US Stock Market Weekly Update March 9 - March 13, 2020

US stocks had a week of historic losses as worries deepened about the impact of the coronavirus outbreak, and its negative effects on global economy, pushing the major indexes into bear market territory. The Cboe Volatility Index (VIX) reached its highest level since the financial crisis of 2008, and circuit breakers designed to halt stock trading and prevent panic selling were activated more than one time during the week. It is very unusual for the US stock market to see a decline on 10% on one day, and gains of 9% the next day, but it happened at the end of the week. On Thursday, March 12, 2020, all major stock market indices plunged 10%, and on Friday, March 13, 2020 they rallied 9% as trump and business leaders pledged support to fight coronavirus outbreak.

Main economic and business news during the previous week

The World Health Organization (WHO) declared coronavirus outbreak a global pandemic, The Fed injected more liquidity into the financial system to support the economy, three central banks cut interest rates to combat coronavirus impact. These banks were, Norway’s central bank, the Bank of England and the Bank of Canada. Surprisingly, the European Central Bank did not cut interest rates, holding a more conservative monetary policy, at least for now. Oil prices collapsed on Monday, March 9, 2020, having their biggest one-day decline since 1991, as a result of a Russia – Saudi Arabia oil price war. The US dollar appreciated this week against major currencies and the US bond yields rose significantly with a diminishing risk-aversion, towards the end of the week.

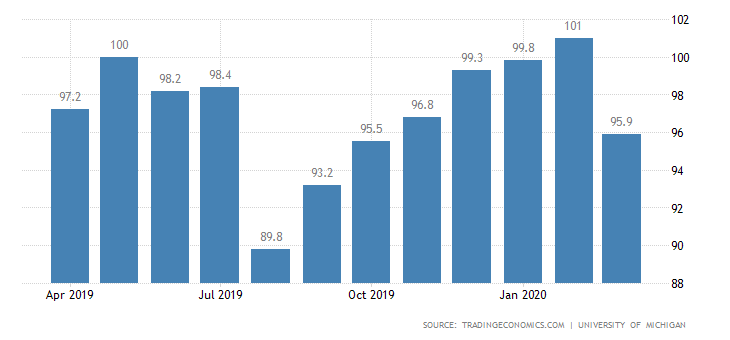

United States Consumer Sentiment

“The University of Michigan's consumer sentiment for the US fell to 95.9 in March of 2020 from 101 in the previous month but above market consensus of 95, a preliminary estimate showed. That was the lowest reading since October, due to the spreading coronavirus and the steep declines in stock prices”.

Source: Trading Economics

For the week of March 9– March 13, 2020 the major US stock market indexes closed as follows on Friday, March 13, 2020:

• Dow Jones Industrial Average (DIA): Close 23185.622, -10.36% for the week, -18.76% Year-to-date

• S&P 500 Index (SPY): Close 2711.02, -8.79% for the week, -16.09% Year-to-date

• NASDAQ (QQQ): Close 7874.88, -8.17% for the week, - 12.23%, Year-to-date

• Russell 2000 (IWM): Close 1210.13, -16.50% for the week, -27.47% Year-to-date

Weekly Stocks Gainers

These are the top 3 gainers, stocks with 5 days of consecutive price advances:

1. Liquid Media Group Ltd (YVR), Close 2.50, 5-day change +25.74%

2. Premier Inc Cl A (PINC), Close 34.95, 5-day change +21.02%

3. Blue Capital Reinsurance (BCRH), Close 7.20, 5-day change +4.05%

Weekly Stocks Losers

These are the top 3 losers, stocks with 5 days of consecutive price declines:

1. Hovnanian Enterprises Inc (HOV), Close 9.90, 5-day change -57.31%

2. Dave & Buster's Entertainment (PLAY), Close 13.27, 5-day change -54.76%

3. Onespaworld Holdings Ltd (OSW), Close 4.81, 5-day change -54.10%

Economic events for the week March 16- March 20, 2020:

Important economic data for this week will be the Fed's interest rate decision, housing starts and the leading economic index. Will Fed make a surprise, or will it make another interest rate cut? The FOMC decision can move the financial markets this week, and the US dollar. Any additional aggressive interest rate cut of 50 basis points in such a short time period may be a relief, but we cannot rule out an interest rate cut of 25 basis points, leaving more room for altering the monetary policy in the future.

Stock market commentary

Airlines, cruise operations saw their stocks plunging this week, but it could still be too early to catch a bottom for their shares. Sustained increased volatility in the financial markets has high probabilities being a dominant theme until we have more clear news about the coronavirus developments.

Sources:

https://quotes.wsj.com/index/US/COMP

https://www.barchart.com

https://www.dailyfx.com/economic-calendar

Disclosure: I have no position in any stock mentioned