Mo' Money, Mo' Cash Deals With Attractive Spreads

Author Update Thu, Jan. 29, 2:41 PM

On Monday January 26, 2015, COV was successfully acquired by MDT at a premium to the price available when the article was published. Earlier today, APAGF was successfully acquired for $14.50 per share. The average spread was $0.49, it traded as wide as $1.47, and there was still a $0.35 spread when the deal closed. Holders of each of these spreads made over 80% annualized net returns since the ideas were published. DRIV’s stock price has increased by over 1%, but the spread remains attractive. The remaining spread of $0.35 equals annualized net return of over 22% between today and the likely closing on February 16, 2015.

Summary

- Merger arbitrage spreads widened substantially in October 2014; many are still wide.

- Here is the universe of merger arbitrage spreads that might be worth owning.

- Specifically, here are four opportunities with spreads that appear to be wide for historical reasons.

TM Editor's Note: This article discusses one or more securities that do not trade on a major exchange. Please be aware of the risks associated with these stocks.

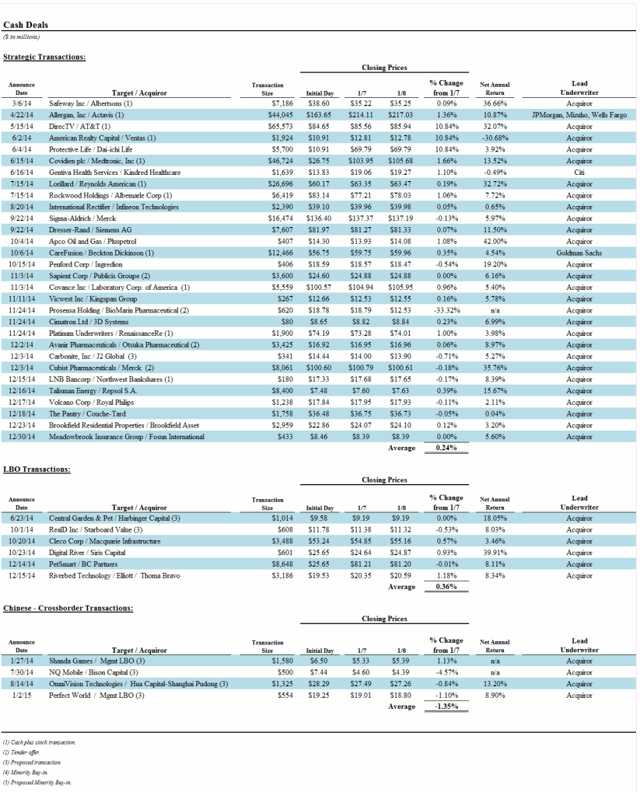

Welcome to 2015. As of the first of the year, each of us is flat YTD and no smarter than the next guy. Where should we begin? I would submit for your consideration that one attractive opportunity is the universe of merger arbitrage spreads, especially a number of deals that have had major scares over the past months. Such scares - even after the underlying problem has been resolved - can lead to spreads that remain much wider than they were before the problems first emerged. There are a number of potential causes, but regardless of the cause it appears that these deals are tossed into the "hairy" pile and that they tend to stay wide until they close. Here is the current universe of merger arbitrage spreads:

(click to enlarge)

Focusing only on the wider spreads, here is what we have:

|

Target / Acquirer |

Ticker / Ticker |

Value |

Spread |

Return |

|

AGN / VRX / ACT |

$228.27 |

$11.30 |

10% |

|

|

TRLA / Z |

$46.14 |

$1.17 |

11% |

|

|

DRC / SIEGY |

$84.65 |

$3.30 |

11% |

|

|

HCBK / MTB |

$10.18 |

$0.36 |

11% |

|

|

WPZ / ACMP |

$42.27 |

$0.38 |

12% |

|

|

OVTI / N/A |

$29.00 |

$1.72 |

13% |

|

|

COV / MDT |

$106.65 |

$0.93 |

13% |

|

|

TLM / REPYY |

$8.00 |

$0.42 |

15% |

|

|

IBCA / OZRK |

$10.20 |

$0.15 |

16% |

|

|

BHI / HAL |

$64.03 |

$6.86 |

16% |

|

|

CENT / N/A |

$10.00 |

$0.79 |

18% |

|

|

PENX / INGR |

$19.00 |

$0.51 |

19% |

|

|

GLNIF / BCE |

$26.88 |

$1.16 |

21% |

|

|

TWC / CMCSA |

$162.09 |

$15.12 |

25% |

|

|

DTV / T |

$92.31 |

$6.32 |

32% |

|

|

LO / RAI |

$69.55 |

$6.48 |

32% |

|

|

IGT / GTKYY |

$18.25 |

$1.32 |

33% |

|

|

CBST / MRK |

$102.00 |

$1.38 |

35% |

|

|

ANSBF / LPX |

$3.42 |

$0.09 |

36% |

|

|

SWY / N/A |

$36.15 |

$0.88 |

36% |

|

|

APL / NGLS |

$28.36 |

$2.23 |

36% |

|

|

DRIV / N/A |

$26.00 |

$1.11 |

39% |

|

|

APAGF / N/A |

$14.50 |

$0.40 |

42% |

Within that group, there are four particularly worth mentioning. Each have had major problems but are still likely to close on their original terms:

Continue reading on Seeking Alpha.

more