Will USDCAD Rally Higher?

Before the start of the January 13 2025 trading week we called for USDCAD to make a move lower first and terminate the wave ((ii)) which will then be followed by a rally higher. The Elliott Wave chart below advises to our members to watch for buying opportunities once the wave ((ii)) terminates with 1.4276 as the invalidation level.

USDCAD 1 Hour Weekend Update January 11 2025

(Click on image to enlarge)

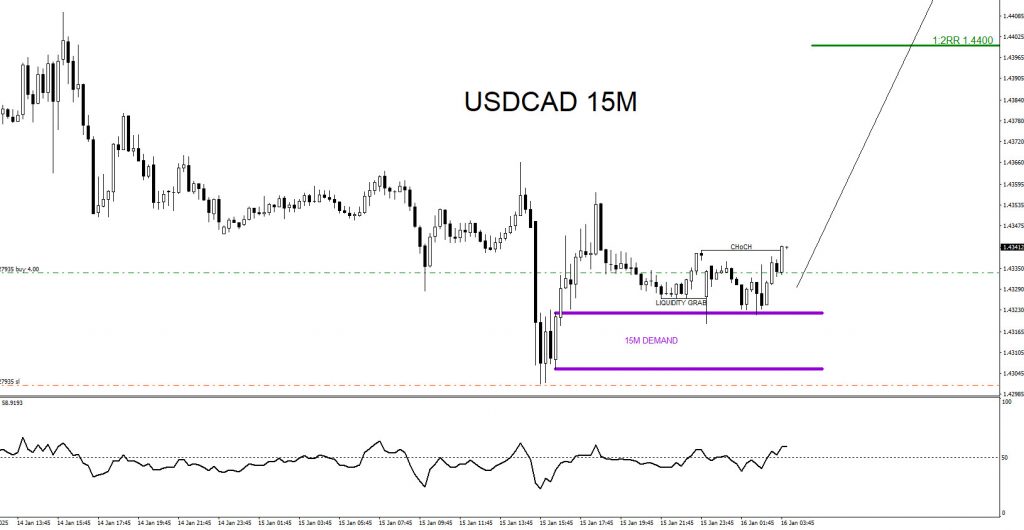

The Elliott Wave count also confirmed other bullish patterns. The charts below clearly shows a bullish Gartley pattern (Blue) with a bullish divergence pattern (Red) terminating in a demand zone (Light Blue) signalling that the pair would reverse higher. I posted the charts below on social media @AidanFX on January 15 2025 and squeezed the BUY trigger and bought when price pushed back higher above the XA 0.786 level. Price also respected the 15 Minute demand zone (Purple) adding more reasons the pair was ready to bounce higher. All these bullish patterns combined with the Elliott Wave count calling for a move higher was enough for me to BUY USDCAD with confidence. Only thing that remains now is if USDCAD will rally higher and hit the targets. Only time will tell.

USDCAD 4 Hour Chart January 15 2025

(Click on image to enlarge)

USDCAD 15 Minute Chart January 15 2025

(Click on image to enlarge)

A trader should always have multiple strategies all lined up before entering a trade. Never trade off one simple strategy. When multiple strategies all line up it allows a trader to see a clearer trade setup. We at EWF never say we are always right. No market service provider can forecast markets with 100% accuracy. Only thing we at EWF 100%, is that we are RIGHT more than we are WRONG.

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade. Hope you enjoyed this article and follow me on social media for updates and questions> @AidanFX

At Elliottwave-Forecast we cover 78 instruments (Forex, Commodities, Indices, Cryptos, Stocks and ETFs) in 4 different time frames and we offer 5 Live Session Webinars everyday. We do Daily Technical Videos, Elliott Wave Trade Setup Videos and we have a 24 Hour Chat Room. Our clients are always in the loop for the next market move.

More By This Author:

Elliott Wave View: Oil Impulsive Rally In ProgressElliott Wave View: Silver (XAGUSD) Double Three Correction In Progress

OIL Elliott Wave Forecasting The Rally After 3 Waves Pull Back

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more