U.S. Trade Deficits Are Growing Larger. Or Are They?

Another year has brought another record United States trade deficit, along with the usual dismissal of it as anything but a symbol of American excellence and a booming economy. It is true that, in our modern monetary system, a balance of payments deficit is simply the aggregate exchange of domestic asset ownership for foreign goods and services and not a problem in and of itself.

Measuring economic activity in fiat currency, however, is akin to using an ever-changing tape measure, and we must be highly suspicious of any conclusions derived from such figures.

The Raw Numbers

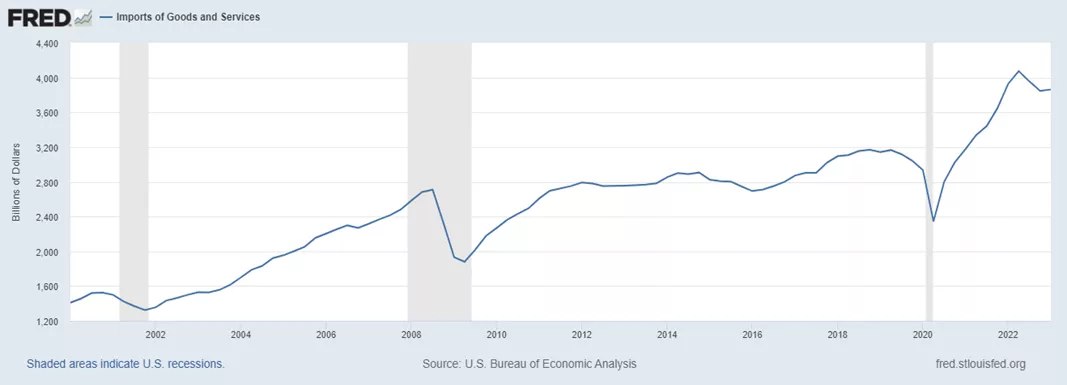

It is wise to take stock of the jaw-dropping nominal figures. The annualized US trade deficit in the first quarter of 2022 was equivalent to the gross domestic product (GDP) of Indonesia, and imports of US goods and services of the same time period amounted to roughly the GDP of Germany.

Figure 1: US imports of goods and services, 2001–23

(Click on image to enlarge)

Source: US Bureau of Economic Analysis (BEA), FRED.

Figure 2: US trade deficit, 2013–23

(Click on image to enlarge)

Source: Organisation for Economic Co-operation and Development (OECD), FRED.

If we simply examine our everyday consumptive habits, it certainly seems like fewer and fewer of those goods are produced domestically. These figures only lend further credence to this conclusion.

The Relative Numbers

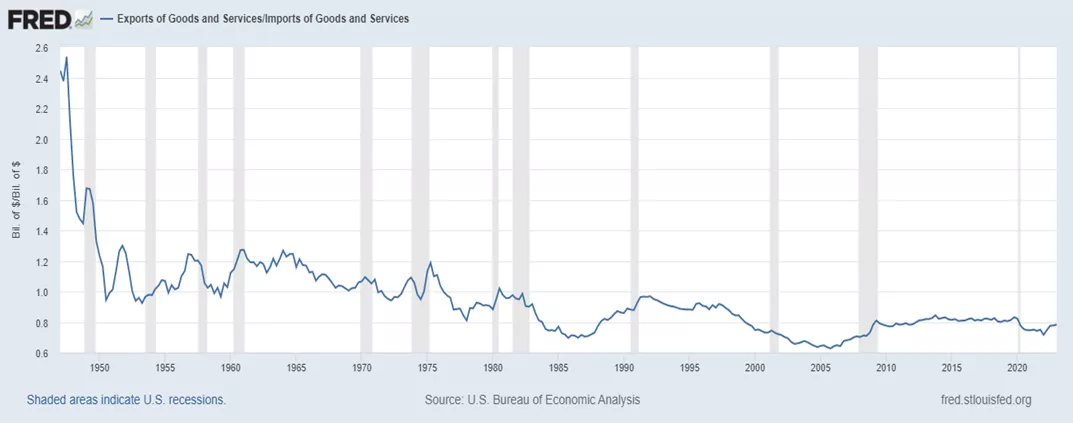

The ratio of exports to imports (essentially an inflation-adjusted measure of the balance of trade), however, remains around the same level it was forty years ago.

Figure 3: Ratio of US exports to imports, 1945–2023

(Click on image to enlarge)

Source: BEA, FRED.

