Will The “Sell USD” Narrative Keep Growing?

Image Source: Unsplash

Video Length: 00:02:31

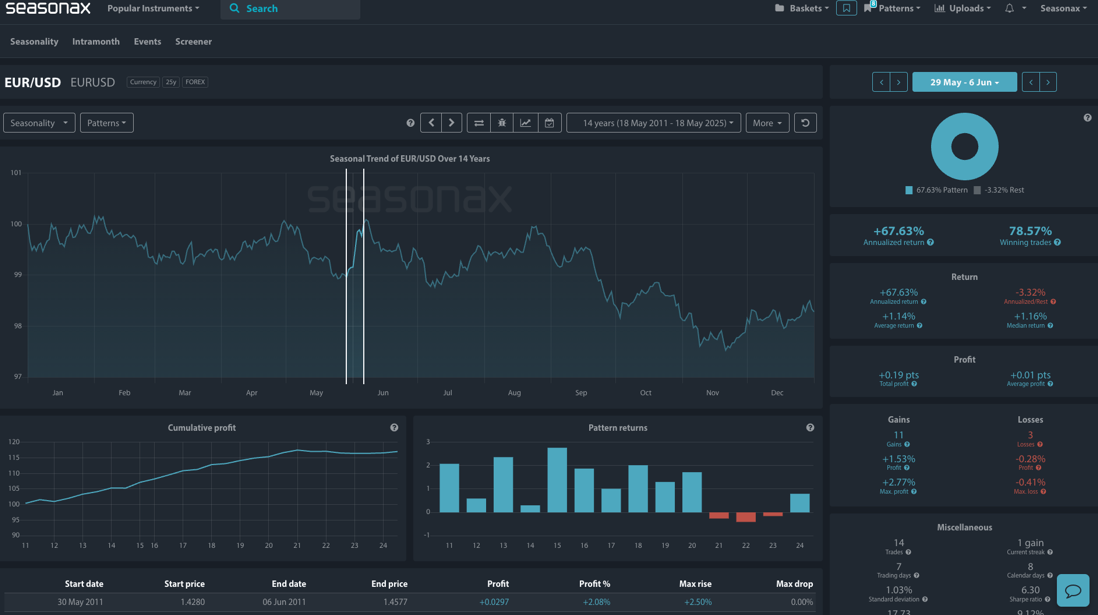

- Instrument: EUR/USD

- Average Pattern Move: +1.14%

- Timeframe: 29 May – 6 June

- Winning Percentage: 78.57%

You may not realise that the end of May often favours euro strength. With the US dollar under renewed pressure following Moody’s sovereign downgrade to Aa1, this short seasonal window for EUR/USD may offer useful insight — and we want to analyse the data in more detail.

The chart below shows you the typical development of EUR/USD between May 29 and June 6 over the past 14 years. The pair has posted gains in 11 of those years with an average return of +1.14%. The strongest years (2011, 2013, 2015, & 2018) all saw moves above +2%, while downside risk has been muted historically to a maximum of 0.41% in 2022.

(Click on image to enlarge)

Dollar Drag: Sovereign Risk

The backdrop for this pattern couldn’t be more fitting. Moody’s recent downgrade of the US sovereign rating reflects long-standing fiscal concerns that markets are now beginning to factor in more visibly. The Trump administration’s new tax-cut package threatens to increase the US debt pile by $3–5 trillion over the next decade, further stoking fears of long-term imbalance.

Friday 16th of May’s US Treasury TIC data showed that China reduced its Treasury holdings by $19 billion, suggesting capital reallocation could already be underway.

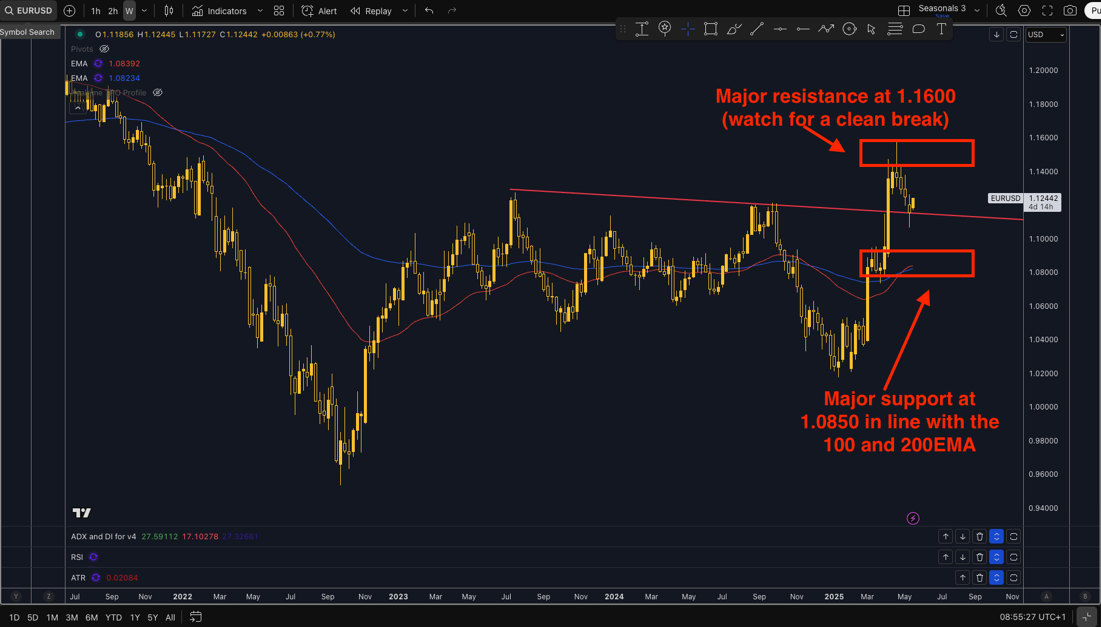

Technical Perspective

Technically, the EURUSD has support around 1.1000, but a break below opens the door to major support at 1.0850. A clean break above 1.1600 opens the door for another leg higher to 1.18000

(Click on image to enlarge)

Trade Risks

The EUR/USD bullish pattern may be disrupted if Fed rhetoric turns unexpectedly hawkish or if US data surprises to the upside. Any major de-escalation in US-China tensions could also spur markets to move back into the USD.

More By This Author:

Home Depot’s Post-Earnings Lift: Seasonal Tailwind Meets Support On The ChartsGBP/USD: Facing A Pivotal Moment As BOE Rate Cuts Loom

Recession Risk – Will Copper’s Seasonal Slump Deepen?

Disclaimer: The information on this website is for educational purposes only and should not be considered investment advice.