What The Volatility Index Is Telling Us

The volatility index (VIX) measures fear, and right now it’s showing us that a lot of people are worried about a lot of things. The question becomes, what will happen to that fear? Will it dissipate, or will it shoot higher?

People are worried about so much right now, starting with the presidential election – both the outcome and post-election chaos. They are worried about the covid-19 pandemic, the potential for a punishing third wave (which has already begun), and the question over when things will go back to normal. Then there’s the economy, which is struggling to recover from the worst quarter (Q2) in the history of our nation.

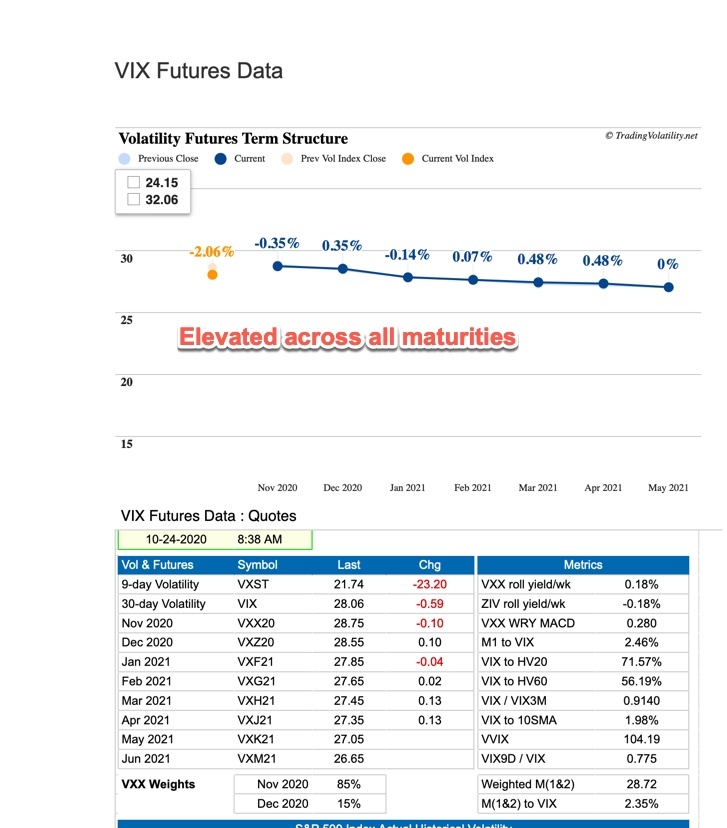

You can clearly see these worries play out in the volatility index. This fear gauge has been high ever since the coronavirus began spreading through the US in early Spring.

What the volatility index is telling us

We are approaching a crossroads when the fear will either dissipate or increase to a level that can be best described as panic.

I think we’ll experience the former rather than the latter, and we’ll see the fear recede. This prediction is based solely on my years of experience. By no means am I predicting complete relief. Also, I could be very wrong in this assessment, and I’ll have to change my options trading strategies.

So, why do I think volatility will dissipate? If you look at the above VIX Futures data you’ll see that the term structure is in a state of contango, where each future price is higher than the prior one (in time). This is often a bullish construct. When the opposite occurs (known as backwardation) then we have a bearish condition. Backwardation only occurs briefly, but the damage can be severe (as it was in March and December 2018).

One thing is for sure: The elevated volatility is sending a very clear message. Don’t take anything for granted, don’t get complacent, and don’t listen to the media. The pundits will chew over every interview to further stir up your emotions. Ignore them.

As we’ve been saying for weeks (and reiterated during last week’s webinar), keep plenty of cash on hand, positions on the small side, index puts working as protection … and wait. Sometimes, that’s the best action (inaction?) we can do – WAIT. This too shall pass, and those who wait for better opportunities will find themselves in a great position to capture them.

Comments

No Thumbs up yet!

No Thumbs up yet!