Will The S&P 500 Make It 9 Losing Days In A Row?

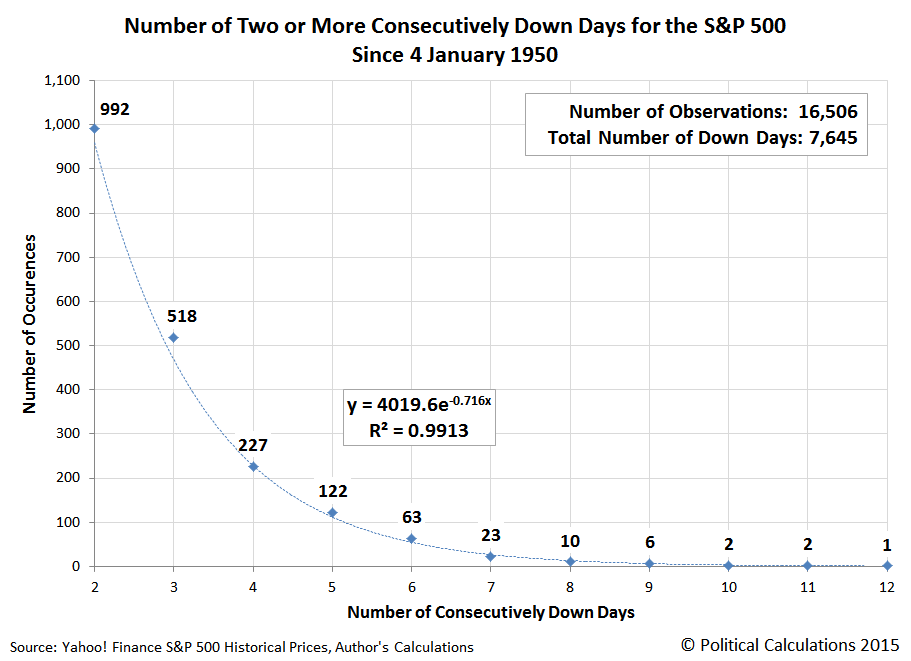

Over the past eight trading days, the S&P 500 is doing something highly unusual in having declined in value from the previous day's closing value in each of those days. How unusual can be seen in the following chart that we first presented last year as we mapped out the S&P 500's losing streaks since 3 January 1950.

Before this week, we see that since 3 January 1950, the S&P 500 has had losing streaks run eight trading days or longer some 21 times, with 10 of those streaks lasting exactly eight days before the index finally recorded an up day to break its losing streak.

We find that for the S&P 500 to have fallen in each of the previous eight days, the approximate odds of it having done so are 1 in 1,262.

The odds of a losing streak in the S&P 500 lasting for eight days isn't quite as unlikely as it may appear - it's actually a bit more likely than the odds that an American will die in a year from any accident or injury (1 in 1,656).

But for it to go nine days in a row would be a 1 in 2,583 event. And there is roughly a 1 in 2 chance that it will happen.

As for why, while recent reporting has focused on "U.S. election nerves" as a contributing factor, there may also be more fundamental factors at work.

Compare this chart to the previous version we showed just four days ago.

We don't know yet if the sudden increase in the number of dividend cuts announced during the first three days of November 2016 is simply noise or if there's more to it. The cumulative number of dividend cuts announced since 2016-Q4 began however does point to cause for concern.

As for which companies have announced dividend cuts in November 2016, our real-time sampling of dividend declarations indicates that it is a pretty broad based list in terms of affected industries: HCP (NYSE: HCP), New York REIT (NYSE: NYRT), Horizon Tech Finance (NYSE: HRZN), Sturm Ruger (NYSE: RGR), Melco Crown Entertainment (NASDAQ: MPEL), Teekay Tankers (NYSE: TNK), Sabine Royalty Trust (NYSE: SBR), First Mid-Illinois Bancshares (NYSE: FMBH), Terra Nitrogen (NYSE: TNH).

The market will bear close watching over the next several weeks.

Disclosure: None.