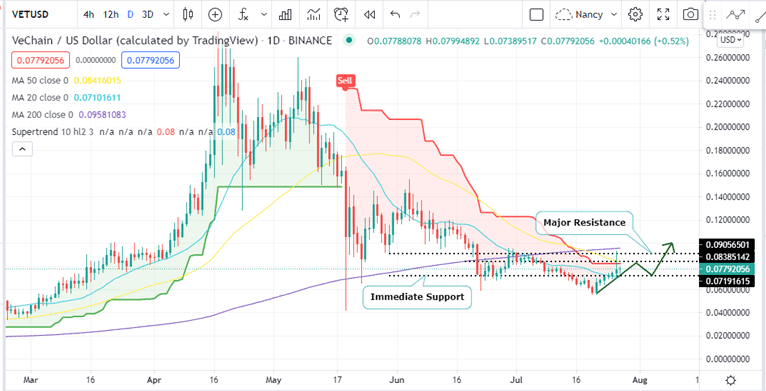

VeChain Price Forecast: Can VET Violate The $0.090 Resistance Level?

VeChain price has rallied 37% above the June July 20 low at $0.057 based on the current price. VET is trading in the green for the seventh day running, a sign that bulls are committed to reversing the last week’s losses. However, the easy job seems to be over as VeChain now faces a commanding resistance that will slow down the bullish momentum in the near term.

Source: Cryptocoinspy.com

Can VeChain Price Violate $0.090?

VET is currently hovering at $0.077 having lost approximately 9.3% over the last 24 hours according to CoinGecko. The rally from the July 20 at $0.057 low reached 67% at yesterday’s $0.093 high before VeChain price being rejected by the 200-day Simple Moving Average (SMA) which is currently at $0.095. VET price reversal can be attributed to the upward hurdles posed by the 50-day SMA, $0.090 major resistance level and the upper SuperTrend line. The 200-day SMA reinforces these levels of resistance as seen on the daily chart.

VeChain price remains bullish on the four-hour chart in a market that is largely bullish at the moment.

If you are interested in trading VeChain using crypto brokers, this guide may be useful.

On the higher side, for VeChain price to overcome the $0.09 resistance, it has to close the day above the 200-day SMA at $0.095. If this happens, VET will have built a formidable bullish momentum and the only remaining thing will be flipping the SuperTrend from a sell to a buy signal. If this happens, VeChain price could retest the June 21 high at the $0.1 psychological level.

VeChain Price (VET/USD) Daily Chart

(Click on image to enlarge)

How Can The VET Price Rally Be Invalidated?

The VET price bullish momentum could hit a hiatus in the short term of investors continue to cash in on the profits after a remarkable recovery. Note that VET’s immediate support is reinforced by the 20-day SMA at around $0.078, a support that was successfully held between June 21 and June 29.

Note that VeChain price daily close below $0.078 will invite the creation of a double top pattern towards the July 20 low at $0.057. A failure to hold the support will see VET target lower prices and confirms yesterday’s retraction as seen on the four-hour chart.

The bearish narrative is reinforced by the crypto signal by the SuperTrend indicator which is currently sending a sell signal. Note that as long as the VET price remains under the SuperTrend line, the bearish thesis is set to be validated.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more

It's a red flag when someone giving TA advice refers to a breakout from resistance as a "violation."