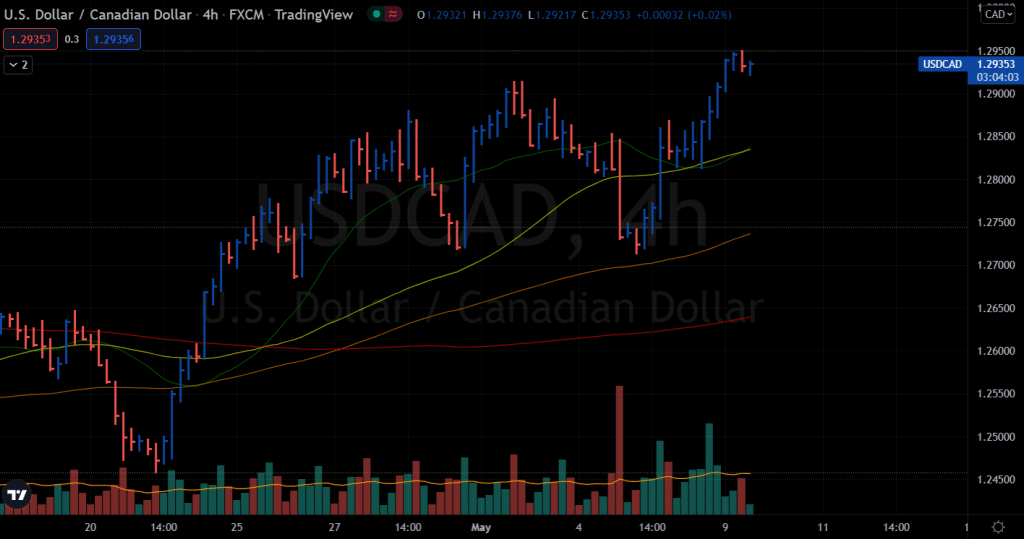

USD/CAD Price Hits YTD Highs Amid Firm USD, Soft WTI Prices

A combination of factors contributed to the USD/CAD pair’s third day of gains on Monday, building on its recent strong bullish move. First, a more aggressive Fed tightening possibility led to a surge in the US dollar near its two-decade high. Furthermore, falling crude oil prices served as a tailwind for the major Canadian currency and undermined the commodity-linked currency.

Last week, Jerome Powell, chair of the Fed, said that a 75 basis point hike was not actively considered. Markets believe, however, that the US Federal Reserve should take stronger action to curb inflation and continue to expect another 200 basis point hike by the end of 2022. This, in turn, drove bond yields higher. As a result, the dollar strengthened as the benchmark 10-year US Treasury bond hit its highest level in over a decade.

A rapid rise in US interest rates and Chinese lockdown restrictions fuel fears of a recession and a slowdown in global economic growth. The result was a dampening of investor appetite for risky assets and a dampening of crude oil prices, despite concerns about supply cuts. Furthermore, Friday’s somewhat unassuming Canadian jobs report supported the USD/CAD pair.

What’s Next To Watch?

Neither the US nor Canada is expected to release any major economic data on Monday. Therefore, US bond yields and market risk sentiment will continue to play an important role in stimulating demand for the US dollar. In addition, for short-term opportunities in USDCAD, traders will continue to monitor oil prices.

USD/CAD Price Technical Analysis: Buyers To Face 1.3000

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more