Zoom Video: Tracking The Ultimate Bubble Stock

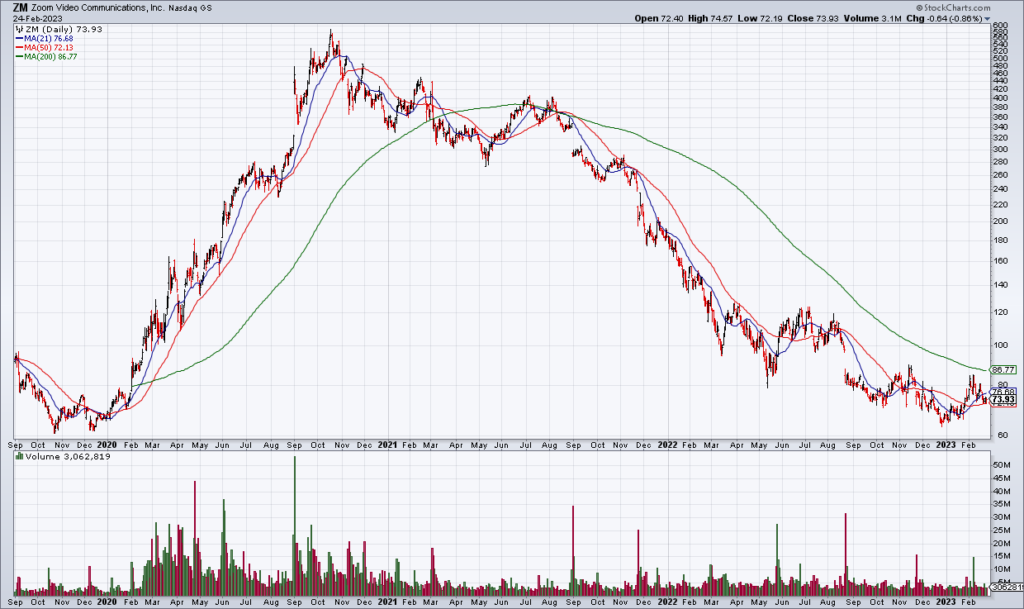

In many ways Zoom (ZM) – which reports 4Q22 earnings Monday afternoon – is the ultimate bubble stock. In October 2020 – as the pandemic raged and we were all Zooming each other from lockdown – ZM shares reached almost $600 giving the company a market cap near $200 billion. Fast forward two and a half years to today and shares are down almost 90% to $74.

It’s worth noting that ZM has always been a profitable business with a good product. While the pandemic massively accelerated its growth and resulted in a bubble in its stock price, ZM has continued to build its business.

ZM guided Full Year 2022 revenue to $4.37-$4.38 billion and Non-GAAP diluted EPS to $3.91-$3.94. ZM has almost $5.2 billion in cash and marketable securities on its balance sheet – and no debt. These are solid fundamentals for a company with a market cap of $22 billion – though not for one with a $200 billion market cap. Fear and greed. Mania and depression. Some things never change.

More By This Author:

Market Preview For The Week Of Feb. 27-March 3

NVDA: Technicals Vs. Fundamentals: Another Test Of The Competing Narratives

Home Depot Earnings Reflect Slowing Housing Market