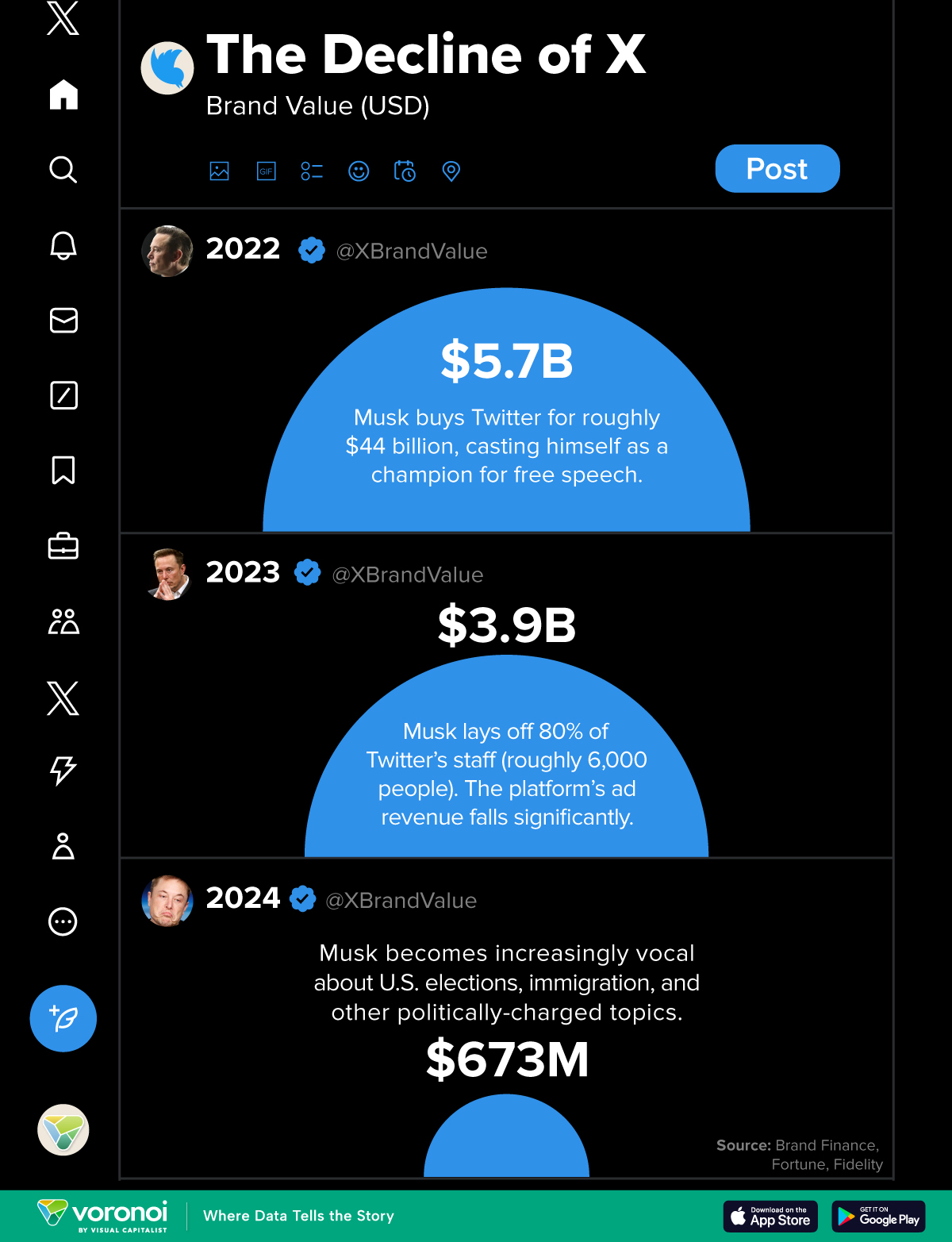

Visualizing The Decline In Brand Value Of X (Formerly Twitter)

(Click on image to enlarge)

X (formerly Twitter) was acquired by billionaire Elon Musk in 2022 and has since been the subject of ongoing debate.

This chart, using data from Brand Finance, illustrates the decline in X’s brand value following Elon Musk’s acquisition in 2022.

Methodology

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach, a brand valuation method compliant with the industry standards set in ISO 10668. This method estimates the likely future revenues attributable to a brand by calculating a royalty rate that would be charged for its use, resulting in a ‘brand value’ defined as the net economic benefit a brand owner would achieve by licensing the brand in the open market.

It is important not to confuse brand value with the value of the company as a whole.

Timeline

2022: Musk purchases Twitter for roughly $44 billion.

2023: Musk stirs controversy after laying off 80% of Twitter’s staff (approximately 6,000 employees). According to Fortune, the platform’s ad revenue declines significantly.

2024: Musk becomes increasingly outspoken on U.S. elections, immigration, and other politically-charged topics.

Brand Decline

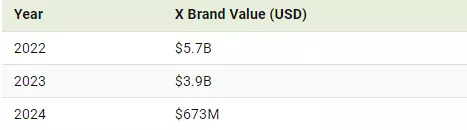

In 2022, Brand Finance valued Twitter at $5.7 billion. By 2023, this dropped to nearly $3.9 billion, and by 2024, the brand’s value had fallen to $673.3 million.

According to Fortune, X’s ad revenue declined sharply, dropping from over $1 billion per quarter in 2022 to approximately $600 million in 2023.

More By This Author:

Breaking Down The U.S. Government’s 2024 Fiscal YearSuper Micro, Once The Hottest AI Stock Of 2024, Has Collapsed

Mapped: Spirits Consumption By U.S. State

Disclosure: None