Will Boeing Recover?

Boeing

The word "air bridge" is derived from the German "Luftbrücke" and is used as a term to describe the "Berlin Blockade". Because the allied powers supplied food and goods to West-Berlin with airplanes isolated by land due to the Soviet occupation, the situation is referred to as an "air bridge". Was that the only air bridge? No way! Currently, we can identify many air bridges. For example, in the Brexit and the according to delays at the land (tunnel) and sea borders, the trade in goods shifted heavily to air cargo. While the global commercial flight business dropped by 2/3s, the freight business remains robust. Boeing makes this happen with its Dreamliner Boeing 787, which can carry all sorts of goods. With a capacity of 40 tons, low carbon emissions, and a lower price, the long-range cargo plane is an attractive alternative to other ways of overseas freight shipping. Capitalizing on the difficulties that arose through the Corona Pandemic, the plane builder makes sure we experience a new "air bridges" era.

History

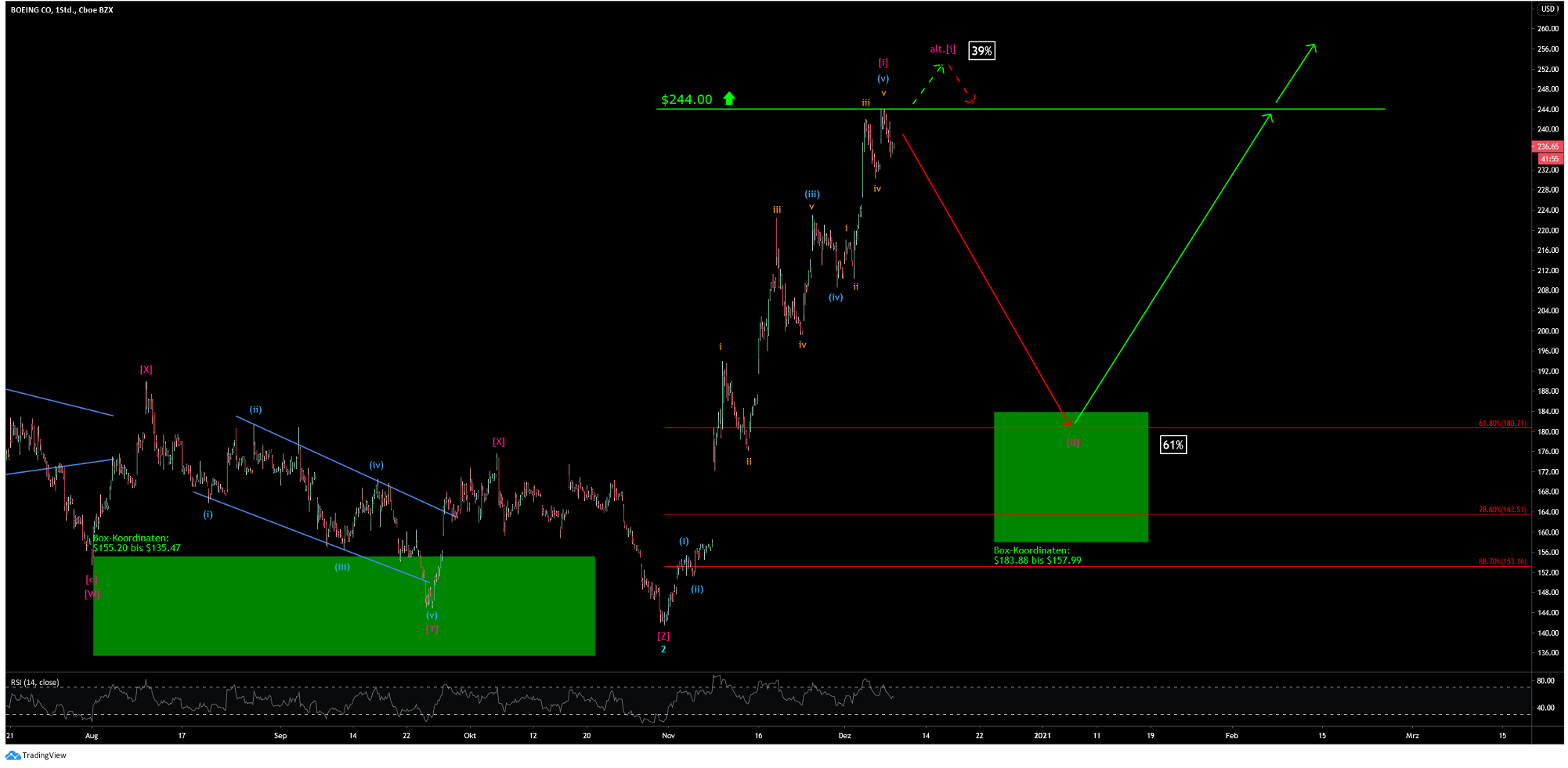

In our chart, which we made at the beginning of December 2020, there is the target area's green box between late summer and late autumn 2020. As we can see, the coordinates were $155.20 - $135.47, and the curve dove deeply into that area. However, the following upward trend remained below expectations. Instead, the curve, again, dove into the previous target range. After that, the bulls gained strength and pulled the price up to the resistance mark of $244.00. From there, we expected (with a chance of 61%) the course to drop as a result of a correction and approach another green box. This green box was between $183.88 and $157.99.

Looking at the chart from January 2021, the price moved towards the green box, but in the meantime, the mark of $201.10 proved to be difficult to overcome on the way down. To reach the target area, the bears must pull the price below this supporting line, which we think they'll be able to do since we are giving them a 72% chance.

Boeing 1h Chart from 08.12.2020

(Click on image to enlarge)

Boeing 1h Chart from 12.01.2021

(Click on image to enlarge)

Primary Scenario

Currently, we have reduced this probability to 59% in our primary scenario. In other words: it is getting exciting! The probabilities of both scenarios are moving closer together, which is based on the chart's current situation. For the time being, we still give a slight edge to the primary scenario and expect the price to reach the target area. To get there, we will first see an increase up to $224.09. From there – marked with a blue (b) – the stock price should turn around to approach the green box. Ideally, we'll see a price of $180. If that happens, we will massively stock up our positions since we see one of the most significant upward potentials in this stock among the Dow Jones stocks. The according point is marked with red (ii). From there, we are set to move up to new heights.

