Why We Expect A ‘Hawkish’ 75bp Hike From The Fed

We expect a third consecutive 75bp hike. High inflation means 100bp is a risk, but inflation expectations and corporate price plans look less threatening and the growth outlook is more uncertain so we don’t see it.

Still, a more hawkish message surrounding sticky inflation will see the Fed dots closer reflect the market pricing of a 4.25-4.5% terminal rate.

75bp remains the call

The market was favoring a 75bp hike ahead of the August CPI report, but the higher-than-expected inflation numbers, that saw the core rate accelerate to 6.3% from 5.9%, have led the market to price a 20% chance that the Fed go over and above that and opt for a 100bp move. 75bp is still our favored call and the overwhelming majority of economists appear to think the same.

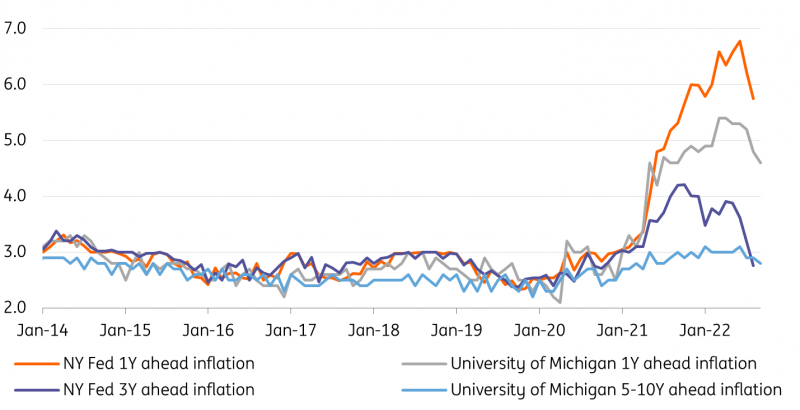

Inflation does indeed appear to be stickier than we'd first thought and it remains broad-based. That said, there isn’t a great deal the Fed can do about current inflation so its response will depend on where it sees inflation heading. The jobs market remains strong, and near-term activity data has been holding up, but there are encouraging signs on both market and household inflation expectations, and also corporate price plans which suggest inflation may not be as embedded as some in the market fear.

Consumer inflation expectations heading lower

Source: Macrobond, ING

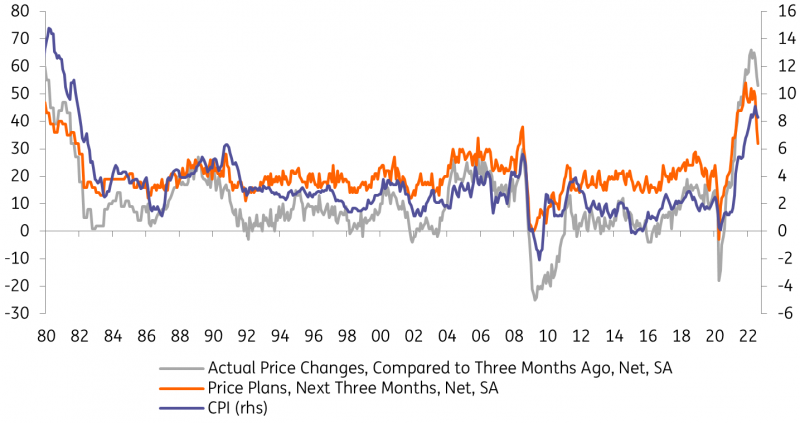

Corporate pricing power shows signs of weakening

Indeed, the National Federation of Independent Businesses reports that the proportion of companies looking to raise prices over the next three months has fallen from 51% in May to 32% in August. This is a sizeable turn which, given the strong relationship over the past 40+ years, offers a signal that inflation rates could soon start to slow. After all, in the current environment, there has been a strong argument that consumers flush with stimulus cash have been able to tolerate higher prices. Also, households have been expecting more price rises to come which had effectively given many companies some 'cover' to raise them still further.

But the lagged effects of rate rises, weak equity market performance and concerns over the state of the housing market suggest that consumer spending is plateauing; retail sales, for example, are down 0.7% since March in volume terms. A more competitive environment means less corporate pricing power and fewer inflation pressures.

NFIB points to weakening corporate pricing power

Source: Macrobond, ING

Fed forecasts set to change

Nonetheless, we acknowledge that higher near-term inflation prints are not welcome and hurt the Fed’s credibility. The subsequent meetings in November and December could therefore see more aggressive action from the Fed than we are currently penciling in.

Our current 50bp call for November looks on very shaky ground with 75bp probably more likely right now, while the 25bp we have been forecasting for December could easily become 50bp. As such, depending on what the Fed says, we will be looking to formally change our house view from a 3.75-4% terminal rate in December 2022 to a 4.25-4.5% call. Key to this will be the Fed’s forecasts. Below is a table of what they forecast in June versus what we think they will say on Wednesday.

Expectations for the Federal Reserve forecasts

Source: Federal Reserve, ING

Four alternative scenarios

In the graphic below, you can see how we've been exploring different scenarios and their potential impact on the FX and Treasury markets. The forecast levels for EUR/USD and 10Y yields are based on the assumption that both trade at current levels on the morning of the Federal Reserve meeting.

