Why Would Anyone Want To Buy A Department Store?

Macy’s (M) got a well above market bid to buy out all outstanding shares. It rejected the offer.

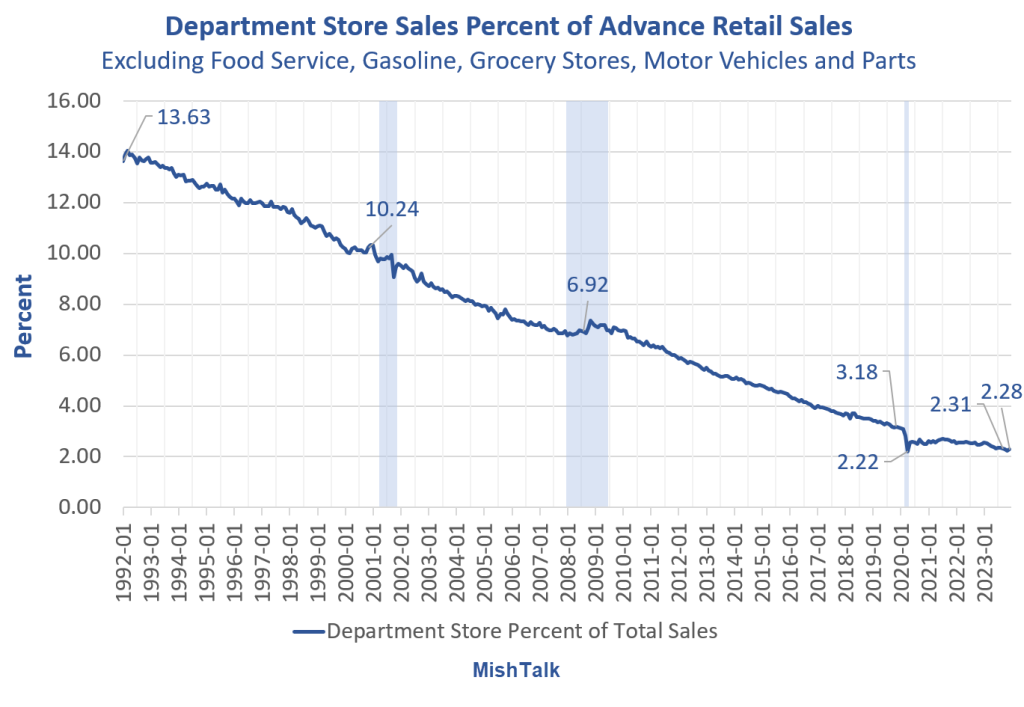

Advance retail sales data from the Commerce Department, calculation and chart by Mish

Buyout Offer

On December 1, Reuters reported Macy’s Investors Mount $5.8 Billion Buyout Bid

An investor group consisting of Arkhouse Management and Brigade Capital has made a $5.8 billion offer to take department store chain Macy’s (M.N), opens new tab private, according to a person familiar with the matter on Sunday.

Arkhouse Management, a real-estate focused investing firm, and Brigade Capital Management, a global asset manager, submitted a proposal to acquire the Macy’s stock they don’t already own for $21 a share on Dec. 1, the person said.

J.P. Morgan analysts estimate Macy’s total real estate value at about $8.5 billion, or $31 per share, including the iconic Herald Square property worth about $3 billion.

Macy’s to Cut 2,350 Jobs, Close Five Stores

On January 18, the Wall Street Journal reported Macy’s Announced 2,350 Job Cuts.

Macy’s plans to lay off about 13% of its corporate staff and close five stores in a bid to trim costs and redirect spending to improve the shopping experience for customers.

The job cuts total roughly 2,350 positions, or 3.5% of Macy’s overall workforce excluding seasonal hires, according to a memo sent to employees Thursday afternoon and people familiar with the situation.

Macy’s plans to add more automation to its supply chain and is outsourcing some roles, according to the memo, which didn’t specify which jobs. It’s also reducing management layers to speed decision-making.

The company will be investing in areas that impact consumers, such as adding more visual display managers to enhance the look of stores and upgrading digital functions to make online shopping more seamless, one of the people said.

Macy’s Rejects Offer

On January 21, we learned Macy’s Rejects Arkhouse’s $5.8 Billion Bid.

“The Board has determined not to enter into a non-disclosure agreement or provide any due diligence information to Arkhouse and Brigade,” Macy’s said in a statement, citing “a lack of compelling value” in the proposal.

Macy’s also said that information furnished by Arkhouse and Brigade “failed to address the Board’s concerns regarding Arkhouse and Brigade’s ability to finance their proposed transaction.”

Macy’s said it had concerns with the uncommitted financing that had numerous non-standard preconditions.

