Using Leverage With Futures

Obtaining leverage with futures is one of the most appealing aspects for investors and traders. This can allow investors to maximize returns for a limited amount of capital. It can also allow the deployment of more complex strategies in a portfolio. This article will look at some of the practical ways investors can use futures as leverage in their portfolios.

What is Leverage on Futures?

Leverage is the ability to control a large amount of interest in an asset with a small amount of capital. In the futures markets that interest is the notional value of the future’s contract. The initial margin is the capital required to trade that asset.

What makes a futures contract unique is the degree of leverage that it offers over other financial instruments. The reason for this comes down to the nature of the contract itself.

How Do Futures Have Leverage?

When a trader buys a futures contract, they are buying the right to purchase an asset in the future. They are not buying the obligation to buy the asset right now. It’s almost similar to a handshake agreement. The key problem with the handshake is that there is no enforcement to honor a handshake (aside from social credit).

You probably have that one friend who owes you $5 on the Superbowl outcome years ago that has never paid up. Or maybe you are that friend. Thankfully a futures contract solves this problem by going through a clearinghouse. This is an intermediary between both parties that makes sure both the buyer and seller are able to fulfill their obligations.

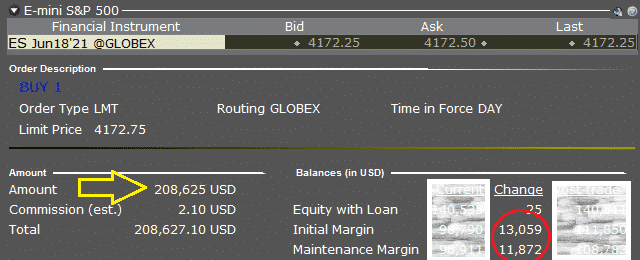

In terms of collateral, the intermediary requires you to post an initial margin. For most futures contracts, this initial margin is extremely low. Let’s take a look at the S&P mini contract (ES).

Here we are able to buy over $208,000 notional of the S&P 500 with only $13,000 in initial margin. Only 6%. Now, a lot more capital is needed to actually maintain this contract. This is because as the price of the S&P moves, our margin requirements change, as well.

For example, if the index drops 2%, we will need to post almost an additional $5,000 in margin just to stay solvent. Of course, if we are trading this contract, we should have far more funds in our account than the initial margin.

Leverage is All Around Us

Many people have said to me that investing with leverage is crazy. “Why would you leverage your portfolio? Sounds reckless.” The irony is these people often have hundreds of thousands of dollars in a mortgage. They are far more leveraged than I am. Things like student loans, mortgages, and credit card debt are all forms of leverage.

Businesses borrow countless amounts of capital simply to function. Leverage is an integral part of our capitalist society. To be successful economically in one form or another, one needs to embrace it.

Cheap vs. Expensive Leverage

The leverage provided by futures and options is far superior to most other forms of borrowing. Credit cards have interest rates of up to 30%. Business loans are often around 10%. Mortgages are usually set at the bank’s prime rate, which currently is around 3%. To borrow funds on margin from your brokerage can cost from 1.5% to greater than 10%.

Now let’s turn to a simple long equity futures contract. The interest rate is already embedded into the futures contract and is equal to approximately LIBOR (the overnight rate banks lend to each other). Currently, this is around 0.5% in interest annually. Hence, with a futures contract, a trader can currently get the return of the S&P 500 and borrow the money for 0.5%. This is almost free (as long as interest rates stay low).

It is an absolute tragedy that people are using borrowed margin and paying 10% to invest in equities when they can do it at a fraction of the cost by using futures. A contrasting point with this may be that by borrowing money from your brokerage, you can select the stocks you want instead of having to choose an index.

My response is that if you can consistently beat the index return by 10% with simple stocks, get a job at a hedge fund.

