US Stock Market Weekly Review April 13- April 17, 2020

A second consecutive week with gains for all major US stock indexes despite weak economic releases makes a recent article posted on Yahoo Finance titled “The stock market wants to embarrass the experts” an interesting one. The article has compelling arguments such as the following ones:

“The rebound comes despite a backdrop of weekly unemployment claims in the millions, a historic plunge in retail sales, and the biggest drop in manufacturing since 1946. Goldman Sachs predicts GDP in the U.S. will shrink a whopping 24% in the 2nd quarter, and rebound in the 3rd and 4th quarter.

Over the past weeks, analysts and investors have warned we are not in the clear yet and to watch out for a ‘bear market trap.

So many strategists are calling for a retest that Mr. Market will try to embarrass the greatest number of strategists at any one point in time,”.

However, we disagree with the main title. The financial news is not good, the stock market is now being driven on hopes and positive momentum about the latest news about the coronavirus contamination developments and news about reopening the US economy in early May 2020. When the stock market participants will start wondering about the current stock prices and their valuation another selloff may occur. And while no one can predict the magnitude of this potential stock market correction, the fact that major US banks have made credit reserves and have warned about the future recession of the US economy makes us believe that another stock market correction is highly likely.

Another key theme during the week of April 13- April 17, 2020, was the collapse of oil prices. On Friday, April 17, 2020, the crude oil prices closed at $18.12, -1.75(-8.81%) despite an agreement reached by global producers to reduce the output. While the low oil prices are bad news for the producers of oil, it is very positive news especially for the companies which can hedge and lock low oil prices for a long period, as this move will have a significant impact on their costs and profitability.

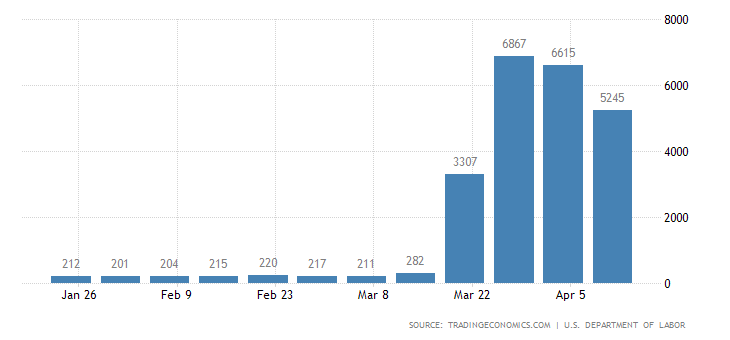

The United States Initial Jobless Claims

“The number of Americans filing for unemployment benefits was 5.245 million in the week ended April 11th, down from the previous week's 6.615 million and compared to market expectations of 5.105 million. The latest figure brought the total reported over the past month to 22 million, as the coronavirus pandemic swept across the US. The 4-week moving average, which removes week-to-week volatility, jumped to an all-time high of 5.509 million while continuing jobless claims hit a record 11.976 million in the week ended April 4th.”

Source: https://tradingeconomics.com/united-states/jobless-claims

It is considered positive the fact that there have been two consecutive weeks of declining figures as we may have reached the peak for this trend. Still, within four weeks the US economy lost more than 20 million jobs. For the US economy to create 20 million jobs it needed almost 11 years as of 2009 until today. This mentioned news shows the magnitude of the negative impact of the coronavirus on the broader economy.

For the week of April 13– April 17, 2020, the major US stock market indexes closed as follows on Friday, April 17, 2020:

• Dow Jones Industrial Average: Close 24242.49, +2.21% for the week, -15.05% Year-to-date

• S&P 500 Index: Close 2874.56, +3.04% for the week, -11.03% Year-to-date

• NASDAQ: Close 8650.14, +6.09% for the week, - 3.59%, Year-to-date

• Russell 2000: Close 1229.10, -1.41% for the week, -26.33% Year-to-date

Weekly Stocks Gainers

These are the top 3 gainers, stocks with 5 days of consecutive price advances:

1. Pennsylvania Rl Estate Invt TR (PEI) Close 6.44, 5-day change +55.18%

2. Aravive Inc (ARAV), Close 11.41, 5-day change +53.15%

3. Moderna Inc (MRNA), Close 46.85, 5-day change +47.05%

Weekly Stocks Losers

These are the top 3 losers, stocks with 5 days of consecutive price declines:

1. Chesapeake Energy Corp (CHK), Close 14.45, 5-day change -57.50%

2. Akers Biosciences (AKER), Close 3.42, 5-day change -33.33%

3. Northeast Bncp (NBN), Close 10.51, 5-day change -25.51%

Economic events for the week April 20- April 24, 2020:

Important economic data for this week will be the earnings season, a week with about 20% of the companies in the S&P 500 reporting their first-quarter results. Major economic indexes include the releases of the existing home sales, the April preliminary Purchasing Managers' Index (PMI), the House Price index, the weekly continuing Initial and Continuing jobless claims, the Durable Goods Orders and the University of Michigan consumer sentiment index.

Disclosure: I have no position in any stock mentioned