US Stock Market Forecast For 2020

Investors want to get a handle on the US stock market forecast for 2020 after stock prices rose in excess of 30% in 2019. The gains in the past year resulted solely from an expansion of the price-to-earnings valuation metric as growth in earnings proved elusive. Investors are now worried about the longevity of the bull market. What is AlphaProfit’s US stock market forecast for 2020?

The US economy fared reasonably well in 2019.

The unemployment rate declined to a multi-decade low of 3.5% from 4.0% at the start of the year.

US gross domestic product grew a strong 3.1% in the first quarter. Although the pace of growth slowed, it remained healthy growing at or in excess of 2.0% in the second and third quarters.

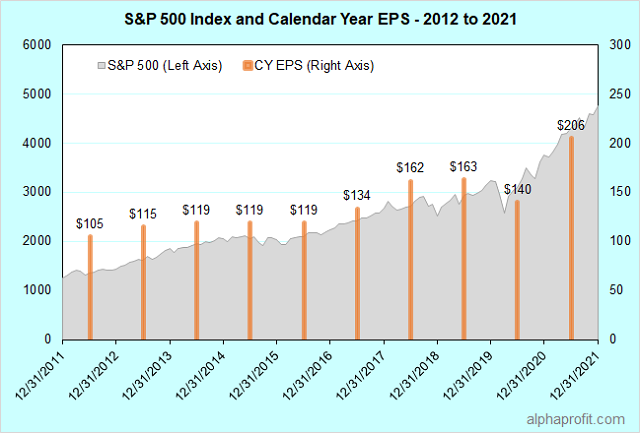

S&P 500 member companies had a tough time growing their earnings in 2019 after their 2018 tally received a one-time boost from lower corporate income tax rates. According to FactSet, S&P 500 member earnings grew less than 1.0% in the first and second quarters of 2019 and declined 1.6% in the third.

The Federal Reserve reversed its stance on interest rate policy in 2019 after hiking interest rates in 2018. As threats to continued global economic expansion rose from the trade tariff war between the US and China, the Fed lowered interest rates thrice in 2019. The federal funds rate now stands at 1.75% after starting the year at 2.5%.

Popular large-cap benchmarks, the S&P 500 and the Dow Jones Industrial Average rose 31.5% and 25.3%, respectively while the small-cap Russell 2000 benchmark gained 25.5% in 2019.

Most of the gains in the S&P 500 in 2019 accrued during the first and fourth quarters. Register to learn how AlphaProfit model portfolios performed in 2019.

Stocks rebounded in the first quarter from the selloff in the fourth quarter of 2018 as trade negotiations between the US and China progressed and the Federal Reserve took a patient stance in determining future interest rate increases.

During the second and third quarters, stock prices were range-bound as trade talks progressed in fits-and-starts and the Federal Reserve cut benchmark interest rates.

Stocks surged in the fourth quarter ending 2019 on a high note after the US and China agreed to a ‘phase one’ trade deal and committed to signing the agreement in January 2020.

US Stock Market Forecast for 2020: What’s on Investors’ and Analysts’ Minds?

The bull market that began in the depths of the Great Recession in 2009 is now in its eleventh year. The S&P 500 has recorded only one losing year since 2009. This was in 2018 when the benchmark lost 4.4%. The extended rally in stock prices has enabled the S&P 500 to set several new all-time highs along the way.

The S&P 500 ended 2019 close to an all-time high after more than fully recouping the 4.4% loss suffered in 2018. Incidentally, 2018 marked the first losing year for the benchmark after 2008. Register to learn more on the year-over-year performance of AlphaProfit model portfolio since inception.

A recent survey of fund managers conducted by Bank of America shows investors are most concerned with US Politics and the outcome of the US Presidential Election in 2020.

Some investors are worried about inflation ticking up from wage pressures amid historically low unemployment rates.

Likewise, some investors are concerned the expected acceleration in earnings growth may not materialize in 2020 since signs of a bottom in the global economic slowdown have not yet materialized.

On the earnings front, FactSet shows analysts currently expect S&P 500 companies to grow their earnings per share to $177.64 in 2020 from $162.23 in 2019. In other words, analysts expect EPS to grow by 9.5% in 2020.

