Why The King Of Debt Is So Wrong!

Donald Trump has always reminded anyone who would listen that he is the "King of Debt".

Given his record at the 271-day mark in the Oval Office, we can't but wholeheartedly agree. The Donald's Treasury Department has borrowed an average of $95 million dollars per hour on a 24/7 basis ever since inauguration day!

As Senator Dirksen famously said, pretty soon it adds up to real money----in this case, the net Federal debt has risen from $19.6 trillion to $2.23 trillion. That a $613 billion gain since January 20----and annualizes to a $825 billion run rate or 4.3% of GDP.

Moreover, rather than coming from economic factors at the bottom of a recession, this is a deliberate, policy-driven outcome 100 months into a long-in-the-tooth business expansion. By way of comparison, the longest GDP expansion on record, which occurred under the far more beneficent conditions of the 1990s, was just 118 months and the average since 1950 is only 61 months.

Even as the nation has drifted ever deeper into fiscal profligacy for several decades now there was at least a passing belief and practice in the Imperial City that said deficits should shrink as the economy recovers and approaches so-called full employment.

By the lights of the BLS and the Keynesian priesthood, we are now there. Yet fiscal policy is still operating with a wide-open throttle----in a manner that is completely unprecedented.

We mention the nation's baleful fiscal condition because the events of last week underscored the perfect storm of aggravating forces now working to make it far worse. And when this gathering fiscal storm reaches critical mass, its explosive impact will shatter the massive bubbles throughout the financial markets.

Thus, it was officially announced on Friday that the Federal deficit for FY 2017 rose for the third year running to $666 billion and is now 51% higher than the 2015 post-recession low ($439 billion).

At the same time, the GOP Congress threw in the white flag completely on arresting the surging national debt by embracing the Senate's completely bogus FY 2018 budget resolution. And then to add insult to injury, the Donald explicitly aligned himself with Art Laffer's preposterous lie that tax cuts pay for themselves.

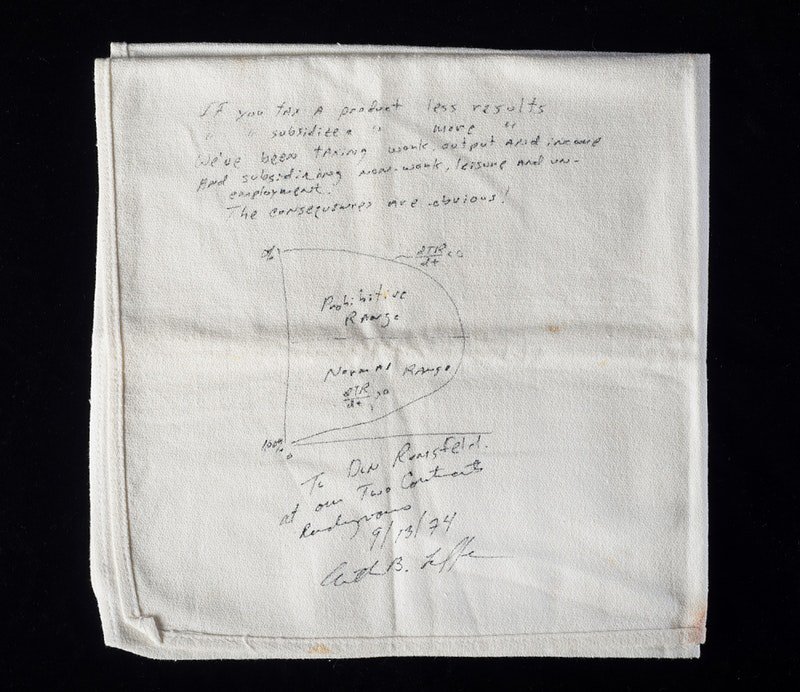

That's been pure snake oil, of course, ever since Laffer drew his infamous napkin back in the 1970s, but the Donald wasn't loath to embrace his latest emission of quackery:

Art Laffer just said that he doesn't know how a Democrat could vote against the big tax cut/reform bill and live with themselves!

The answer, of course, is that since the Jeffersonians were purged from the New Deal in the 1930s, the Democrats have always been ready to tax anything that moves and anything that stands still, too, in order to fund Big Government budgets-----which even then required a goodly dollop of borrowing.