The investment firms’ bid has spotlighted how undervalued Macy’s is relative to its real estate, which is projected by analysts to be worth between $7.5 billion to $11.6 billion.

Macy’s owned 316 of its 722 total stores as of the end of January, according to its most recent annual report.

Two Possible Reasons for the Offer

- Arkhouse wanted to drive up the share price for the shares it owns.

- Arkhouse actually believes the property is worth more than its bid

Macy’s Daily Chart

Macy’s chart courtesy of Stockcharts.Com

The above chart has me wondering: Who knew what, well in advance of the Arkhouse offer.

I also wonder if Arkhouse really wanted to buy Macy’s or if the whole intent was to drive up the share price.

Department Stores Getting Killed by Online Sales

Advance retail sales from commerce department, calculation and chart by Mish

I created the chart by taking total sales and subtracting things one does not normally buy online.

Gasoline is obvious, so is eating out at restaurants.

Although one can buy groceries online and have them delivered, most do not order much food online. Omaha steaks and Christmas cheese packages don’t add up to much. I subtract groceries from the total.

The same applies to cars. Most do not buy cars online. But I am sure this will change eventually.

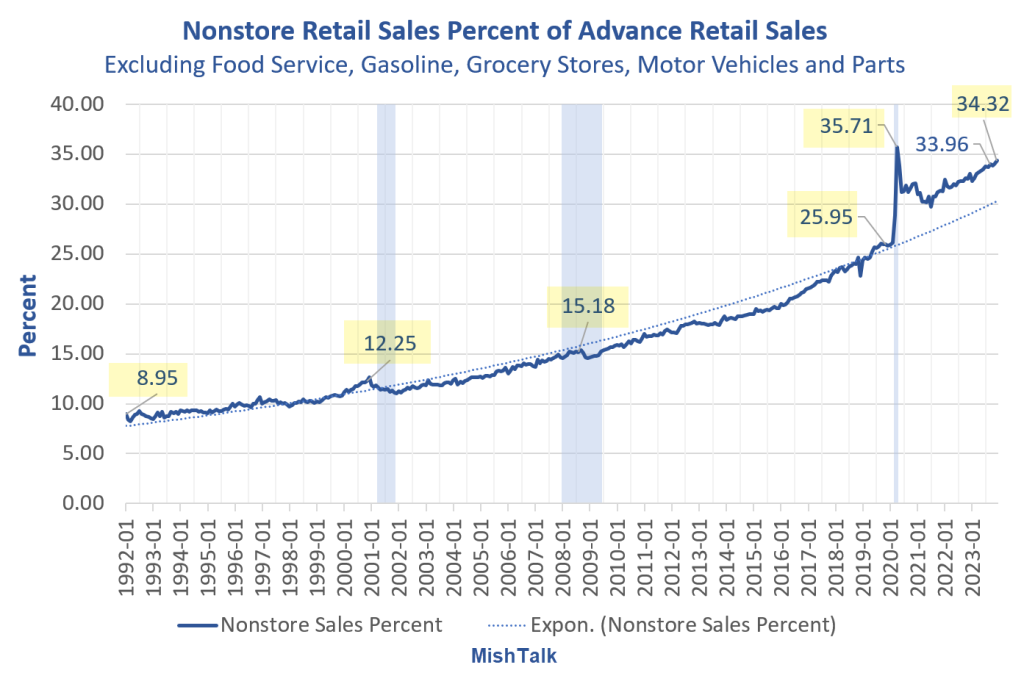

On January 20, I asked How Did Covid Change Your Propensity to Buy Things Online?

Covid did not change the trend towards online shopping but it certainly accelerated the trend.

Progression

- In 1992, about 9 percent of sales were online

- In the next eight years online sales rose to about 12 percent.

- In another eight years ending to the start of the covid recession, online sales were at 15 percent then dipped in the recession.

- In the 10 years starting from 2010 to 2020 online sales zoomed from 15 percent to 26 percent.

- In the last four years online sales jumped over eight percentage points from about 26 percent over 34 percent, ignoring the initial covid spike.

Every step of the way, department store sales as a percentage of sales went the other way.

On top of that, we have shoplifting issues.

Target, Nike, REI Close Stores in Portland Due to Surge in Crime

Please consider Target, Nike, REI Close Stores in Portland Due to Surge in Crime.

I am sure Macy’s is in better locations, but what is the upside?

Are millennials and zoomers suddenly going to reverse course and head to department stores?

If the Macy properties are really worth $11 billion, not the $5.8 billion offered, then for what use?

This whole thing is more than a bit curious from many angles. But I can’t quite put my finger on which angle is right.

More By This Author:

Average Price Of Used Tesla Declines 18 Straight MonthsHow Did Covid Change Your Propensity To Buy Things Online?

Existing Home Sales Drop To Lowest Full Year Total Since 1995

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more