Alternative Scenario

What is alternatively possible and with a chance of 41% pretty close to the primary scenario? If the price happens to follow this path, the preliminary correction is definitely completed now. There is a chance that the price drops below the supporting line of $201.10, but only to starts its long upward trend from there. In both scenarios, the price must pass the resistance of $244.00.

Boeing 1h Chart

(Click on image to enlarge)

Certainly some areas of the Boeing company are doing well. BUT given the LARGE DESIGN FLAWS and software shortcomings, which have lead to two recent crashes and several emergencies, I see much less reason to hope for the organization's survival.

The fact is that some errors are fatal. And choosing to repeat a fatal error is an indication of a far more flawed condition.

So while some may defend a stupid choice that has already killed hundreds, I do not.

I can certainly agree with you on several points. One particular argument in favor of their survival is the fact that Boeing is the second biggest contractor of the U.S. federal government: en....pedia.org/.../...the_U.S._federal_government

Boeing's responsibility to avoid future crashes is indispensable.

The problem that I see is that they have not revised their approach to the portion of the system that caused those crashes. That is the automatic stall correction system. They are taking the approach that the only flaw was inadequate pilot training resulting in not being able to correct the problem. The flaw is that the stall detection system is not nearly adequately reliable, since it only uses one sensor, while aircraft safety and control systems always use redundant sensors. And the software seems to have an attitude that the crew is stupid and incapable of the correct actions. So the appearance is that Boeing needs to have a severe attitude adjustment made, and that will probably affect the share value and reduce the profits for a while. So while this is a very small part of the Boeing entity it does represent a potentially huge liability if it keeps killing people, which that problem does not appear to have been adequately addressed.

Let's hope that they clean up their mess internally, even if they blame publicly blame it on external factors.