Wall Street Stunned As June Payrolls Unexpectedly Smash Expectations As Labor Force Shrinks

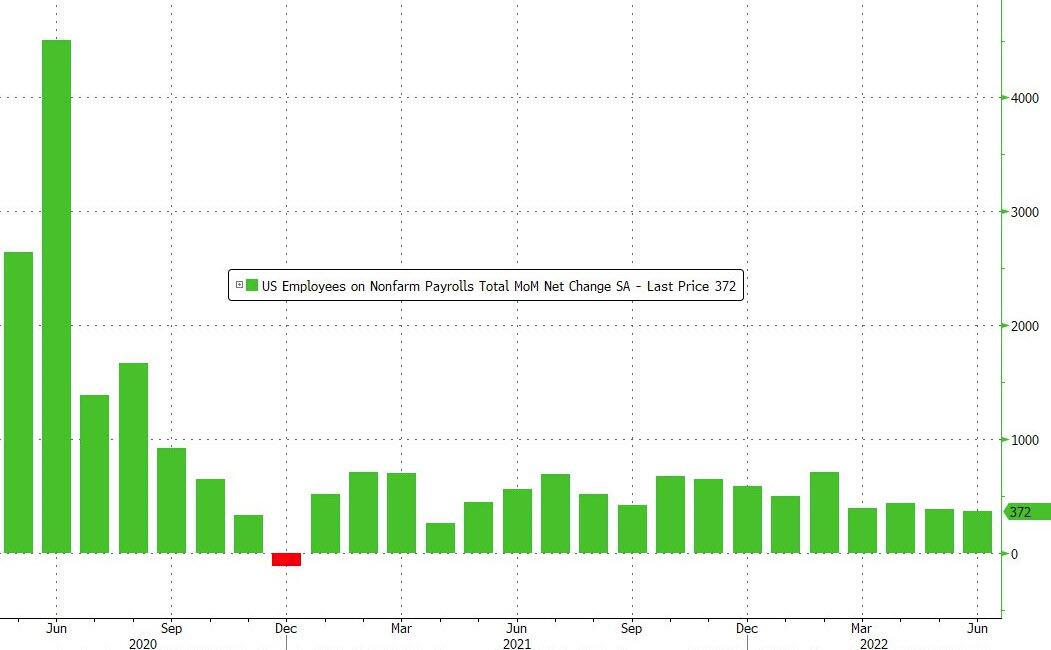

With even permabull economists conceding that the US economy is slowing rapidly and today's payrolls report should show a big slowdown, moments ago the BLS confirmed yet again that the monthly payrolls number is nothing but a politically mandated homework assignment (where trends only change when someone gets a tap on the shoulder), when - at a time when US GDP is set to decline for two quarters in a row - it reported that in June US payrolls rose by 372K, smashing expectations of a 268K increase, coming well above the whisper number of 245K, and trouncing Goldman's preferred payrolls range of 175-250K.

(Click on image to enlarge)

The change in total nonfarm payroll employment for April was revised down by 68,000, from +436,000 to +368,000, and the change for May was revised down by 6,000, from +390,000 to +384,000. With these revisions, employment in April and May combined is 74,000 lower than previously reported.

The June payrolls number was not only the 3rd consecutive beat to expectations but the biggest beat going back to February.

(Click on image to enlarge)

As a reminder, this is what Goldman said coming into today's report: "the market wants not too hot not too cold to keep this bid. Strong enough to say the world isn't going into recession. Not too strong to send US10s back to 3.25% on the day. Not too cold to highlight US data deteriorating while inflation will stay high and fed hiking 75bps into dramatic slowdown. Something like 175k to 250k.”

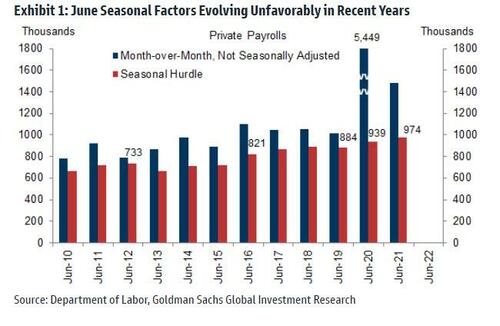

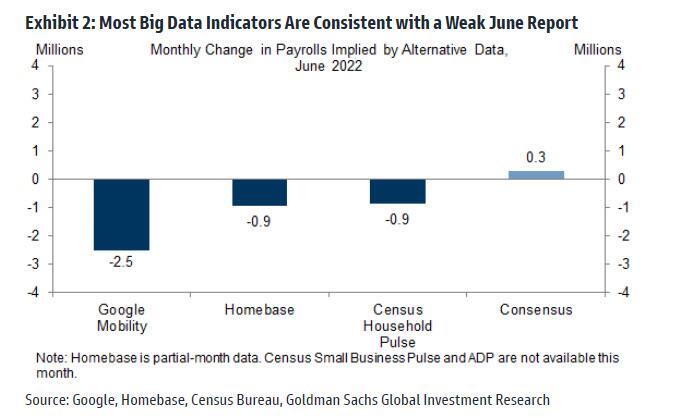

What is even more confounding is that according to "big data" watched by Goldman, today's print should have been a -1 million drop.

