US Retail Sales Tumbled In May As Gas Prices Fell, Car-Buying Stalled

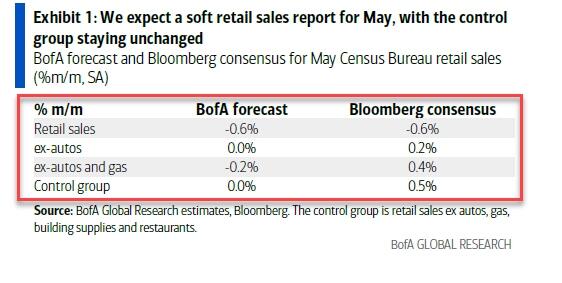

BofA's omniscient analysts' warning ahead of this morning's retail sales data from the US is simple: Brace!

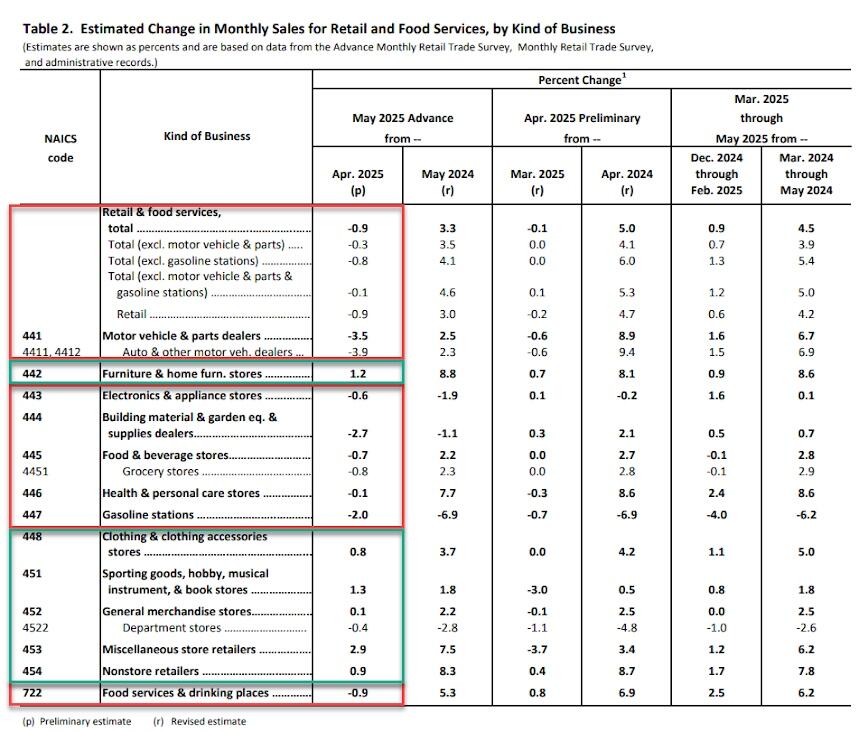

And after the small 0.1% MoM rise the prior month was revised to a 0.1% MoM decline, BofA was right again with Retail Sales tumbling 0.9% MoM in May - the biggest drop since March 2023...

Source: Bloomberg

The big driver of downside was a drop in Gasoline Station sales - which makes some sense as gas prices have tumbled - and an even bigger drop in Auto Sales (as the tariff front running surge evaporates)...

The tariff front-running hangover hits...

Source: Bloomberg

Ex Autos and Gas, sales fell 0.1% MoM (worse than the +0.3% expected) and Ex-Autos sales dropped 0.3% MoM (worse than the +0.2% MoM expected).

So an ugly set of data reflecting sentiment's slump?

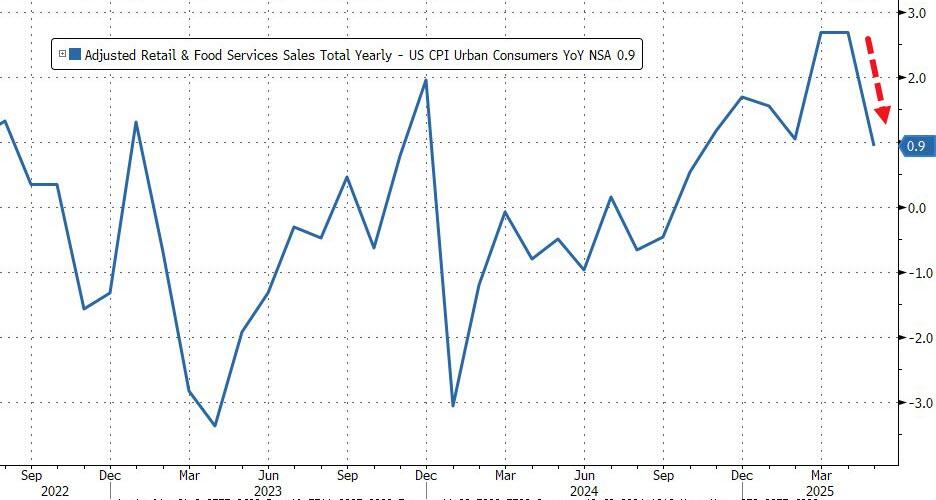

As a reminder, this data is nominal, so adjusting (very roughly) for inflation, retail sales rose 0.9% YoY, back to its lowest since Oct 2024... but still positive...

While the seasonally-adjusted sales print was down, unadjusted sales were higher in May (as they have been seasonally for years)...

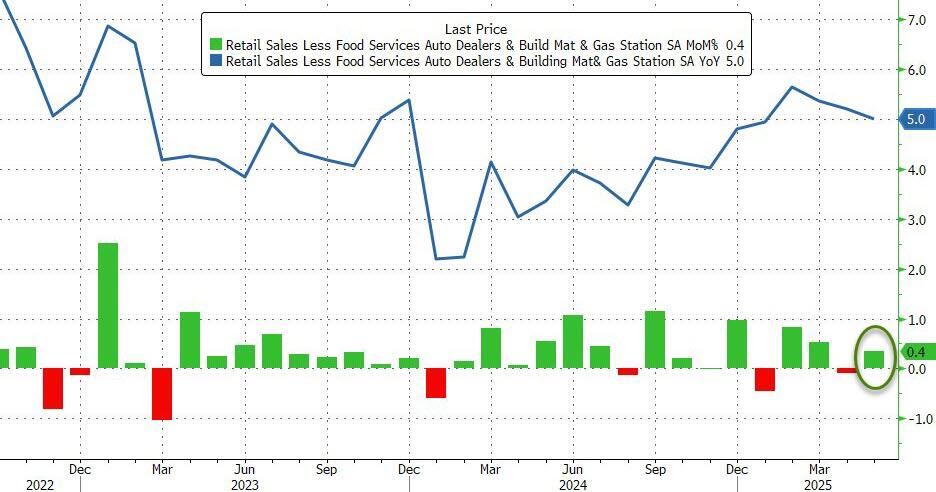

However, there is a silver lining as the Control Group - which feeds directly into GDP - rose 0.4% MoM (better than expected) and considerably stringer than the upwardly revised 0.1% MoM decline in April...

So, the bad news is Americans seem to be spending less... but top-down GDP will be positively impacted in Q2.

More By This Author:

Key Events This Holiday-Shortened Week: FOMC, Retail Sales, G7, Middle East War20Y Auction Prices "On The Screws" Amid Solid Foreign Demand

Taiwan Imposes Export Controls On China's Huawei, Semiconductor Manufacturing International Corp

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more