That did not lead to the fiscal ruin of the Republic, however. That's because the GOP of Hoover, Taft, Eisenhower, Dirksen, Goldwater, and Ford not only kept the old-time religion of fiscal rectitude burning brightly, but effectively forced its observance in national policy.

President Eisenhower balanced the budget three times during his tenure and kept the average deficit to under 1% of GDP. Similarly, the GOP Congress came down so hard on LBJ's "guns and butter" deficits which reached 3% of GDP in 1968 that he was forced to enact a 10% surtax to bring the accounts back into balance.

Even the hapless Gerald Ford tried to rectify the fiscal mess he inherited from Nixon by proposing a tax increase---along with sweeping budget cuts----in the fall of 1974. Indeed, until 1980 an overwhelming majority of GOP legislators----including your editor during his terms in the US House---embraced a balanced budget amendment to the constitution.

After 1980 everything changed. In a word, the stable fiscal equilibrium that had resulted from the political competition between Big Government Dems and the old time balanced budget religion of the GOP gave way to a fiscal free lunch consensus of convenience between both political parties.

To be sure, the GOP didn't embrace Keynesianism directly; Republicans crab-walked backwards into becoming the big deficits party owing to the takeover of the GOP by the neocons and tax cut cultists. Not surprisingly, the two participants in the 1974 dinner at a Washington restaurant where Laffer purportedly drew his infamous napkin were Dick Cheney and Donald Rumsfeld.

When the history of America's fiscal demise is finally written, these two will be among its largest villains. As a young Congressman, Rumsfeld had been a dove on Vietnam, but became a raving hawk during his stint as Secretary of Defense during the Ford Administration.

Thereafter he morphed into an arrogant neocon bully during his corporate years prior to again holding the SecDef job under G.W. Bush. During his second stint running the Pentagon he fathered the insidious doctrine of "regime change", which was embraced widely by Republicans after 9/11; and which resulted in a doubling of national security spending compared to what was in place at the turn of the century and what was warranted by the disappearance of America's only industrial state enemy--the Soviet Union---in 1991.

Likewise, we served with Cheney in the House between 1978 and 1981 and are quite certain that he gave as many tub-thumping speeches against the deficit on the House floor as we did. But during Cheney's 1980s service on the House Intelligence Committee and then as George H. W. Bush's SecDef he lapsed into the worst possible kind of beltway raptor: Namely, a raving military hawk and an imperious, tax-cutting fiscal dove.

Not only did Cheney famously say Reagan proved deficits don't matter in defending Dubya's giant deficit-financed tax cuts of 2001 and 2003, but he also became the godfather of the neocon cadres that infested the Bush Administration during 2001-2008 and the GOP membership of the national security committees on Capitol Hill ever since.

In effect, Cheney forged a tacit alliance between the Warfare State and the GOP's beltway establishment, which discovered that a perennial agenda of tax cutting was a sure ticket to filling campaign coffers on K-Street and among main street businessmen alike.

Eventually, this Karl Rove-style GOP fund-raising machine embraced a cynical credo of undiluted hypocrisy under which campaigning and governing became completely divorced.

That is, the anti-Washington rhetoric never ceased back home. At the same time, after about 2000 the Congressional GOP has never once took a stand on live fiscal issues---including during the phony shutdown challenges to Obama---which threated in any way the perpetuation of the power and prerogatives of its "lifer" leadership represented by the likes of Boehner, Ryan, McConnell and Corker.

Marketwatch.com

That was all crystallized in last week's Senate GOP budget resolution. It is actually hard to imagine a more cynical, irresponsible document.

What it actually did was confirm that the purpose today of a budget resolution is not to establish a concrete fiscal policy framework, but to simply function as a parliamentary gimmick. Under the rules, it circumvents the 60-vote filibuster hurdle in the U.S. Senate, thereby enabling in this instance expedited consideration of a tax reconciliation bill that amounts to little more than a legislative "safe harbor" for adding $1.5 trillion to the nation's burgeoning debt.

That is a far cry from the world of 1981. Back then the GOP leadership was resolutely orthodox in its fiscal views. House Minority Leader Bob Michel hailed from the same Peoria Illinois district once represented by Senator Dirksen and was a hard-charging deficit hawk, and Senate GOP Leader Howard Baker had actually called Reagan's proposed 30% tax cut a dangerous "Riverboat Gamble".

Accordingly, the only way that the 1981 Reagan tax cut saw the light of day on Capitol Hill was because it was proceeded by passage of a sweeping spending reconciliation bill. The GOP elders had made it an absolute pre-condition.

