WTI Crude Oil And Natural Gas Forecast - August 9, 2016

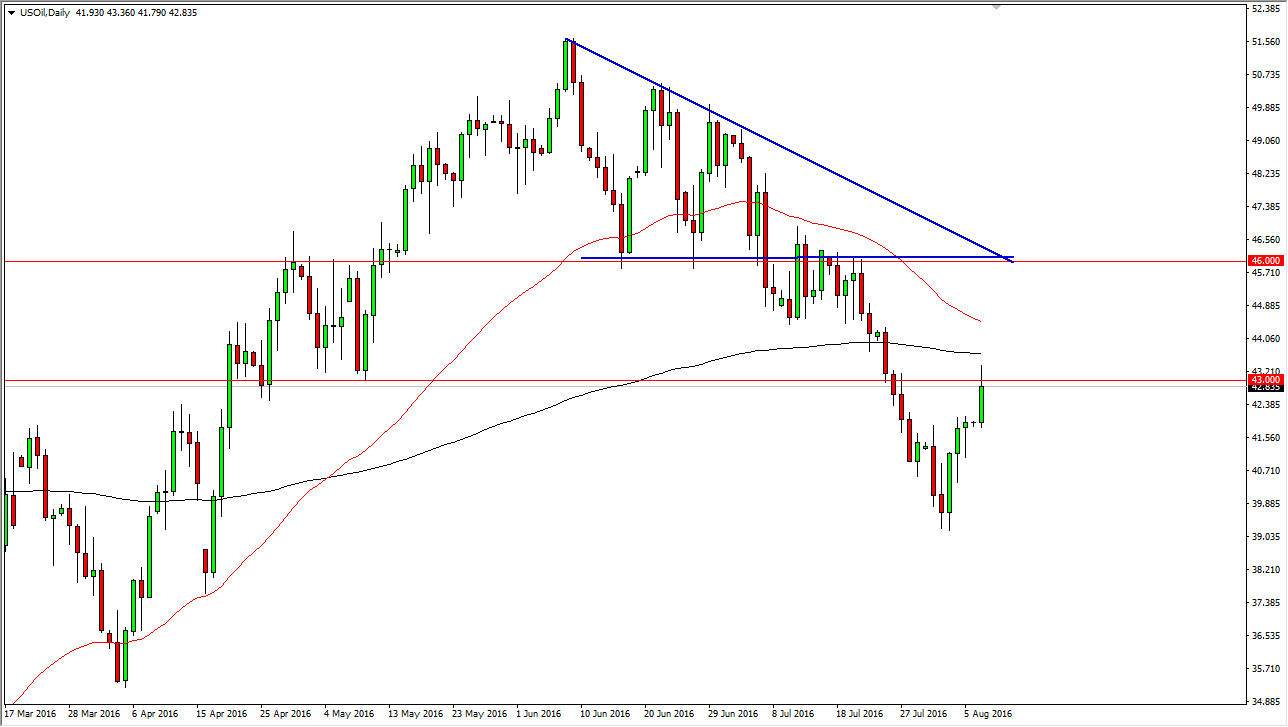

WTI Crude Oil

The WTI Crude Oil market initially rallied during the day on Monday, slamming into the $43 level however, there is a significant amount of resistance just above that level, and it makes sense that the market will continue to find trouble there. On the 4-hour chart, we have formed a nice-looking shooting star right here at the $43 handle, so it would not surprise me at all to see this market turn things back around and fall. On top of that, I have the red 50-day exponential moving average on the daily chart in front of you, as well as the 200-day exponential moving average. It looks like we are about to cross, and that of course is a very negative sign. Because of this, I’m looking for a reason to start selling, and as a result will be short of this market fairly soon.

(Click on image to enlarge)

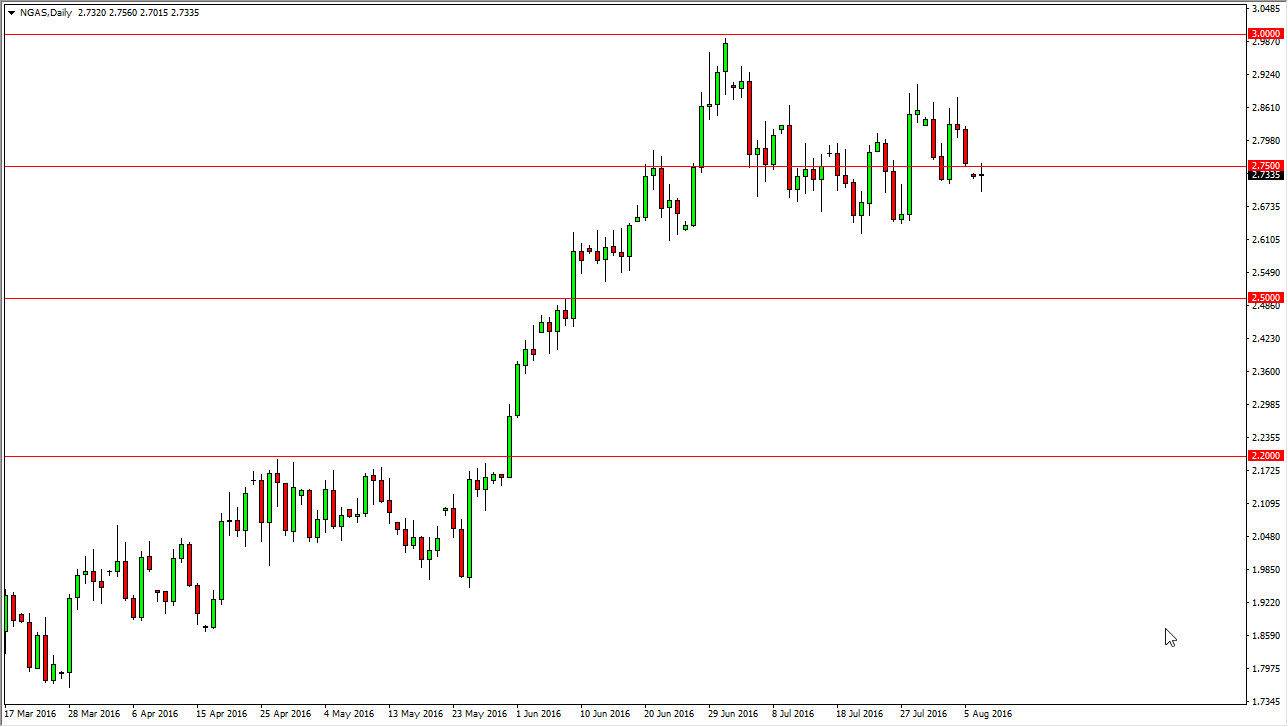

Natural Gas

The natural gas markets gapped lower at the open on Monday, but found quite a bit of volatility and support just below the $2.75 level. A break above the $2.75 level would be a bullish sign, and I think sooner or later the market will reach towards the $2.85 level. With this, I feel that the market will eventually try to break out to the upside, and with this we could very well find quite a bit of buying pressure in a market that’s so bullish. I think we will eventually have to test the $3 level again, which is a large, round, psychologically significant number. Ultimately, this is a market that has shown quite a bit of bullish pressure lately but I do believe that sooner or later this is a market that will rollover for the longer term, but we are nowhere near that of the moment, so given enough time we will do that, but in the meantime we are going to go higher during quiet summer trading months.

(Click on image to enlarge)

Disclosure: None.

Thanks for your information