US Stock Market Forecast for 2020: Key Risks to Stock Prices

The US stock market will likely have to contend with three key risks in 2020. They include high stock valuations, unforeseen events, and potential for changes to the political landscape.

High stock valuations. The rally in stock prices in 2019 has resulted solely from an increase in the valuation metrics as earnings did not grow from 2018. As such, the price-to-earnings ratio commonly used to value stocks has gotten richer over the past year.

The P/E ratio is currently supported by expectations that earnings would resume growing in 2020 and interest rates would remain low.

The bullish earnings growth thesis is based on the premise business investment will revive and growth in emerging market economies will perk up, now that the ‘phase one’ trade deal between the US and China has been agreed by both nations.

The interest rate assumption is supported by low inflation and central bank policies. After diverging for a few years, the interest rate policies of the US Federal Reserve, the European Central Bank and the Bank of Japan are now in sync. The three leading central banks are currently trying to stimulate economic expansion.

Stock prices will likely be vulnerable if the above expectations for earnings growth and interest rates fail to come true.

Learn more: Which sectors are likely to fare well this year?

Unforeseen events. The opening weeks of 2020 have underscored the risk to stock prices from unforeseen events.

First, stocks threatened to derail after the US ordered an airstrike to kill Iranian Gen. Suleimani, raising tension between the US and Iran. Gen. Suleimani headed Iran’s elite military unit and was in charge of Iran’s foreign military and quasi-military operations.

Second, stock prices have come under pressure after the highly contagious coronavirus has spread from China to other parts of the world. The concern of the virus is impacting Chinese consumer spending on travel and luxury goods.

Such unforeseen events have the potential to upend the bullish investment thesis and lead to a decline in stock prices.

Learn more: What are the best growth stocks to buy now in the top sectors?

Potential for changes to the political landscape. Although a change in the US political landscape from the Presidential Election does not appear imminent, this possibility cannot be totally ignored.

Stocks face risks from corporate unfriendly policies supported by Democratic Presidential Candidates. All Democratic candidates in the 2020 election cycle want to undo the cut in the corporate tax rate brought forth by President Trump.

Some Democratic candidates are also backing proposals to break up technology giants, control drug prices, and ban fracking. Such moves will hit corporate earnings and are therefore a negative for stock prices.

So, what does all this mean for AlphaProfit’s US stock market forecast for 2020?

US Stock Market Forecast for 2020: Bottom Line

Historically, stock market returns tend to be lower when the starting forward 12-month price-to-earnings ratio is elevated.

Going into 2019, the forward 12-month P/E ratio was generally in line with the historical average at 14.2. This left ample room for the P/E ratio to increase, despite US companies failing to grow earnings in 2019.

The situation is quite different going into 2020. Stocks have started the year with a relatively rich forward P/E ratio. The S&P 500 closed at 3,230 on December 31, 2019. Analysts estimate S&P 500 companies to earn $177.64 a share in 2020, implying a forward P/E ratio of 18.1. For comparison purposes, the forward P/E ratio has averaged 16.6 and 14.9 over the past 5 years and 10 years, respectively.

The trailing P/E ratio for the S&P 500 stands at 19.8 if the index is normalized using analysts’ 2019 EPS estimate. Comparatively, the trailing P/E ratio has averaged 19.8 and 17.5 over the past 5 years and 10 years, respectively.

Gains for the US stock market can match the magnitude of growth in earnings in 2020 if US companies match or exceed earnings expectations and valuation metrics do not change materially.

The S&P 500 would close 2020 at 3,517 if S&P 500 members earn $177.54 a share as expected in 2020 and the trailing P/E remains unchanged at 19.8.

This scenario would imply a solid single-digit return in 2020. This can happen if the US elections do not materially change the political landscape and interest rates continue to stay low.

On the downside, significant changes in the US political landscape will likely compel analysts to lower their 2021 earnings per share forecast. The resulting deterioration in investor sentiment, either with or without rising interest rates can cause the P/E ratio to contract. US stock prices would decline by about 18% if no growth in EPS is assumed between 2020 and 2021 and the forward P/E ratio reverts to its 10 year average of 14.9.

Disclosure: Get two special reports Five Smart Ways of Using Fidelity Select Funds and Avoid Three Common Mistakes ETF Investors Make when you more