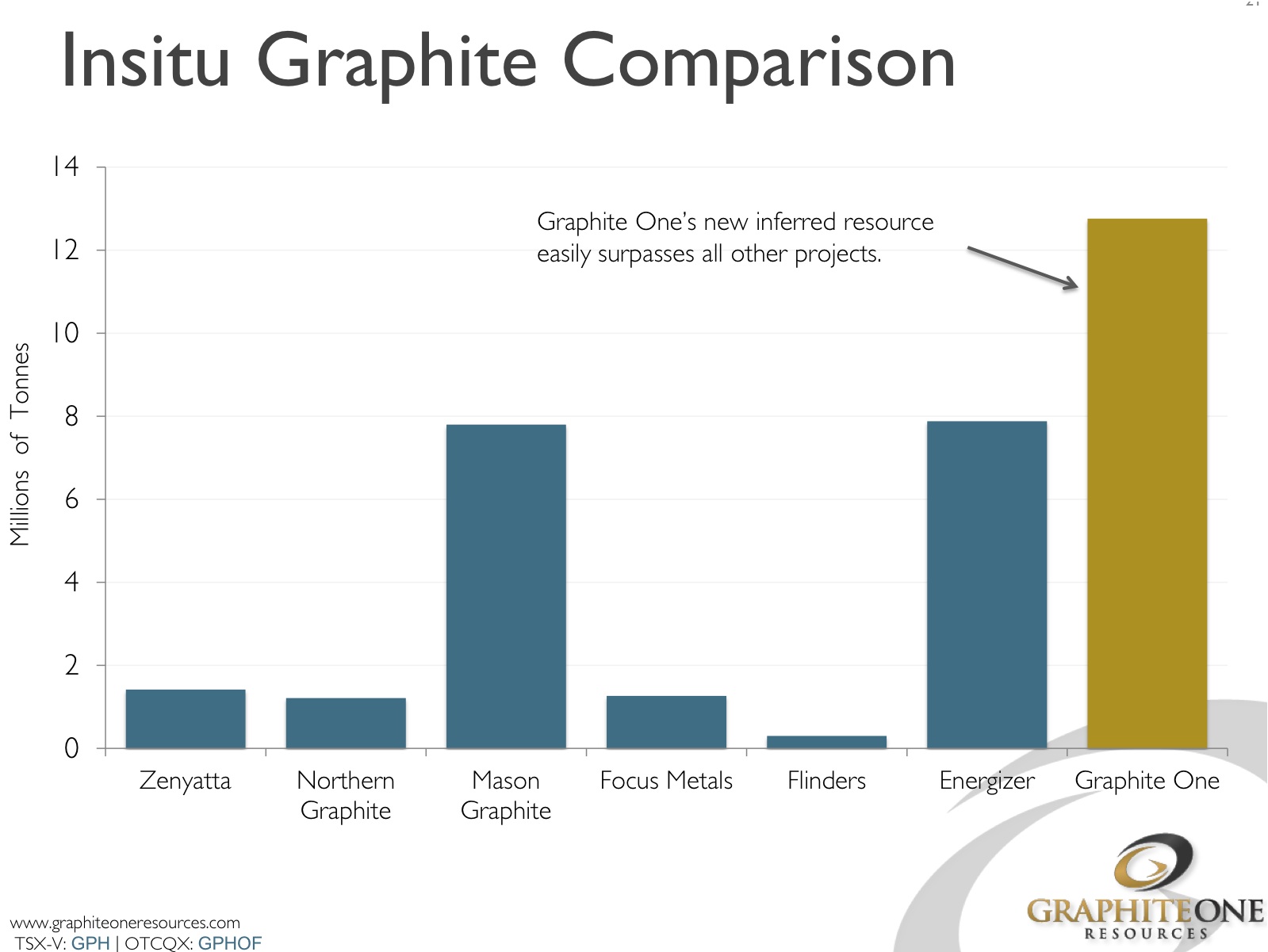

Watch Graphite One in Alaska, which just released an updated mineral resource estimate of an indicated 17.95 million tonnes of 6.3% graphitic carbon (Cg) and 154.36 Million tonnes of 5.7% Cg. This news makes Graphite One the largest published graphite resource in the United States. The grade improved considerably and so did the indicated resource. There is high grade graphite at the surface and the deposit remains open. Graphite One is planning to use this resource to publish a maiden NI 43-101 Preliminary Economic Assessment on the Graphite Creek Deposit. See the full resource estimate news release by clicking here.

