What If New Housing Does Not Reduce Housing Prices?

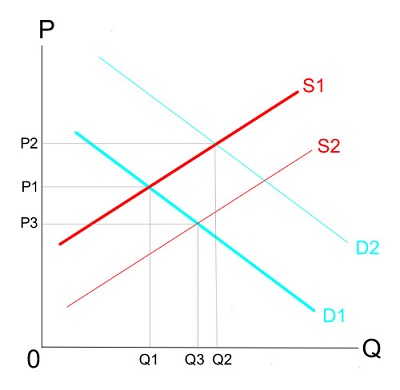

Almost all economists believe that a policy change that encourages the building of more housing will tend to reduce housing prices. That’s what the laws of supply and demand seem to predict. There are empirical studies supporting this claim. And yet, according to Bloomberg many people do not seem to accept the obvious:

In a working paper released in November, three scholars from three different University of California campuses reported public-opinion-survey results showing that “about 30%-40% of Americans believe, contrary to basic economic theory and robust empirical evidence, that a large, exogenous increase in their region’s housing stock would cause rents and home prices to rise.” (Italics theirs.) A similar percentage believed that such an increase would cause rents and prices to fall, with the balance predicting no change.

Another study by political scientists Clayton Nall of UC Santa Barbara and Stan Oklobdzija of UC Riverside and law professor Chris Elmendorf of UC Davis found that this skepticism does not carry over to other commodities:

We show that the public understands the implications of supply and demand in markets for agricultural commodities, for labor, and even for cars, a durable consumer good that, like housing, trades in new and second-hand markets.

The confusion may be due to endogeneity—builders prefer to build new units in booming areas where prices are rising. But it is theoretically possible that new construction might actually cause housing prices to rise. For instance, suppose new construction made a formerly run-down neighborhood more attractive. In that case, it might create such strong positive externalities that the price of existing homes in the area actually rose, despite the increase in supply. In other words, it might boost demand by more than it boosted supply.

In practice, this sort of spillover argument is unlikely to apply over any significant geographical range. But what if it were true? What would be the policy implications?

Standard economic theory suggests that if an activity produces positive externalities, then the argument for encouraging that activity becomes stronger, not weaker. Thus if building new housing causes housing prices to fall, that’s great news.The free market is at work providing more homes for more people. And if building new housing causes housing prices to rise, that’s really, really good news. The free market is at work providing more homes for more people, and the quality of nearby neighborhoods is also rising due to positive externalities.

Ironically, in the debate over housing construction, rising prices are widely seen as a sign that the policy causing a supply increase has not been successful, that it has failed to achieve its goal. In fact, economic theory suggests just the opposite.If new construction causes rising prices as a spillover effect then the benefits are so strong that governments might want to actually subsidize new construction.

Why are people confused on this point? Because they focus on prices, whereas they should be focused on the quantity and quality of housing. More quantity means higher living standards, and more quantity plus more quality means much higher living standards, regardless of what happens to prices.

It’s analogous to the way that almost everyone misunderstands taxes. People focus on who writes a check to the federal government, not how a person’s flow of consumption is altered by the tax system. If taxes are not reducing your consumption, now or in the future, then you aren’t paying any taxes.(Perhaps your children or grandchildren are paying the tax, or it’s paid by the workers in the business you don’t create because your capital was confiscated by the government. Or those who would have received your charity.)

Economics is not about money, it’s about how resources are allocated. Don’t follow the money—follow the goods and services.

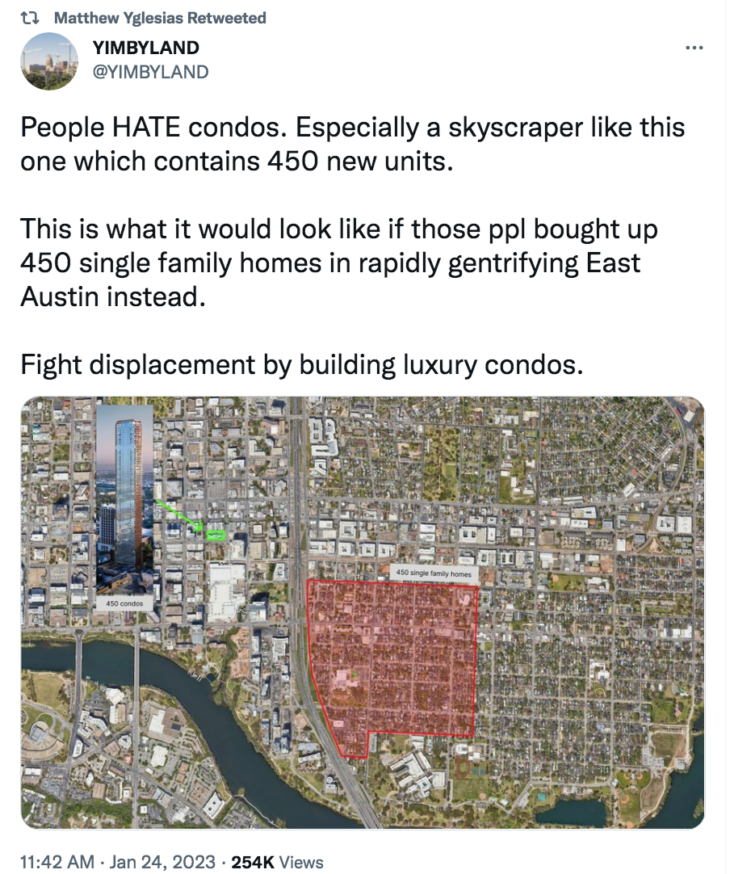

PS. I did a recent post discussing the construction of new residential skyscrapers in Austin. This tweet caught my eye:

More By This Author:

If Things Are Going WellThere’s Nothing Special About Zero Growth

On Reconsideration, Arthur Burns Was Still A Bad Fed Chair