Yields Slide After Solid 5Y Auction Reverses Bitter Aftertaste From Ugly 2Y Sale

The difference between the disappointing 2Y auction earlier today and the just concluded sale of $55BN in 5Y paper was almost, but not quite, like night and day.

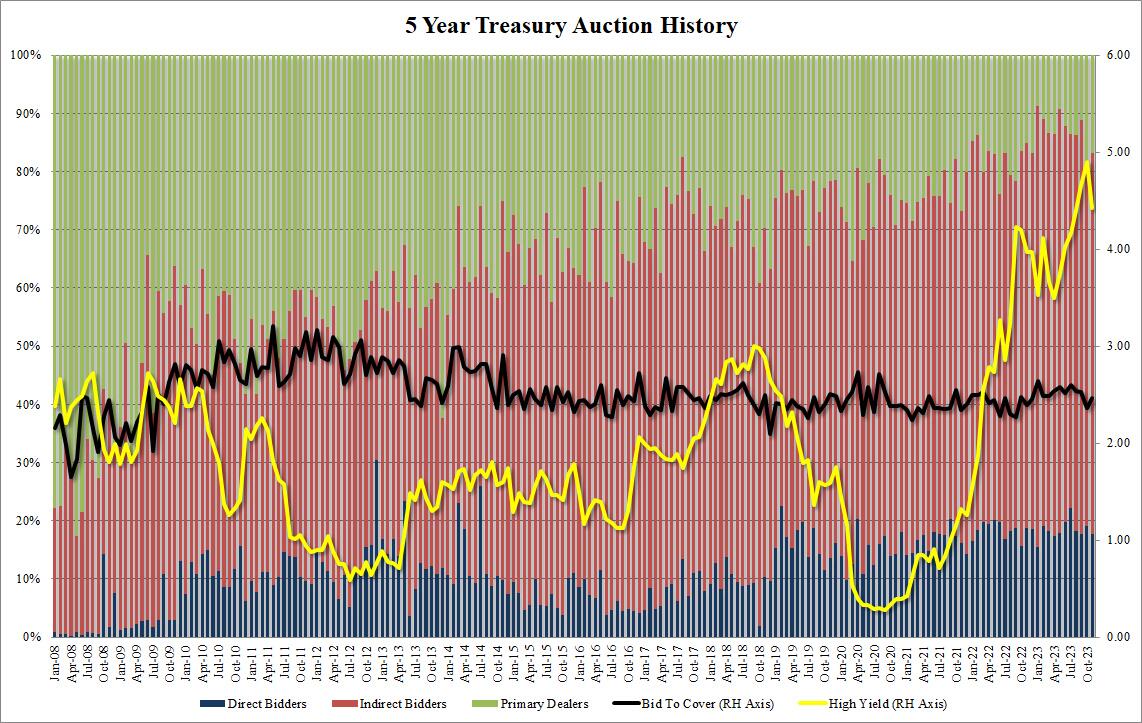

Pricing at a high yield of 4.420%, the 5Y auction stopped through the When Issued 4.425% by 0.5bps, a reversal from last month's whopper of a 1.9bps tail, and more to the point, the stop yield of 4.420% was almost 48bps below last month's auction yield of 4.899%. Compare that to the 1.1bps tail in the 2Y auction earlier today.

The Bid to Cover of 2.46 was also a notable reversal from the BTC slump in the 2Y auction earlier, as it actually increased from October's 2.36 to 2.46, which nonetheless was below the recent average of 2.52%.

The internals were also solid, with Indirects rising from 61.5% to 65.5%, just below the recent average of 67.6%. And with Directs awarded 17.6%, down from last month's 19.1%, Dealers were left holding 16.8%, which while down from last month's 19.4% was above the recent average of 13.3%.

(Click on image to enlarge)

Overall, while it wasn't stellar, the 5Y was a much stronger auction than this morning's ugly 2Y which however had little impact on the market. Meanwhile the solid response to the 5Y has managed to drag yields down to session lows below 4.40% which in turn has pushed duration (i.e., Nasdaq and tech stocks) to session highs.

More By This Author:

New Home Sales Hammered In October As Homebuilders Hit The Wall, Prices Plunge

Dear Santa, Can I Pay Later This Year?

Are People Losing Interest In Black Friday?

Disclosure: None