WTI Crude Oil And Natural Gas Forecast - August 5, 2016

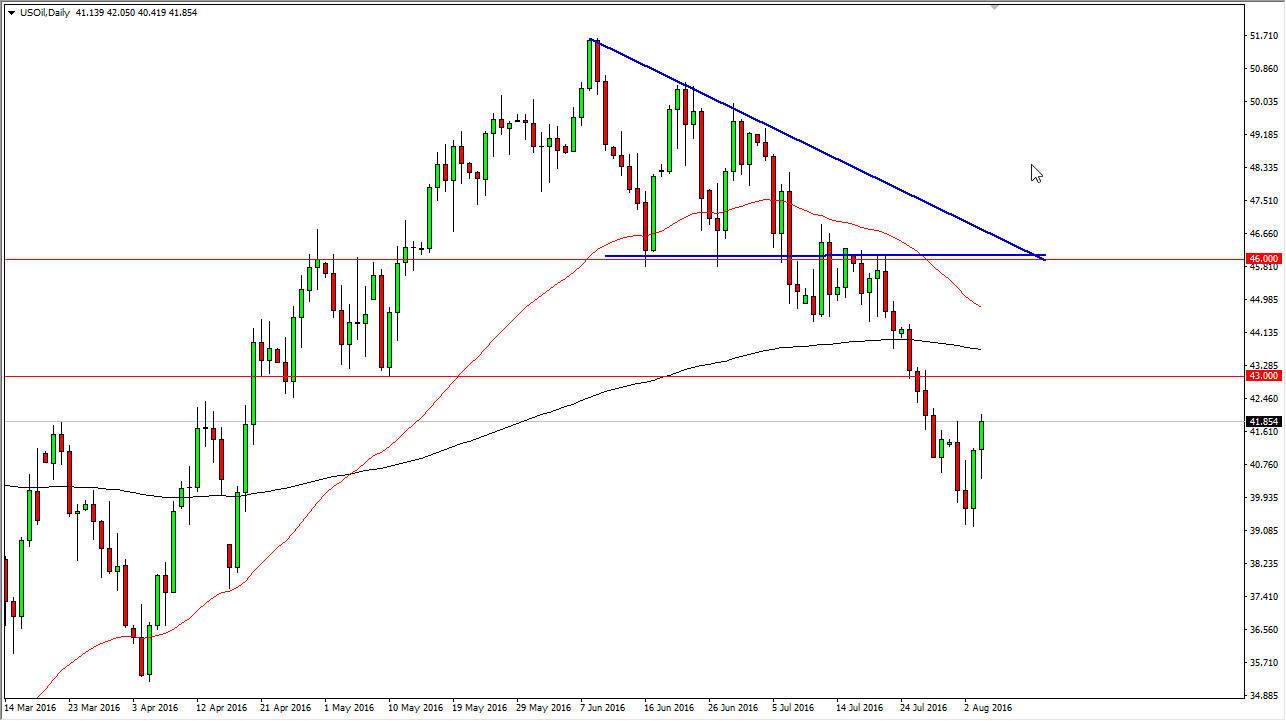

WTI Crude Oil

The WTI Crude Oil market initially tried to fall during the session on Thursday, but turned right back around to form a hammer. The hammer of course is a very bullish sign but I feel that more than likely what we’ve seen is some type of short position covering ahead of the Nonfarm Payroll Numbers coming out today. I believe that the $43 level above is a massive barrier, and that the 50-day exponential moving average above pictured in red, should very well reach towards the 200-day exponential moving average pictured in black, and cross. Once we get that happening, that is a longer-term sell signal. In other words, I am simply waiting for some type of exhausted candles I can start selling.

(Click on image to enlarge)

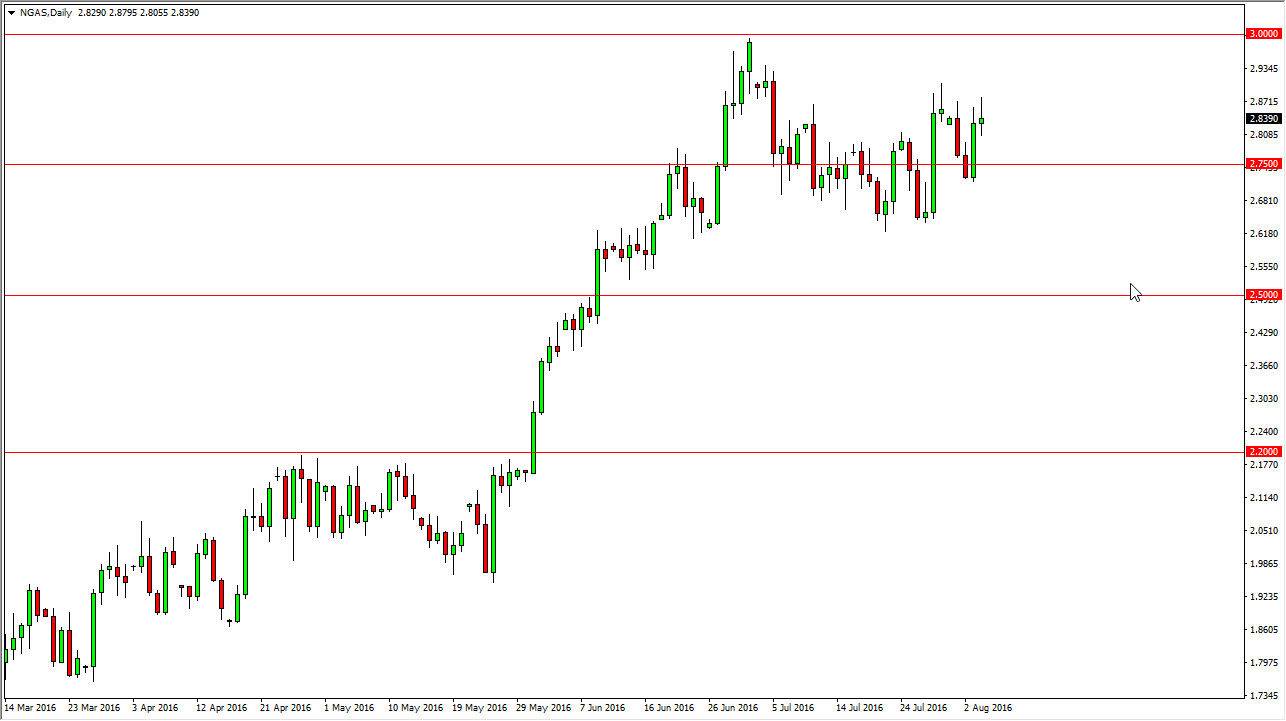

Natural Gas

The natural gas markets went back and forth during the course of the day on Thursday, but ended up forming a bit of a shooting star. This is a slightly negative candle, so I feel that we will probably pull back just a little bit during the day. I think short-term sellers may jump into the market, but I do recognize of the $2.75 level below should be supportive. A break above the top of the shooting star would be a very bullish sign, and I do think that eventually we try to reach towards the $3 level, but it isn’t going to happen today. With the type of volatility that the employment numbers can bring, it’s likely that we will chop around. Quite frankly, I would just as well stay out of this market during the course of the day as we have seen quite a bit of noise.

Ultimately, I think this market does rise but whether or not we can get above $3 is a completely different question. I think that today is probably a really good day to stay away from what has been a very choppy market to begin with.

(Click on image to enlarge)

Disclosure: None.

Thanks for sharing