Yields, Stocks, & Crypto Jump; VIX, Gold, & Crude Dump

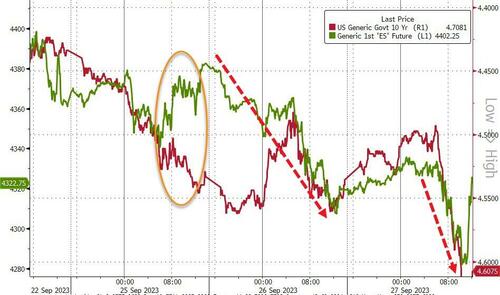

It seems that because World War III did, literally, not break out this weekend, it is BTFD time... and there was much rejoicing that "stocks managed to rally in the face of rising rates" with no thought of why.

Source: Bloomberg

Now, where have we seen that before?

Source: Bloomberg

Anyway, Small Caps and Nasdaq were the day's big winners with The Dow lagging but all comfortably green...

AAPL opened ugly - on China demand fears - rallied to green and failed... rallied to green again... and failed again...

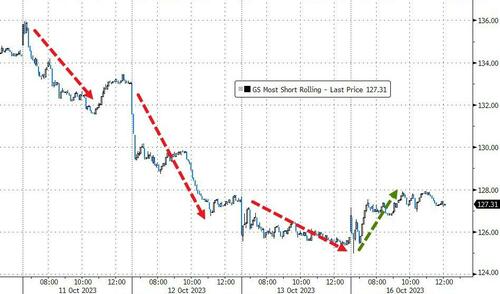

Today saw the first short-squeeze day in the last four days and for context, it was not very impressive...

Source: Bloomberg

VIX was clubbed like a baby seal back to a 17 handle, finding support at pre-Israel Attack levels...

But we note that 0-DTE traders fought the uptrend most of the day...

The S&P continues to hover at the low-end of the September gap-down. Will Retail Sales or Powell fill the gap?

Interestingly, AI names underperformed AI-at-risk names (though both were up significantly on the day) after the Biden admin cracking down on chips to China headlines...

Source: Bloomberg

Additionally, for a change, the GLP-1 Obesity names underperformed the at-risk names (though again both were higher)...

Source: Bloomberg

Treasury yields were higher across the entire curve with the long-end underperforming...

Source: Bloomberg

Notably, the 2Y yield broke above Thursday's post-CPI spike high yield but the 10Y could not...

Source: Bloomberg

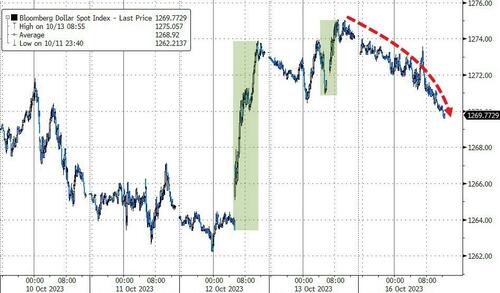

The dollar rolled over today, with selling accelerating as the day wore on...

Source: Bloomberg

Israel's Shekel slumped to its weakest since 2015, back above 4/USD...

Source: Bloomberg

Bitcoin had a brief shining moment in the sun after a tweet said that a Spot ETF had been approved... which was then denied... sending the crypto all the way back down to $28k from its spike to $30k.BUT then BTC caught a bid and lifted again along with stocks, back up near $29,000...

Source: Bloomberg

Oil slipped lower today on headlines that the Biden admin will allow another 'dictator' to sell more oil (Venezuela)...

Gold stalled at 9/25 ledge levels after ripping higher post-Israel (and payrolls) and slipped lower...

Finally, it appears the market is ready for some volatility in the next couple of days from Retail Sales and Fed Chair Powell's address...

Source: Bloomberg

But, after that, vol collapses.

More By This Author:

Ticking Time-Bomb: Food Inflation Is Crushing Millions Of Low Income AmericansKey Events This Busy Week: Retail Sales, Housing, Earnings And Torrent Of Fed Speakers Including Powell

Oil Slides On Biden-Maduro Deal For "Freer" Venezuela Elections, Easing Export Sanctions

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more