The latter included hundreds of detailed cuts in entitlements and other mandatory programs, and when fully effective would have reduced spending by the equivalent of $300 billion per year in today's economy.

By contrast, last week's Senate resolution is a completely Fake Budget. It pretends to cut discretionary (appropriated) spending by $632 billion over the next decade, but the Senate has already taken budget actions which render that spending cut target absolutely bogus.

To wit, total discretionary outlays under the CBO baseline are estimated at $13.6 trillion over the next decade---split evenly between defense and domestic spending. But the Senate---led by hawks like McCain, Graham, Corker, Cotton, Rubio and countless more----- has already approved FY 2018 defense spending that is $90 billion above the CBO baseline, and would amount to a $1 trillion add-on over the next 10 years.

Not surprisingly, the Senate budget resolution is completely silent on the split between defense and domestic appropriated spending, but self-evidently it intends to fully fund the aforementioned military build-up. Senator McCain and others explicitly made that a condition for their support.

What that implies, in turn, is that the domestic spending baseline would be cut by $1.632 trillion or 24% over the next decade. Trump's amended request for FY 2017, however, included a down payment on non-defense cuts which amounted to just 8% of the CBO baseline.

Yet not a net dime was cut by the enacted CR (continuing resolution) for 2017. And that was even as the GOP appropriators have signaled that these sweeping cuts----such as 30% at the EPA and 20%for health research and 15% for education----- will never see the light of day in the FY 2018 appropriations (which is also on a CR until December 8) or any time thereafter.

Likewise, the Senate resolution assumes $3.6 trillion in entitlement changes over the 10-year period, but does not include reconciliation instructions for any of these savings. It does not take much study to determine that during the last three decades there have been virtually no entitlement reforms that weren't mandated on the jurisdictional committees by a reconciliation instruction.

In short, the Imperial City no longer even maintains the pretense of having a fiscal policy nor of using the reconciliation mechanism for the purposes intended by the 1974 Budget Reform Act.

In fact, it has only been used twice in the last eight years. And both times as a partisan battering ram on health care----first to enact ObamaCare purely with Dem votes in 2010 and then to repeal and replace it with purely (insufficient) GOP votes in 2017.

Needless to say, the current tax reconciliation instruction falls in the same category of parliamentary abuse. That's because no one of sound mind would say-----after eight years of business expansion, racking-up of $10 trillion of additional debt since 2008 and the prospect of $12 trillion more under the adjusted CBO baseline by 2027----that a $1.5 trillion deficit-financed tax cut makes any sense at all.

Instead, the very idea of what the Trump/GOP majority is attempting to do rests on nothing more than Laffer's snake oil. So after a career in debt-financed real estate development that rode the 30-year wave of unprecedented asset inflation fueled by the Fed's Bubble Finance regime, it is not surprising that the Donald is gung-ho for this ultimate outbreak of fiscal insanity.

At the same time, Trump's about as clueless as they come on monetary policy and central banking. That is, large fiscal deficits were modestly tolerable during the long years in which the Fed was expanding its balance sheet and, along with its fellow traveling central banks around the world, thereby monetizing a significant share of the new Federal debt

As a consequence, short-run negative economic effects from "crowding out" were precluded and kicked down the road.

But the end of that road is where we have now arrived. Even the Fed has realized that it is out of dry powder and must begin systematically shrinking its balance sheet. Another word for that is demonetizing the public debt.

Accordingly, when both the Fed (and soon other central banks) and the US Treasury are together selling trillions of debt securities to a limited pool of real money savings, the jig will be up. Bond yields will soar and the whole financial house of cards will come tumbling down.

In that event, the Donald will find out that on top of his own dubious protectionist economic agenda, he has now poured on a huge gallonage of Laffer's snake oil.

Under the best of conditions, tax cuts can regenerate 20-30% of their cost through higher economic growth. But as we shall demonstrate in Part 2, after 30 years of fiscal profligacy and egregious central bank money printing, these are the worst of conditions.

The Trump/GOP debt-financed tax cut would actually not generate any economic growth and jobs at all-----even as it would usher in a thundering collapse in the bond markets.

If he survives in the Oval Office, which we continue to doubt, the King of Debt will truly earn his self-proclaimed moniker.

But not in a good way!

Disclosure: None.

Comments

No Thumbs up yet!

No Thumbs up yet!