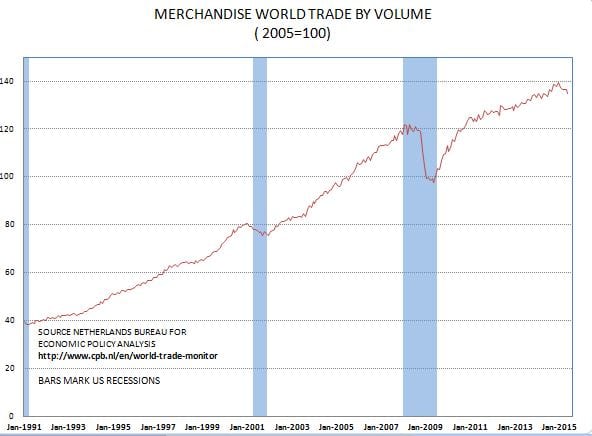

World Trade Is Falling

The recent stock market fall appears to be in reaction to weakness in foreign economies, not domestic developments in the US.

One measure to watch is world trade from December to May world trade volume fell -3.4%.

Interestingly, in the first five months of the 1971 decline trade fell -3.5%, essentially the same as this drop. The year over year growth rate is 0.4%.

The year over year change in world trade has only turned negative twice sine 1990, as far back as this data series goes. For what it is worth those two declines also coincided with US recessions.

For now, the critical question is how much of the weak growth abroad impact US growth. Almost certainly the impact is likely to be significant.

Disclosure: None.

This could be the vengeance of excessive reliance on "private" capital to increase or perfect the benefits of modern life ("Don't worry, the 'market' will solve all the problems."): this chart shows over-capacity, in terms of industrial production and consumption. Meanwhile, infrastructure, created by "public" funds, languishes, as the so-called captains of industry retreat to their walled and guarded compounds. This also reflects a version of the tragedy of the commons. And at some point wage arbitrage is unavailing. There is a proper mix of public and private spending, and purchasing. We can't count on the private sector to do all the work here.