... while seasonals alone were a 200K headwind.

While this was still the lowest number back in April 2021 (even after May was revised lower from 390K to 384K), the pace of slowing is nowhere near enough for the Fed to be satisfied that the economy is cooling fast enough, which means an economy-crushing 75bps rate hike in July squarely in the Fed's sights.

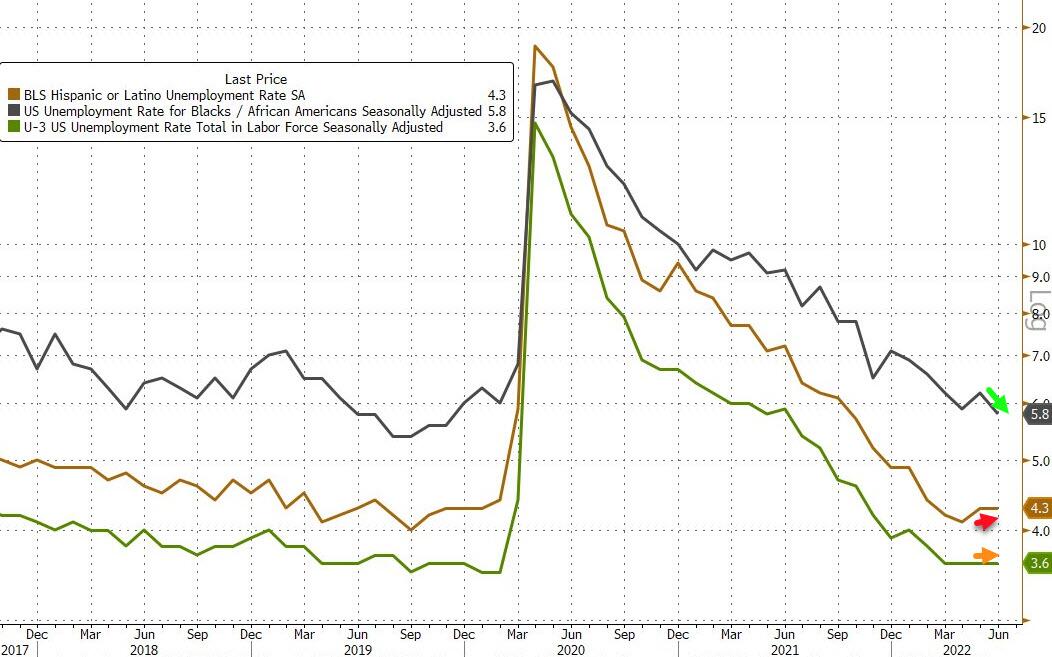

Going back to the report, the unemployment rate came as expected, at 3.6% (and unchanged from last month), with black unemployment dropping to pre-covid levels, Hispanic unemployment slightly higher up, and national flat.

(Click on image to enlarge)

Even more amazing - and improbable - is that the underemployment rate printed at 6.7%, the lowest on record!

(Click on image to enlarge)

Meanwhile, and perplexingly, the labor force shrank again - declining from 164.376 million to 164.023 million, and the participation rate dropped more than expected, dropping to 62.2%, from 62.3%, and below the expected increase to 62.4%.

(Click on image to enlarge)

On the wage front, average hourly earnings for all employees on private nonfarm payrolls rose by 10 cents, or 0.3%, to $32.08, in line with expectations and down from 0.4% last month. Over the past 12 months, average hourly earnings have increased by 5.1%, slightly hotter than the 5.0% expected.

(Click on image to enlarge)

The average workweek for all employees on private nonfarm payrolls was held at 34.5 hours in June, and came in below expectations of 34.6, which however would have been a flat print vs last month which was also revised lower to 34.5. In manufacturing, the average workweek for all employees was little changed at 40.3 hours, and overtime fell by 0.1 hours to 3.2 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls remained at 34.0 hours.

More By This Author:

China FX Reserves Unexpectedly Plunge $56 BN To 2-Year Low, Hint At Significant Bitcoin UpsideWTI Drops After Huge Surprise Crude Build, Crack Spread Soars On Product Draws

Initial & Continuing Jobless Claims Accelerate As Layoffs Soar

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more