Why The US Fed Has To Keep Tightening Even Though The Most Reliable Recession Indicator Is Flashing “Game On”

It may be hard to believe, but modern macroeconomics actually has a few theories worth paying attention to. One of these is driving central bank behavior right now, and all indications — thus far — is that U.S. Fed Chairman Jerome Powell is not in the Greenspan-Bernanke-Yellen “cave in to political pressures” mold, and more of a Paul Volcker-type of central banker. And you should care about this because, in the long run, continued tightening of monetary policy is in all of our best interests. Using the two graphs below, I’m going to explain 1.) why Powell is leading the Fed in a better direction than it’s been led in at least 20 years, 2.) why the U.S. economy is most likely going to experience a brief, shallow recession, and 3.) why we should be happy about this.

Exhibit 1 below shows the Unemployment Rate in the U.S. minus the Natural Rate of Unemployment since 1950. Recessionary periods are shaded. Here’s what we learn from the graph: when the unemployment rate dips below the lowest possible rate of unemployment that will not trigger a long-term upward inflationary spiral (the “natural” rate of unemployment), we enter a countdown to the next recession. As the graph shows, this indicator has predicted 9 out of the last 10 recessions. And, thanks to the poorly-timed 2017 tax cuts, which pushed the economy past full output and lowered unemployment below 4%, the recession clock has started ticking once again.

Now, just in case you’re a “9 out of 10 ain’t good enough for me” type of person, I will point out that the 1981-1982 recession, which is the only one in 70 years that was not preceded by the unemployment rate dipping below the natural rate, was Paul Volcker’s second attempt at deliberately engineering a recession to break a vicious inflationary spiral (with a Fed Funds rate greater than 20%, well above the worst inflation rates experienced during those years). Since that recession was artificially induced and almost completely disconnected from market forces, we can give the theory a mulligan, just this once.

The upshot from the graph is that the 2018 unemployment rate of 3.9% is well below the natural rate of unemployment of 4.6%, and, according to the laws of probability, the recession clock has started ticking once again.

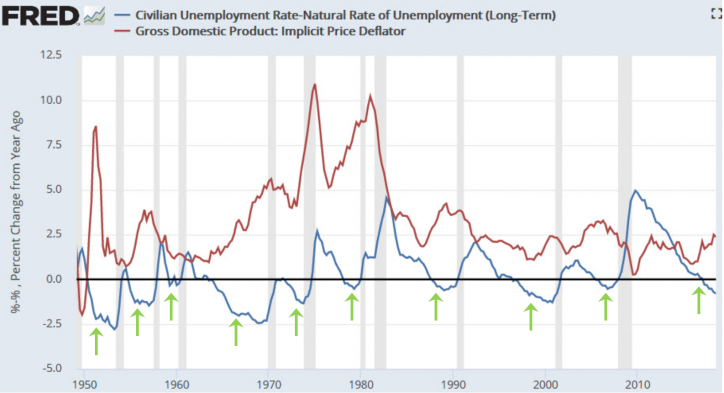

Next I’ll explain why all you long-run thinkers out there should be happy about this. Refer to Exhibit 2 below. The green arrows pinpoint the time period when the rate of unemployment falls below the natural rate. The red line is inflation, measured as the GDP deflator. It’s clear what happens when unemployment gets too low: with a time lag, inflation sparks. And, as higher inflationary expectations take hold, they trigger a cascade of natural market forces, resulting in investment and consumer spending pulling back a bit, a slowing economy, and unemployment drifting back up towards (and temporarily overshooting) the natural, non-inflationary rate. These forces help moderate inflationary pressures, and before too long we move on the next period of growing prosperity.

What did we learn from the second graph? It’s in our long-term best interest to harness our post-election activism and pressure elected officials to insulate the U.S. Fed from political pressures. We should applaud Jerome Powell for raising the real Fed Funds rate closer to “normal” levels because higher interest rates will dampen the demand for credit, allow spending and hiring to slow down a little, and give the U.S. economy a brief “time out” — even if that turns into an economic contraction for a quarter or two. Because if we let this happen, by late 2019 or early 2020 we’ll be back in business and enjoying another period of sustainable prosperity.

My view is, if you consider yourself a free-market capitalist, you’ve gotta be tough enough to live through a few “down” quarters now and then so you can profit from many more “up” quarters over the long run. It’s that simple. In our post-election political exhaustion, there’s one more thing we can all do to help the U.S. remain prosperous: write to your Congressperson or Senator and tell them to leave the Fed alone. In my opinion, this is the first time since Volcker that we’ve got a Fed chairman who is thinking long-term. We need to let him do his thing. In a final effort to convince you, I’ll ask you to remember what happened AFTER the Volcker recession — the rate of inflation declined for decades and we enjoyed the Reagan prosperity and a 30-year bull market in stocks.

That’s your Macroeconomics 202 lesson for today.

The article is interesting. There are three issues. First, no one knows how deep the recession could go. All bets are off because of tariffs. Secondly, capacity utilization is still running below 80, so we have spare capacity unless measurements are wrong. And there are stii chronically unemployed from the Great Recession. Thirdly, we have exotic structures in finance like leveraged loans and other new vehicles that could tighten up the supply of credit like what happened in the Great Recession.

Good read, thanks.