I became interested in their Graphite Creek Project near Nome, Alaska. Alaska is financially supportive of mining and as in the case of other junior developers has pledged to finance the infrastructure capital expenses.

Investors can purchase Graphite One near all time lows and get it near the cheapest prices to date. They have put a lot of work into potentially one of the biggest large flake graphite deposits in North America which is amenable to low cost open pit scenarios. Look for a breakout above the downtrend on GPHOF at $.08.

Graphite One just announced that they received a report on the distinguishing features of their large flake graphite which could have a positive impact on the upcoming PEA. Significant research will need to be followed up to confirm these findings on the graphite which included that “naturally occurring graphite in the shape of spheres and close to the size ranges of interest for lithium ion battery-grade graphite was seen in all drill-hole concentrate samples…As this may impact the strategic direction of the Company, Graphite One is now assessing the Stage B Report to determine the next steps in incorporating the results into the PEA.” See the full news release on these findings by clicking here…

Graphite One may be undervalued as it owns the 2nd largest resource in its peer group yet has a ridiculously low market cap and is located in the US which sources all of its graphite supplies from foreigners.

In conclusion, Tesla is building a $5 billion battery factory in Nevada as they see huge growth. They must secure the raw materials, specifically lithium and graphite. Undervalued mining equities may soon see injections of capital for secured off-take of the materials in the near term.

TM Editors' Note: This article discusses one or more penny stocks/microcaps. Such stocks are easily manipulated; do your own careful due diligence.

Disclosure: I own Western Lithium and Graphite One. Graphite One is a current website sponsor, Western Lithium was a website sponsor. Please do your own due diligence as conflicts of ...

more

Looks like many weren't aware of the massive potential lithium project in Mexico. The Sonora Lithium Project being run by two UK listed juniors, Rare Earth Minerals plc and Bacanora Minerals (REM:LSE, BCN:LSE, BCN:TSX).

So in answer to where will lithium come from and are there any off-take agreements, well as of this week we now know of the first lithium hydroxide related deal.

fortune.com/2015/08/28/tesla-lithium-mine-mexico/

www.rareearthmineralsplc.com

www.bacanoraminerals.com

Plenty of information on the project here:

http://www.rareearthmineralsplc.com/operations/fleur-el-sauz/

I went to an alternative energy fair, in Shoreline Community College near Seattle, and one of the exhibits was a pickup truck powered by Nimh or Nickel metal hydride battery package. The owner said he bought the truck just before the patents were snapped up by an oil company and put into a vault. These batteries could open the electric car market if only for this reason.

This truck maker was somehow privy to who was buying patents and what they were going to do with them. Goodness knows what they had a patent on. NiMH batteries have been around since 1967 and are widely used. You probably own some. I know I do. Most electric cars use them. I can't even think why an oil company would want to own such patents. Isn't it odd how this truck maker knows the specifics of patent sales and what was going to happen to them, but can't name the company involved.

It sounds like he was either making a joke or lying to you. Most electric cars use NiMH cells and most of them are going to continue to do so. Just stop by any car showroom selling electrical cars and you'll see NiMH batteries in them and not a patent lawyer in sight. Is it even possible to patent a 50 year old technology, let alone suppress it?

There have been some developments in NiMH battery technology. BASF have managed to push the specific power (energy density) up to 140 watt-hours per kilogram. Compare that with lithium ion batteries where the energy density is 340 watt-hours per kilogram. As Mr Tolley said, lithium ion batteries are way better than NiMH. It's only cost that has held them back from widespread adoption in electric vehicles. As they're now widely used in consumer electronic devices, the cost has been falling steadily, making it practical for Tesla to take a punt on using them in production vehicles.

NiMH aren't nearly as good as lithium. They are far better than Lead-Acid or Nickel-Cadmium, though.

It's no conspiracy, lithium is just far lighter and holds more electricity.

Mr Tesla needs to fix what he has in his cars and products now for high levels of radiation and Magnetic fields first. his battery cars are horrible for EMF and Magnetic fields are making people sick now and all wireless technology

And yet, despite EMF everywhere - every phone, every computer, GSM networks and wi-fi in nearly every house - people have never been healthier!

While all electrical devices, from table lamps to copy machines, emit EMF radiation, the problem is that there is no established threshold standard that says what an unhealthy dose might be, and no concrete, scientific proof that the sort of EMF produced by electric motors harms people in the first place.

Taken together, the many studies of EMF radiation and human health have been inconclusive. A major analysis of study results, published by the National Institutes of Health in 2002, said that “the overall scientific evidence for human health risk from EMF exposure is weak.”