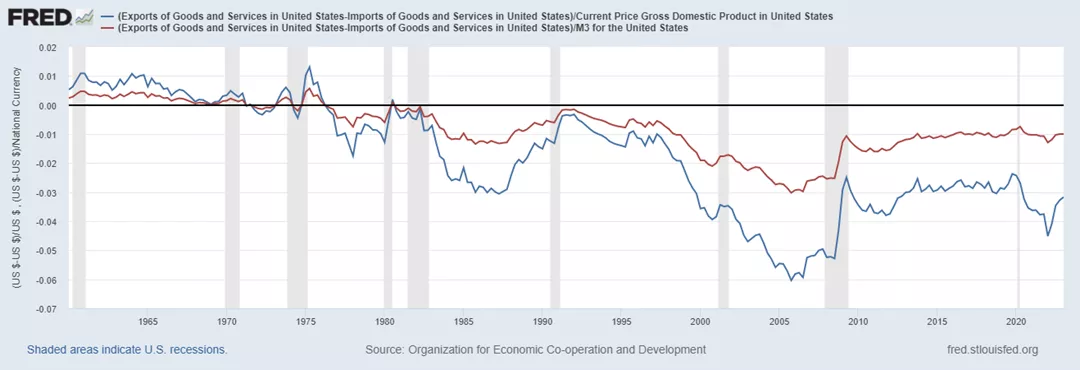

The same can be said for the trade deficit as a percentage of GDP and as a percentage of the M3 money supply over the last forty years. However, both have been more than cut in half since 2006.

Figure 4: The US trade deficit as a percentage of GDP and M3 money supply, 1960–2023

(Click on image to enlarge)

Source: OECD, FRED.

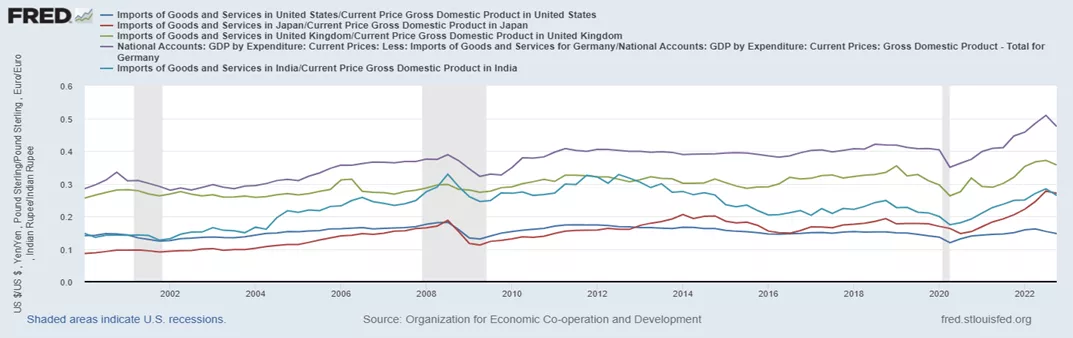

Imports as a percentage of nominal GDP, meanwhile, have fallen since 2008 and are at the same levels as in 2000, lower than in Germany, the United Kingdom, and even isolated societies such as India and Japan.

Figure 5: Imports as a percentage of GDP in the US, Japan, the United Kingdom, Germany, and India, 2000–2023

(Click on image to enlarge)

Source: OECD, FRED.

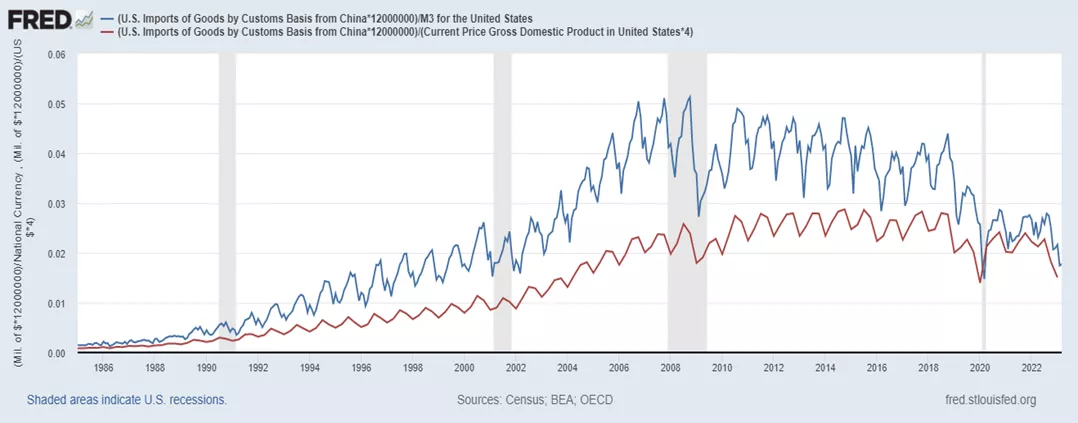

Furthermore, US imports from China are also well off record highs, both in nominal terms and as a percentage of GDP and M3.

Figure 6: US imports from China as a percentage of M3 money supply and GDP, 1985–2023

(Click on image to enlarge)

Source: US Census Bureau, BEA, and OECD, FRED.

This comparative data suggests that US raw trade figures are simply behaving as every financial asset or economic data point has over the long term when measured in fiat currency: continuously making new highs, reflecting the ever-expanding money supply and the ever-shrinking purchasing power of a unit of fiat currency. When adjusted for inflation, the US economy actually appears to have become slightly more isolated over the past decade and a half.