The market is currently assuming a 75bp hike as the bare minimum and it would probably be seen as the Fed taking a level-headed, data-dependent approach. A more cautious growth assessment could see yields move a touch lower following their recent sharp increase.

Anything less than 75bp would be perceived very dovishly. A 50bp move would be the catalyst for an initial downward move in the 10Y yield of perhaps 10bp and the dollar weakening with some further follow-through over subsequent days since it would be interpreted as an earlier end to tightening with a lower terminal rate.

On the hawkish side, a 100bp hike would signal a clear intent from the Fed, and in some quarters could be interpreted as a sign of panic. The knee-jerk reaction would be a stronger dollar and a 10bp+ move in Treasury yields with the market pricing a higher terminal rate, especially if inflation forecasts are revised up for 2023 and 2024. A 125bp hike would not just be a signal of panic, it could be an outright risk to market stability with risk assets crumbling. On the one hand, it could prompt a safe haven bid for bonds in subsequent days, but the initial reaction is likely to be a big gap higher in 10Y yields of the order of 25bp.

Scenario analysis: The Federal Reserve's alternatives

Source: ING

2023 still the year of rate cuts

Looking further ahead, we are not in the camp expecting ongoing rate hikes in 2023. The geopolitical backdrop, the China slowdown story, the potential for energy rationing in Europe, the strong dollar and fragile-looking domestic equity and housing markets point to rising recession risks. A more aggressive Federal Reserve rate hike profile and tighter monetary conditions will only intensify the threat.

We already expect inflation to fall sharply on a weaker housing market translating into lower home rental components in CPI. Falling second-hand car prices will also contribute while less aggressive corporate pricing plans amid weaker demand in a recessionary environment will also drive inflation lower. We also should remember that the average period of time between the last rate hike in a cycle and the first Federal Reserve rate cut has averaged just six months over the past fifty years. Given the risks to growth and the potential for lower inflation, we are still forecasting rate cuts throughout the second half of 2023.

If the funds rate breaks above 4%, the 10yr yield gets pulled higher too

For market rates, their prognosis is tied up with the terminal Fed Funds rate (i.e. where the Funds rate peaks). When it does peak, the likes of the 10yr Treasury yield will feel unshackled and can go ahead and discount future cuts, with yields capable of trading well through the Funds rate. But we are not at that point just yet; we’re still in the Fed Funds up-move phase. For as long as that’s the case, long tenor market rates will tend to be pulled higher. Should the Fed hike by 75bp in September and by another 75bp in November, that would pitch the Funds rate ceiling at 4%. Against that backdrop, and given the likelihood that the rate pushes above 4%, the 10yr Treasury yield is likely to target the 3.75% area (versus 3.45% currently).

Once clear consequence in a likely further inversion of the yield curve. The Federal Reserve will not want to see this become too pronounced, as it would open a gap between the longer-term implied subsequent rate cut discount versus the nearer-term objective to get the Funds rate up. Balance sheet roll-off, which is now running at USD 95bn per month, will slowly address this issue, as the bid for longer tenor bonds is no longer being supported by Fed buying. This also helps to tighten conditions. The Fed has not had a whole lot to say about this in recent months, preferring to let the process play out quietly in the background. But in any case, it is pushing in the same direction as rate hikes and should help to coax longer tenor rates higher.

FX Markets: Hawkish Fed takes us a step closer to Plaza 2.0

The dollar goes into the September FOMC meeting on the highs for the year. The story is quite a simple one. Aggressive Fed tightening and US yield curve inversion have taken their toll on the currencies of the more open economies outside of the US – especially those on the wrong side of the energy war. On a year-to-date basis, this leaves the dollar stronger by as little as 5% against the Canadian dollar and as much as 20% against the Japanese yen.

Driving the most recent leg higher in the dollar has been the August US CPI data, which has inverted the curve still further and prompted money markets to price Fed Funds close to 4.50% next spring. Could the market shift to pricing a 5% Fed Funds rate? That cannot be ruled out over the coming months were the market to second-guess the meaning of ‘restrictive’ policy and US price data were to continue to deliver some nasty surprises. As such we see the dollar staying at these strong if not stronger levels for the rest of the year.

The dollar hitting its highest levels since 1985 has also raised some questions as to whether global policymakers are close to discussing a Plaza 2.0 agreement – or a revised version of the 1985 G5 agreement for an orderly dollar reversal lower. We feel it is far too soon for such an agreement in that for it to be successful the Fed would need to be ready to cut rates – consistent with any coordinated FX intervention to sell dollars probably against euros and yen. Equally the Bank of Japan would need to be ready to hike rates, just as they were in 1985. Neither of these is a given.

That said we do have a G20 meeting of Central Bank governors and Finance Ministers coming up on October 12th in Washington. Were dollar strength to be causing collective anguish, a G20 Communique could express some concern with disorderly moves – and provide some more credibility to Japanese threats to intervene to sell USD/JPY. In reality those, FX moves have not been disorderly and we very much doubt US authorities are yet prepared to sanction a weaker dollar – not until the inflation battle is won.

More By This Author:

Key Events In Developed Markets For Week Of Sept. 19Key Events In EMEA For Week Of Sept. 19

Asia Week Ahead: Busy Week For Central Banks

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more