Users of personal computers are subject to EMF exposure in the range of 2 to 20 mG, electric blankets 5 to 30 mG, and a hair dryer 10 to 70 mG, according to an Australian government compilation. Earth's magnetic field is 250-650 mG. It is thought to be produced by electric currents flowing deep within the earth’s core.

We know that gasoline fumes and exhaust gases are unhealthy without any doubt. So you are changing one known health risk to something so small that it haven't even been proven exist. I wouldn't worry about that.

I really need some cost per KWH figures and some battery life-cycle numbers

Lithium ion battery packs are great because of their energy density. But if you need static battery pack, you do not need energy density. Probably you can have the same 10kW storage using lead acid technology for less than $1000.

It's a little more than $1k, but not a lot more. However, the major advantage of Li batteries over lead acid is the number of cycles you get. A standard 'deep cycle' battery is rated for 500 deep cycles (80% depth of discharge) whereas Li batteries are anywhere from 2,000 to 5,000, depending on the literature you read. So if you're actually going to use the batteries regularly, like in an off-grid setting, Li batteries pay for themselves pretty quickly. There are forklift batteries, which give 1,000-2,000 cycles, but there's regular maintenance required for them and they are HUGE. Another major advantage of Li batteries is that you can discharge them at 4-15x the rate of lead acid without damaging them. This means that if you're using high-wattage equipment, you need a really big lead acid battery to power it without causing damage to the battery. But with Li batteries, you can discharge them from max charge to empty in an hour without hurting them. Lead acid is more like 4-6 hours for a safe discharge. This isn't a huge consideration for most end users, but it's one that needs to be brought into the discussion. And finally, Li batteries are maintenance free (unlike so-called 'no maintenance' lead acid batteries bearing the same label, which are incredibly delicate compared to their more durable wet lead acid cousins)

It is true, that Li batteries have much greater cycle life.

But for home use, it makes absolutely no sense.

Home systems - either isolated or grid-connected - needs only a few cycles per year from the battery.

Grid-connected systems are only for safety purposes, so they barely work at all.

Isolated systems must have large (like 50-200kWh) capacity to ensure continuous supply. Hence, they have very few charge/discharge cycles per year.

For such systems, lead-acid is much cheaper, than Li batteries.

That's the reason, why home battery systems are usually buit from lead-acid batteries.

Tesla is trying to be disruptive with the Powerwall. Their offer is a 7 kWh system for, ideally for use with grid power in combination with solar. Elon's vision is to put one of those in every home to even out the power demand from the grid. At that energy capacity, it sits between a backup system and a completely isolated system, and will indeed typically be cycled every day.

It's a bit pricey, yes. But his bid, just like with the cars, is to start at the top, and wait for the market to grow and the technology to mature. Whether it will be successful, is for the future to tell.

Further to this, the PowerWall unit will be capable of fast charging your Tesla car. A 13A socket takes all night, while the high power output of the battery bank can do it in half an hour. Ideal if you nip home for a recharge.

It depends entirely on the application though. If you can cycle the batteries, you can do things like charge the battery off the grid at night in the winter, when it is cheaper, then discharge during the day when rates are higher. You'd never do that with SLA!

Also, scrap value lead acid batteries are very cheap. There is not yet a comparable market in older lithium cells.

There are non lithium based batteries that work great and almost a slight, plus easily recycled and much much cheaper.

May one be permitted to ask how TESLA and the Chinese and Japanese and Russians and the Indonesians and the Malaysians and the South Americans are all going to get the lithium they need for this lithium battery revolution.

I am sure that more than one country wants to get in on the lithium battery market m- will it end up like OPEC - dog eat dog fighting for the raw materials?

There is one other salient point - the processing of lithium is one of if not the world most polluting industrial processes.

The cost of electric today is outrageous. I could make another house or car payment for what electric costs. I am all for this electro magnetic power. I live in a city where they own the electric and we have NO choice of who we use. They are nothing but a monopoly and I can't wait for the day they when they are no longer needed. They treat their customers as if we are answering to the mafia or mob, they do whatever the hell they want. One man's elderly mother was hospitalized and therefore didn't pay her electric bill, well when she came home she now had to come up with a 1000.00 deposit on top of her already paid deposit because she didn't make her payment. Another struggling single mother was late ea month so they sent her a letter, each time she was late she had to pay another 350.00 towards her deposit. When she moved she couldn't get her 950.00 deposit they had held, no, they would NOT return her money to her, they credited her water bill each month at her new residence. They are dictators. I have never seen a business run like this. This is in Texas.

You must live in Denton.

I don't get it.

Loading comments, please wait...