How Leverage Can Supercharge Your Portfolio

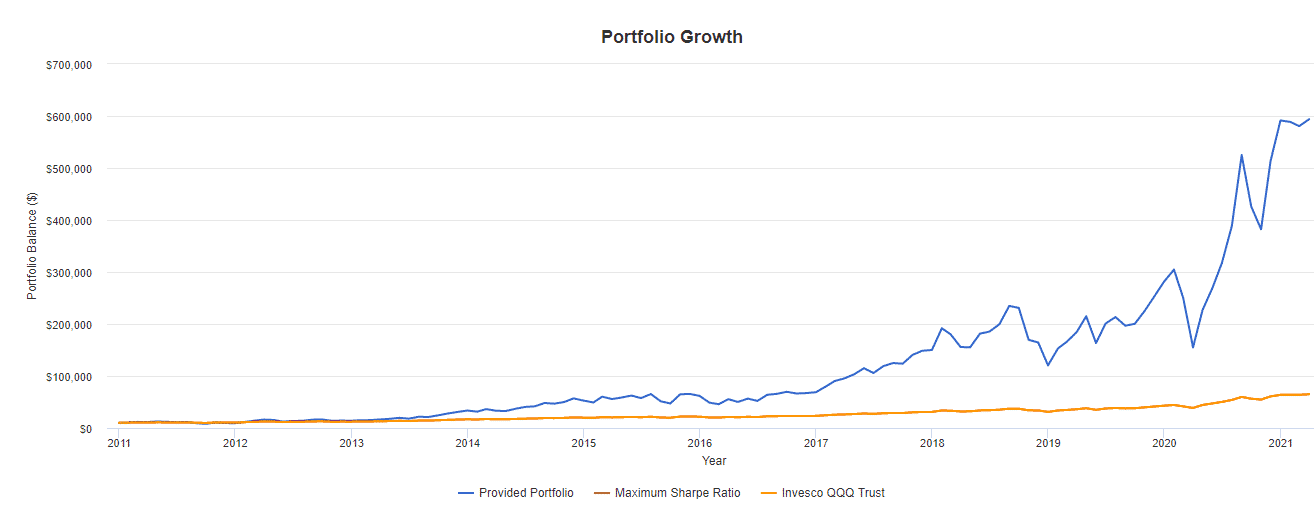

Below I have the returns of the Nasdaq (yellow) and its 3 times leveraged ETN TQQQ (blue). If you had invested $10,000 at the start of 2011, you would have $65,000 with the Nasdaq and an astonishing $594,000 with TQQQ. If you leveraged futures yourself and avoided paying TQQQ’s fees and tracking errors, you could have done even better.

So where is the catch? If the Nasdaq falls enough (such as its 90% drop during the tech bubble) TQQQ would either be worth pennies or could completely blow up (almost like XIV). This is the type of leverage that can build you a house and have it burn down in a fire in the same year.

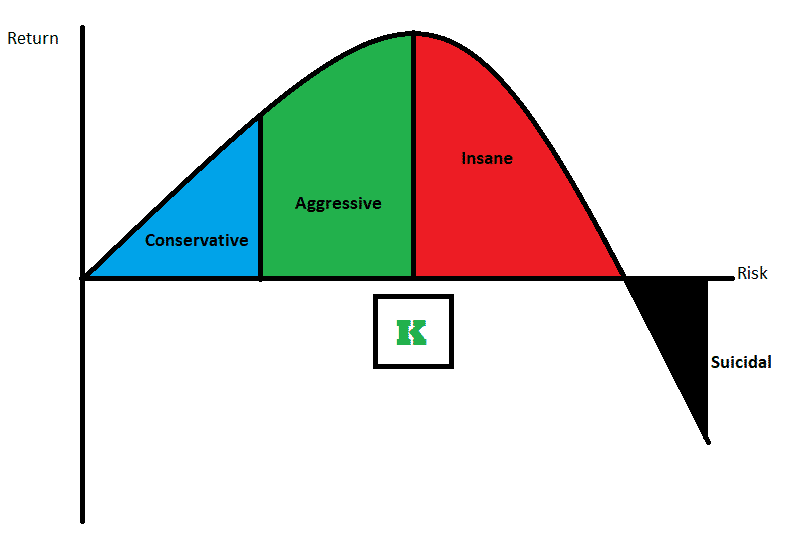

So, it’s definitely not recommended. As an investor, too much leverage, while creating short-term success, leads to long-term failure. For a strict equity index, 2-3 times leverage is probably the maximum you can employ without moving into the “wild” category below.

Source: RHS Financial

Of course, this is to maximize wealth over the long-term.

An investor who already has a retirement lined up or has the money available for a house should not put that at risk with leverage. The goal has shifted from capital growth to capital preservation. There are some more in-depth strategies, such as volatility targeting and leveraged risk parity, which use futures to provide equally astonishing returns with less risk.

Conservatively Beating the Index With Futures?

So, should a conservative investor even consider futures? My answer is an absolute yes. Due to rock bottom interest rates, a simple strategy to beat the index is to buy an equity futures contract equal to the portfolio’s value, then withdraw half of the portfolio and invest in the highest interest savings account you can find.

Most likely the interest will be up to 1% higher than the LIBOR rate you are paying for the futures contract. Sometimes I have found it even higher when you get a promotional interest rate. You basically can create an indexed portfolio that will guarantee to beat the index and requires little management. The only thing is that in a major downturn you may need to move money from the savings account back to the brokerage to meet margin requirements.

That’s it. Tricks like this don’t always last, but they show the power of using futures. An even more conservative investor could take half exposure, sell covered calls on it, and put the rest in the savings account. The opportunities are endless.

Playing Relative Value with Futures

Imagine you think that after the Nasdaq’s multi-year outperformance over the Russell 200, the tide will change. You think it’s now time for value to outperform growth. A position could be established where the trader is long the Russell 2000 futures while short a Nasdaq future. This position will benefit if the investor’s thesis of the Russell outperforming the Nasdaq is correct.

While this trade could be replicated by buying the Russell 2000 ETF and shorting the Nasdaq ETF, the issue is it uses up a large amount of margin. By taking advantage of the leverage provided by futures, the trader is able to put on the relative value trade they want. Afterwards, due to the low margin required, they still have the capacity to take up other positions

Concluding Remarks

Futures offer investors access to cheap borrowing and leverage unavailable otherwise to retail investors. This flexibility can allow investors to design unique portfolios to maximize long-term wealth.

While this leverage can appear scary, it only is when used incorrectly or when one is over-leveraged. By being conservative with leverage, it can help ignite a portfolio and allow an investor to create a dynamic asset allocation.