So how may we explain the discrepancy between our observable economic surroundings and such contradictory statistical evidence?

The Real Numbers

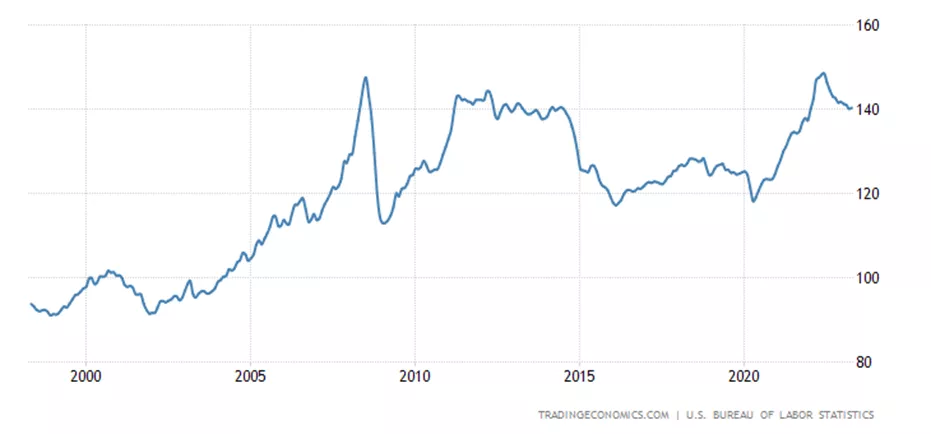

While this previous conclusion that the US economy appears to have become more isolated seems appealingly counterintuitive, a more qualitative analysis can answer the question of the discrepancy. Since 2008, the US dollar has risen against the vast majority of the currencies of US trade partners, keeping import prices in check.

Figure 7: US import price index, 1999–2023

Source: US Bureau of Labor Statistics, Trading Economics.

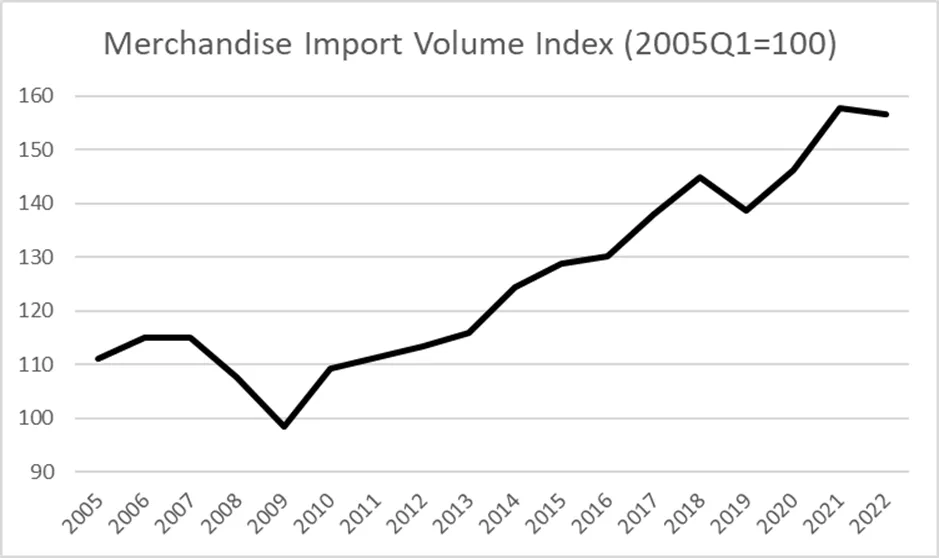

During that same period, the US money supply has continually expanded, and domestic economic figures measured in fiat currency such as GDP have artificially increased. An increasing money supply combined with subdued import prices has thus allowed Americans to increase the real, physical volumes of their imports without imports rising as a percentage of GDP.

Figure 8: US merchandise import volume index, 2005–22

Source: World Trade Organization.

We may therefore conclude that the disparity between economic data and eyewitness testimony is a consequence of favorable exchange rates suppressing the value of imports in relation to domestic goods and services as well as concealing the importance of foreign products in the US economy.

Conclusion

The use of fiat currency is responsible for countless socioeconomic problems, but its most important consequence may well be the distortion of price signals, which severely diminishes our ability to discern economic activity through statistics.

The combination of ever-expanding money supplies and the free-floating exchange rates of fiat currencies drastically alters the dynamics of international supply and demand.

If US exchange rates were to fall and import prices were to rise, Americans would have to severely diminish or alter their current consumption levels.

However, as long as the inflationism of foreign central banks rivals that of the Federal Reserve, the US dollar will maintain its dominance and the status quo will be maintained.

More By This Author:

Higher Corporate Profit Margins Aren't Causing Inflation

The Bankruptcy Caravan Is Now Arriving: Time To Pay For The Easy Money

How Markets Self-Corrected During The 1819 And 1919–21 Recessions